Current Structure of the Financial System

The Philippine financial system is primarily bank-based rather than capital market-based. The banking sector, whose total assets accounted for more than 80 percent of the total resources of the financial system4 and of GDP in 2010, plays the primary role in financial intermediation and is the main source of credit in the economy.

Across banking groups, universal and commercial banks continued to hold the lion's share of key balance sheet accounts of the banking system on account of their market maturity, branch network and capitalization. The comparative market shares of key banking groups are summarized in Table 6.1.

Meanwhile, the market share of non-bank financial institutions remains relatively small, accounting for about 18 percent of total assets of the financial system and 17 percent of economic output in 2010. The Insurance Commission (IC), for instance, reports that only 13.9 percent of the Philippine population has private life insurance coverage. In 2008, the private insurer's penetration rate or the proportion of the premiums to the country's GDP was only 1.1 percent. Among the reasons cited for the low insurance coverage is the lack of priority being placed on insurance products by the citizenry and the low financial literacy level among low income households including the informal sector.

Table 6.1. Comparative Market Shares of Key Banking Subgroups in the Philippines as of end-September 2010 2010*

| Period | Bank Category | Selected Performance Indicators | Physical Composition | ||||||

| Assets | Core Loans (TLP, net of IBL and RRP with BSP) | Deposits | Capital | Net Profit | Head Office | Branches | Total | ||

| End-September 2009 | Universal and Commercial Banks | 88.5 | 83.8 | 88.2 | 86.8 | 91.3 | 4.8 | 57.3 | 52.4 |

| Thrift Banks | 8.7 | 11.6 | 9.2 | 9.2 | 3.3 | 9.2 | 16.1 | 15.4 | |

| Rural and Cooperative Banks | 2.8 | 4.6 | 2.5 | 4.0 | 5.4 | 86.1 | 26.6 | 32.2 | |

| All Banks | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | |

| End-September 2010* | Universal and Commercial Banks | 88.3 | 83.8 | 87.8 | 87.9 | 90.2 | 5.0 | 57.4 | 52.8 |

| Thrift Banks | 9.0 | 11.9 | 9.6 | 8.5 | 5.7 | 9.6 | 16.6 | 16.0 | |

| Rural and Cooperative Banks | 2.7 | 4.3 | 2.5 | 3.6 | 4.1 | 85.5 | 26.0 | 31.2 | |

| All Banks | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | |

*Preliminary data; as of End-September 2010

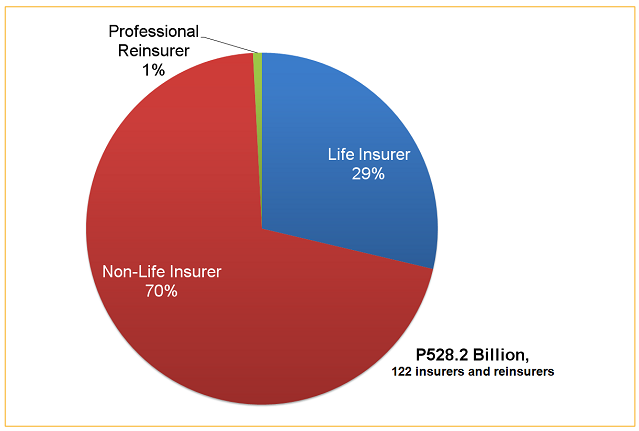

Figure 6.1. Comparative Market Share of the Insurance Industry as of end-December 2009

The insurance industry's total assets reached P528.2 billion as of end-December 2009 with 122 market players. Life insurers captured the bulk of the insurance market at 79% while non-life insurers at 19% and professional reinsurers at 2 percent.

Meanwhile, the number of companies listed in the Philippine Stock Exchange (PSE) grew to 259 companies in 2011 from just 12 companies in 2003. Despite the rise in the number of listed companies, market capitalization as a percentage of economic output remained small (except Indonesia) compared to other ASEAN-5 economies. In 2009, market capitalization dropped to 45.8 percent of GDP from 54 percent in 2002. This reflects that the market remains illiquid and the free float of listed companies in the PSE still limited.

Mutual funds, with market size likewise smallest in Asia,5 are managed by broker-dealers and investment companies where largest of them in terms of asset size are either subsidiaries or affiliates of banks.

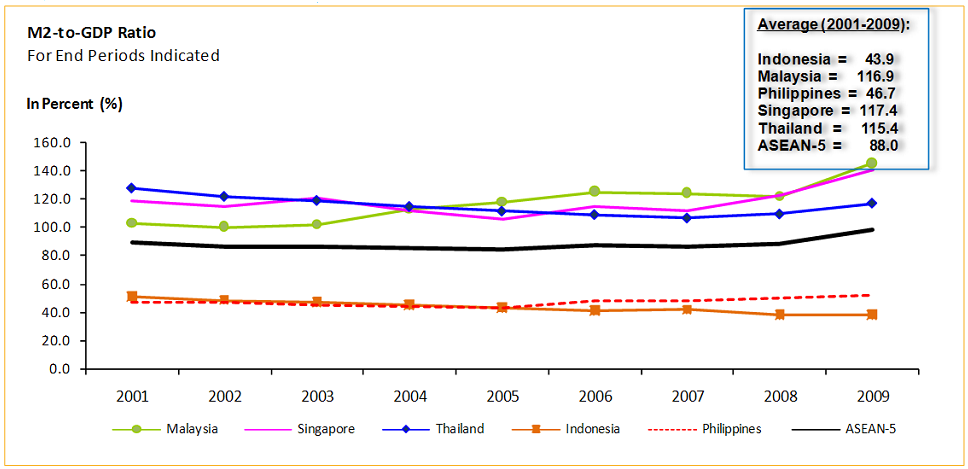

In view of this unbalanced development of the financial sector, the country's M2-to-GDP ratio6 of less than 50 percent over the last decade has been below the ASEAN-5 average and second lowest to Indonesia since 2006 (Figure 6.2). Meanwhile, Malaysia and Thailand have financial depth ratios of more than 100 percent.

The domestic capital market and non-bank sector composed of investment houses, securities brokers or dealers, financing companies and insurance companies also remain small compared to regional peers.

Table 6.2. Philippine Stock Exchange-Listed Companies: as of February 25, 2011

| Company Group | Total No. of Firms per Sector |

| Banks | 16 |

| Chemicals | 8 |

| Construction, infrastructure & allied services | 16 |

| Diversified industrials | 10 |

| Diversified services | 10 |

| Education | 3 |

| Electricity, energy, power & water | 13 |

| Food, beverage & tobacco | 23 |

| Holding firms | 41 |

| Hotel & leisure | 8 |

| Information Technology | 11 |

| Media | 5 |

| Mining | 17 |

| Oil | 5 |

| Other financial institutions | 14 |

| Preferred | 1 |

| Property | 41 |

| 2 | |

| Telecoms | 6 |

| Transport | 9 |

| Total | 259 |

Source: Philippine Stock Exchange

Foreign participation in the financial system remains limited. The banking sector was liberalized and opened to foreign participation following the enactment of the Foreign Banks Law or RA 7721 in 1994. Since then foreign banks have been allowed in principle to establish branches with full banking authority, to invest in up to 60 percent of the voting stock of a new banking subsidiary, or to invest in up to 60 percent of the voting stock of an existing domestic bank.7 The first mode of entry has been closed, however, while the second is also suspended pending a moratorium on the establishment of new banks, except for those engaged primarily in microfinance. In practice, foreign banks may only pursue the third route of foreign entry, which is the acquisition of 60 percent voting interest in an existing domestic bank. Notwithstanding the liberalization of the banking sector, foreign banks to date account for only 11.9 percent of the banking system's total assets8 although they have a stronger foothold in country's credit card business.

Figure 6.2. Financial Deepening in ASEAN-5

Table 6.3. Structure of Financial Systems in ASEAN-5 (Averages: 2000-2009)

| Economy | Domestic Credit Provided by Banking Sector | Equity Market Capitalization (% GDP) | Foreign Currency Bonds Outstanding |

| Indonesia | 54.0 | 26.6 | 2.0 |

| Malaysia | 129.6 | 135.7 | 16.2 |

| Philippines | 56.9 | 45.8 | 25.9 |

| Singapore | 91.0 | 182.2 | 25.3 |

| Thailand | 130.2 | 55.8 | 6.1 |

Source: IMF, World Bank and Asian Bonds Online

Table 6.4. Extent of Bank Access - Customer Reach (2010)

| Country | Deposit accounts per 100,000 people | ATMs per 100,000 people | Branches per 100,000 people |

| Indonesia | 504.7 | 14.4 | 7.7 |

| Malaysia | 2,063.3 | 54.0 | 11.4 |

| Philippines | 499.1 | 14.3 | 11.8 |

| Singapore | 2,236.3 | 49.8 | 10.5 |

| Thailand | 1,448.8 | 71.3 | 11 |

Source: World Bank

The current geographical distribution of financial service providers shows a growing concentration in the high-income and urbanized areas of NCR, Central Luzon and CALABARZON (Cavite, Laguna, Batangas, Rizal and Quezon). Bank density is heavily skewed towards these three regions and the nationwide density ratio of five banks per city or municipality has been largely unchanged for the last decade. Consequently, about 37 percent9 of municipalities in the Philippines do not even have a banking office and can be considered either unserved or underserved with respect to a broad range of critical financial services such as credit, savings, payment transfers, remittances and insurance. Compared to the ASEAN-5, the Philippines lags behind in terms of customer reach (Table 6.4.).

The agenda to develop a robust capital market is of long standing, and has been previously analyzed extensively, yet many of the critical components remain unresolved. To attain the objective of a regionally-responsive development-oriented financial system, there must be a clear acceptance that a thriving capital market is not an optional appendage but a crucial complement to the traditional bank deposit-loan market. The local bond market continues to be dominated by government securities and is largely fragmented, with the presence of too many tenor buckets and a longer maturity profile10 compared to other ASEAN economies (Figure 6.3).

________________________________________________________________________________________________________________________________

4 Excludes the assets of BSP. Likewise, other non-bank financial institutions not under BSP supervision such as investment houses and financing companies without quasi-banking functions and/or trust authorities or are not subsidiaries or affiliates of banks and quasi-banks, lending investors, insurance companies and other government financial institutions (GFI) such as the Social Security System (SSS) and Government Service Insurance System (GSIS) are excluded in the computation of total assets of the financial system due to data constraints.

5 Cf: April 2010 FSAP Report: An Update on the Philippines

6 This refers to the measure of broad money which consists of currency in circulation, peso demand deposits or M1 and peso savings and time deposits. This is the ratio of which over economic output is a common measure of financial depth.

7 Article 99, Chapter XIII of the Cooperative Code of the Philippines (RA 6938) limits the ownership of a cooperative bank to duly established and registered cooperatives in the Philippines, including another cooperative bank.

8 Section 3 of the Foreign Banks Law or RA 7721 limits the aggregate share of foreign banks to 30 percent of banking system's total assets.

9 The ratio may be lower if the client reach of non-bank microfinance institutions (MFI) and non-government organization/civil society organization (NGO/CSO)-oriented cooperatives are included.

10 Largely used as a debt management tool of the government to ensure liquidity for its deficit financing needs.