Banking Sector

The Philippine banking system, which remains the core of the financial system and primary source of credit for the economy, continues to manifest sustained resilience for the last decade at par with its ASEAN-5 neighbors.11

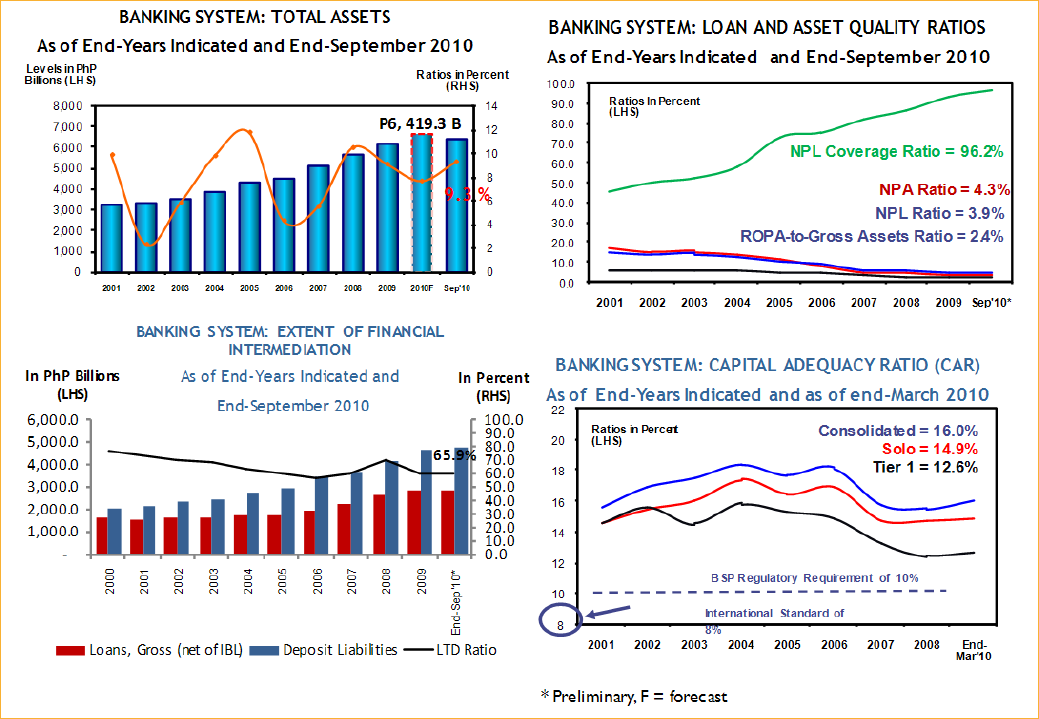

Key performance indicators (Figure 6.4) showed steady growth in assets, lending, deposits and capital accounts. While credit expansion has been modest, averaging 6 percent in over a decade, this was due less to a lack of liquidiy in the system and more to developments in the capital market that allowed some highly rated companies to tap alternative funding. Alongside this, credit underwriting standards were strengthened, which ultimately allowed banks to improve their asset quality and maintain prudent loan-to-deposit ratios. Bank solvency remains above the BSP regulatory requirement of 10 percent and the international standard of 8 percent; the country fully adopted the risk-based capital adequacy framework12 under Basel II in 2007. Core earnings grew together with modest, credit expansion and a general improvement in asset quality.

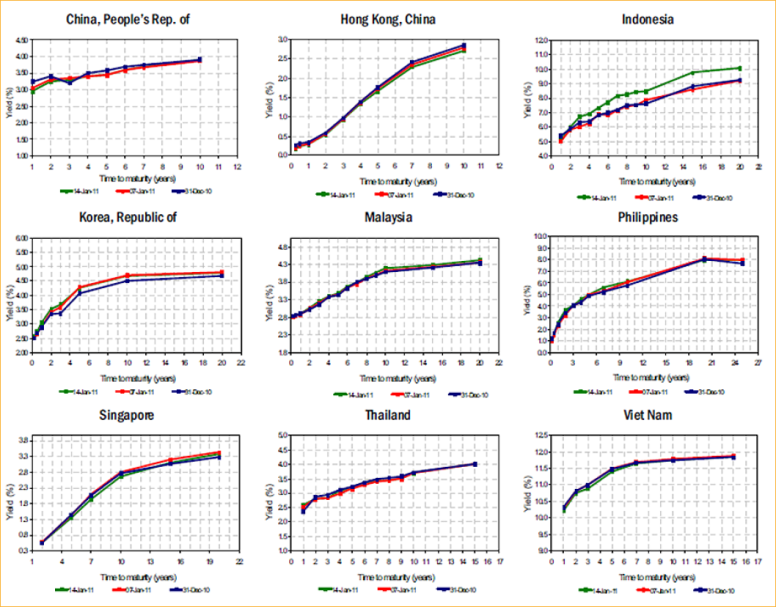

Figure 6.3. Comparative Benchmark Yield Curves, ASEAN+3

Source: Bloomberg, Asian Bonds Online

Figure 6.4. Selected Performance Indicators of the Banking System

Source: Bangko Sentral ng Pilipinas

___________________________________________________________________________________________

12 Prior to the banking system's adoption of Basel 1, Philippine banks were required to maintain a net worth-to-risk assets (NWRA) ratio of at least 10%. On July 1, 2001, the NWRA ratio was replaced by a 10 percent BIS-type risk weighted capital ratio when the banking system adopted the Basel 1 framework for bank capital (BSP Circular No. 280)