7.1.2.3 Sector outlook and findings

Demand for national highways is expected to grow considerably to 2031 with strong population growth across the country. This will place increasing pressure on the current cost recovery model operated by governments.

At present, demand for national highways is moderated by the following charges:

■ registration fees ($7.5 billion);

■ tolls ($1.5 billion);

■ excise on fuel purchases ($9 billion); and

■ the National Heavy Vehicle Charges Determination (which is calculated using registration and road user charges).182

Of these measures, only the excise and road user charges vary according to use of roads, and are applied across the national network. Providing more transparent links between road user charges and expenditure on road planning, investment and maintenance may provide governments with greater means of implementing a more effective road user charging model than at present.

Developing funding methods that reflect the users' willingness to pay and encourage private funding for projects are likely to emerge as key strategies to address growing demand for national highways.183

Demand for national highways for road freight has increased consistently over recent decades. BITRE estimates that the total road freight task for Australia (excluding road freight transported within the eight capital cities) increased from 19.2 billion tonne kilometres in 1971-72 to 157.8 billion tonne kilometres in 2012-13.184 It projects that across all Australian roads, the road freight task is projected to increase from 197 billion tonne kilometres in 2011 to 355 billion tonne kilometres in 2031, constituting growth of 80 per cent over this period.185

Figure 31 shows the growth of the national interstate and intrastate road task from 1971-72 to 2012-13. This road freight task has increased at an average annual rate of 5.1 per cent over the period, with noticeable dips in growth during the recession of the early 1990s and the financial crisis of 2007-08.

Figure 31: Annual interstate and intrastate road freight - 1971-72 to 2012-13

|

|

Source: Bureau of Infrastructure, Transport and Regional Economics (2014d)

Road freight experienced considerable productivity growth over this period, with the introduction of an expanded network for larger trucks (particularly B-double articulated trucks), as well as progressive increases in regulated heavy vehicle mass and dimension limits.186

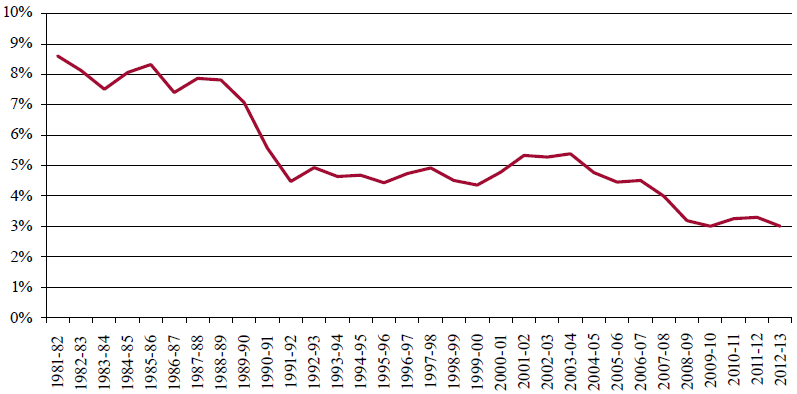

Despite the strong growth in the overall road freight task over recent decades, the rate of growth has slowed over time. As illustrated by Figure 32, the growth in interstate and intrastate road freight (expressed as a 10 year moving average) has slowed considerably since 1982-83.

Figure 32: Annual growth in interstate and intrastate road freight - 10-year moving average - 1981-82 to 2012-13

Source: Infrastructure Australia analysis of Bureau of Infrastructure, Transport and Regional Economics (2014d)

BITRE notes that the recent slowing of growth of the road freight task has been mirrored by a slowing of growth in the productivity of the sector. This trend is expected to continue. The productivity impact of anticipated transitions to higher heavy vehicle load limits and higher productivity vehicles such as B-triples and AB-triples is expected to be minimal.187

The forecast almost doubling of the national land freight task from 2010 to 2030,188 will drive heavy vehicle demand on the national highways. Given that fleet-wide average loads are expected to grow by less than 10 per cent over this period - an average annual rate of growth of 0.3 per cent - the increase in demand for national highways could be considerable.189

High levels of forecast growth in the overall road freight task with low levels of growth in vehicle capacity would result in a dramatic increase in the number of vehicles and drivers operating on the national highways. This trend could have significant implications for the national highways with regard to capacity, safety and maintenance costs.

The Australian Infrastructure Plan is likely to investigate policies and reforms that address this potential trend, including pursuing heavy vehicle road charging. Governments will need to commit sufficient funds to ensure the national highways are maintained at a level to support forecast levels of service, with transparent reporting of costs to road users and the public so that charges can be clearly linked to the services provided.

Performance improvements to the national highways will be required to support the increased use of high-productivity vehicles and to achieve improvements in safety ratings of these roads.

Integrated long-term planning in the freight sector is essential to ensuring that Australia meets the forecast growth in the overall freight task as efficiently as possible. Critical assessment of policies that deliver the most appropriate modal share in each capital city and freight corridor will allow infrastructure investments to deliver the greatest benefits across the network.

Audit findings 51. The national land freight task is expected to grow by 80 per cent between 2011 and 2031, with a large component of this task expected to be handled by road freight vehicles. 52. Accommodating this growth will require a focus on policy reform to enable the wider use of higher productivity heavy vehicles (such as B-triples), and selected investment (such as increasing bridge load limits and targeted safety improvements, aimed at improving the performance of national highway infrastructure). |

_________________________________________________________________________________

182. Bureau of Infrastructure, Transport and Regional Economics (2014c)

183. ACIL Allen Consulting (2014a)

184. Bureau of Infrastructure, Transport and Regional Economics (2014d)

185. Bureau of Infrastructure, Transport and Regional Economics (2014b)

186. Bureau of Infrastructure, Transport and Regional Economics (2014e)

187. Bureau of Infrastructure, Transport and Regional Economics (2011)

188. Standing Council on Transport and Infrastructure (2012)

189. Bureau of Infrastructure, Transport and Regional Economics (2011)

Interstate

Interstate Interstate

Interstate Total (excl intracity)

Total (excl intracity)