Overview of the UK PFI marketplace

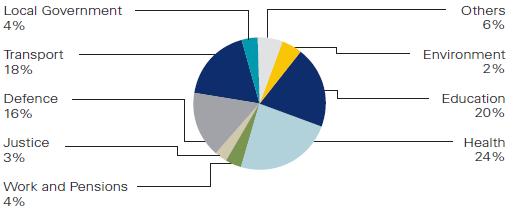

Since the first PFI contract, the construction of the QEII Bridge between Dartford and Thurrock in 1987, over £38bn in capital value has been contracted between public and private sectors. This excludes the 3 London Underground PPP contracts. Health has accounted for the highest amount of capital value with over £9.5bn of contracts signed. This is 25% of the capital value of UK PFI contracts. For the purposes of this analysis English, Scottish, Welsh and Northern Irish contracts are grouped together to make up the overall sector figures.

The top 10 projects by value are split between transport, defence, health and the DWP PRIME contract. Together they account for over £7bn in value (19% of total UK market); they are all listed below along with the London Underground PPP projects that have been excluded from this analysis.

Proportion of total PFI contract value by sector

Top 10 UK PFI projects by capital value |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

London Underground track contracts (excluded from analysis) |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Source: HM Treasury |

|

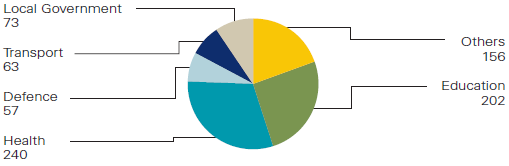

As well as highest capital value the health sector accounts for the largest number of contracts with 240, 30% of the total number of projects carried out since 1987. It is closely followed by education with 202 and together they account for over 55% of the volume of UK PFI contracts.

Number of PFI contracts by sector

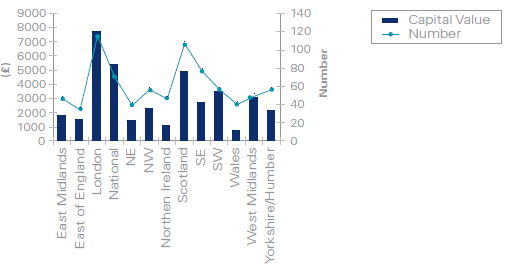

If the regional distribution is analysed it is perhaps unsurprising that London accounts for the highest value and volume of signed contracts. It accounts for 116 with Scotland accounting for 99 and the South East of England 77. If 'national' contracts are excluded, Scotland also accounts for the second highest level of PFI spending by capital value. 46% of Scottish contracts are health related and 32% education. Together, they account for 78% of Scottish contracts by volume and just under 75% by contract value, which differs markedly from the overall UK picture of over 55% and 46% by volume and value respectively.

Contracts by region

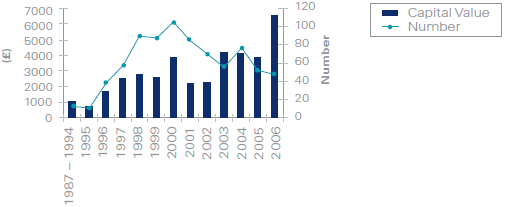

Whilst 1987 was the year of the first PFI contract, there were only 13 up to and including 1994 totalling just over £1bn. Since 1995 there have been 778 contracts signed totalling over £38bn with the zenith being in 2000 with 106 PFI contracts agreed. 2006 was the peak year for contract value accounting for over £6.5bn.

We will wait to see what 2007 brings and will carry out this analysis next year to reflect changes and developments in this innovative marketplace. The overall trend in the current decade appears to be downward, at least in terms of numbers of contracts. Certain sectors, notably Health, are carefully appraising whether the traditional PFI model is still right for their area. We will also be monitoring the impact of the new BSF approach in Education | The overall trend in the current decade appears to be downward, at least in terms of numbers of contracts. Certain sectors, notably Health, are carefully appraising whether the traditional PFI model is still right for their area. |

Contracts by year