Risk transfer

A key benefit attributed to PPPs is that they achieve significant risk transfer from the government to the private sector.

Australian PPPs seek to allocate project risks to the parties best able to manage them. Optimal risk allocation is the goal, where risks are allocated in a manner that minimises the aggregate cost of managing the risks over the term of the contract. Only those risks that the private sector can manage at a lower cost than the government should be allocated to the private sector.

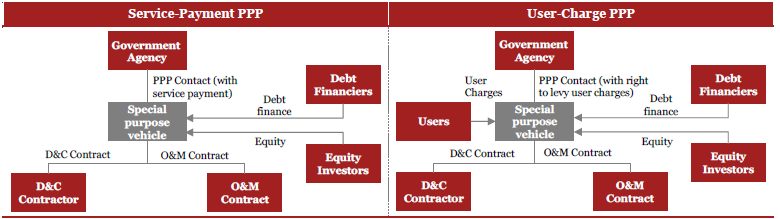

The diagrams below show the basic contractual structure for a service-payment PPP and for a user-charge PPP.

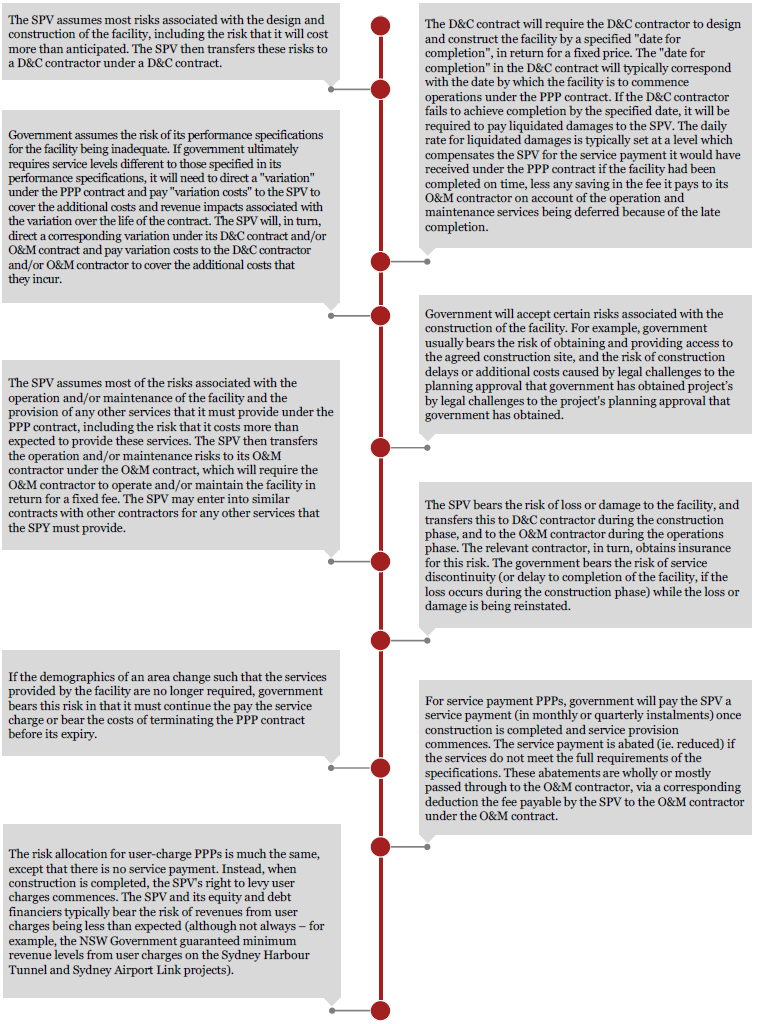

The general risk allocation for most PPPs is as follows:

This basic PPP risk allocation is summarised in the below table.

Risk | Government | SPV (Equity Investors and Debt Financiers) | D&C Contractor | O&M Contractor |

Design and construction risks |

|

| ✓ |

|

Operation and maintenance risks |

|

|

| ✓ |

Inadequate performance spec | ✓ |

|

|

|

Site access; legal challenge to planning approval | ✓ |

|

|

|

Demand risk (Service-payment PPP) | ✓ |

|

|

|

Demand risk (User-charge PPP) |

| ✓ |

|

|

Loss or damage to facility during D&C phase |

|

| ✓ |

|

Loss or damage to facility during O&M phase |

|

|

| ✓ |

Default/Insolvency of Contractor |

| ✓ |

|

|

Default/Insolvency of SPV | ✓ |

|

|

|