Minimise financing costs

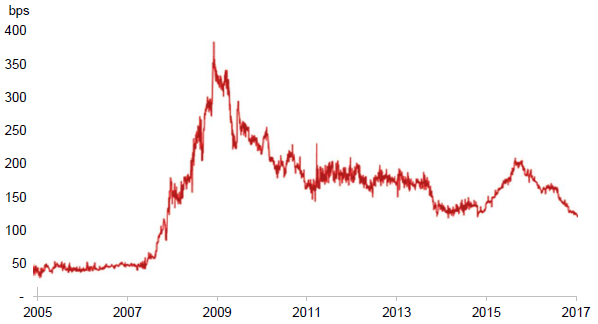

As already discussed, the due diligence and project monitoring undertaken by private sector financiers is a significant driver of the superior cost and time outcomes achieved by PPPs. However, as the below graph demonstrates, the cost of private finance for PPPs was considerably higher in the years that followed the GFC than the years that preceded the GFC. This made it harder for PPPs to provide better value for money than publicly funded delivery models. (The graph shows historical BBB credit margins, which is a good proxy for the credit margins on PPP debt.)

Australian governments responded by adopting funding models for PPPs that minimised the amount of private finance to the level needed to maintain the risk management disciplines which private finance brings. In particular, by providing a portion of its funding earlier, governments have been able to reduce the amount of private finance required, or the period for which it is required. The accelerated government funding has taken many forms, including progress/milestone payments during the construction phase, a capital contribution at or shortly after the facility commences operations, or a service payment structure that is front ended (rather than flat).

Projects that have adopted such funding models include the Sydney Metro Northwest, the Sydney International Convention, Exhibition and Entertainment Precinct, Sunshine Coast University Hospital and the Victorian Comprehensive Cancer Centre.

The impact that the form, amount and timing of any government funding will have on the risk borne by government must be carefully considered. For example, the amount of private debt carried by the SPV and the associated financing costs can also be reduced by government investing equity in the SPV, or by government becoming a lender to the SPV.

However, these approaches involve government assuming the risks borne by equity investors or lenders, which adversely affects the value for money of a PPP compared to publicly funded models. Government guaranteeing the repayment of the SPV's debt raises similar issues. The participation of government in PPPs as both the procuring agency and as an equity investor or debt financier also creates conflicts of interest, as previously mentioned.

For mega projects, where lack of liquidity could force financing costs to be too high to provide value for money, deferring the requirement for underwritten debt finance until later in the bidding process can also reduce the cost of finance.