Background

PFI involves a long term, 30 to 60 year, contract between the public and the private sector. Under PFI, a consortium of investment banks, builders, and service contractors raises finance for new infrastructure and designs, builds, and operates the facilities for the public authority.

Two main types of private finance have been used since 1997, when the government passed an act of parliament guaranteeing repayment of the majority of PFI debts. Senior debt is low risk because the government guarantees repayment. It therefore has a relatively low rate of interest. Equity and subordinate debt is not legally guaranteed by the government and is only paid back after senior debtors have been repaid. It carries higher risk of non-payment than senior debt and therefore commands a higher rate of interest. This type of debt acts as a financial buffer by diverting commercial risk from the main source of funding and so reducing the overall cost of finance. Typically, 90% of finance for PFI schemes is low risk senior debt and the remaining 10% is higher risk equity.

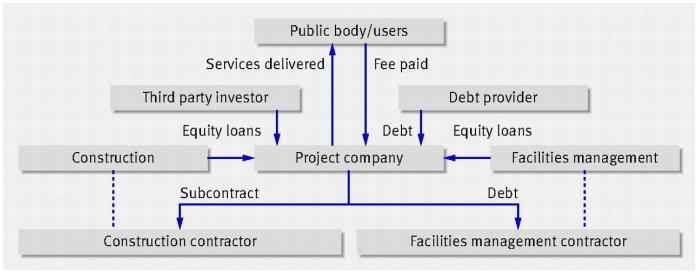

A public authority enters into a PFI contract with a 'special purpose vehicle' (SPV) set up by a consortium of financiers, builders and service providers. The SPV is a shell company with no assets of its own. As well as private finance and construction, the consortium usually provides facilities management services such as laundry, maintenance services, catering, and cleaning (Figure 1).

Figure 1 Contractual structure of PFI partnerships

When the new facility is up and running, the public authority pays the SPV an annual performance‐linked fee, known as a 'unitary payment'. The unitary payment is made of two elements. The first element is the availability fee, which covers interest and principal payments on the PFI debt and the accumulation of cash reserves to meet life‐cycle costs. Unspent cash reserves built up in this way are the property of shareholders. The second element of the unitary payment is the service charge, which covers facilities management.