High PFI costs have been underfunded

The NHS budget and payments to hospitals do not meet the high costs of PFI.

The impact of PFI payments on hospital budgets varies according to the rules and regulations of a country. In the NHS in England, hospital trusts have been required since 1990 to set aside part of their budget to pay 'capital charges' to the government (a cost of capital charge equivalent to 3.5% of the value of their buildings). They must also set aside a proportion of their budget to pay for buildings' depreciation.

The UK government originally assumed that these capital charges would be sufficient to pay the availability fee to the PFI provider when a PFI project was introduced to the equation. However, this was not the case. Capital costs under PFI required a much greater proportion of annual budgets than the government's capital charges that they replaced (table 4).

Table 4

Annual revenue implications of capital costs for eight PFI schemes comparing costs before and in the first year of PFI29

Trust | Before PFI (capital charge as % of revenue 1998-9) | After PFI (capital charges+availability fee as % of projected revenue in 1st year of operations) |

Hereford Hospitals | 3.8 | 14.6 |

South Tees | 5.6 | 13.1 |

Dartford and Gravesham | 6.7 | 32.7 |

Greenwich Healthcare | 2.1 | 16.2 |

Swindon and Marlborough | 3.8 | 16.4 |

Bromley Hospitals | 7.0 | 10.7 |

Calderable Healthcare | 3.4 | 13.1 |

North Durham Healthcare | 4.2 | 12.2 |

Refers to 1999-2000. All calculations include payments to Treasury on existing and retained estate. Data from Department of Health.16 17

In 2002 a pricing system known as the national tariff hospital payment system was introduced. (The tariff is the UK equivalent of the diagnosis related group (DRG) hospital payment system). Under current activity -based reimbursement provisions for hospitals, 5.8% of the allocated resources are reserved for capital costs. However, the capital cost element in the tariff was in many cases less than the PFI fees actually paid. We found that of the 40 NHS trusts paying PFI unitary charges in 2005/06, had capital costs in excess of funding under the tariff. On average, trusts with PFI schemes that were operational and incurring charges in 2005/06 had capital costs of 8.3% that year - i.e. these trusts experienced an average shortfall in income of 2.5%.

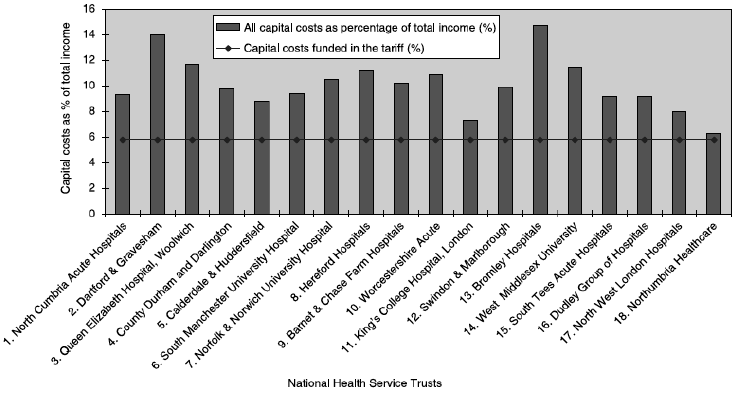

However, many of the 40 PFI schemes that were operational in 2005/06 are small, and their impact on trust expenditure correspondingly minor. For the 18 trusts that were, in 2005/06, paying charges on schemes with a capital value of over £50 million, the impact of PFI costs was much more significant. For these trusts, average annual capital costs were 10.1% of total income in 2005/06, compared with 5.8% in the tariff. These trusts experienced an average funding shortfall of 4.3% (figure 2).

Figure 2: Capital costs for trusts with PFI schemes with a capital value of over £50 million, in 2005/0630

Three short-term measures have typically been adopted to reduce or delay the budgetary impact of PFI repayments.

First, various subsidies have been used to delay the impact of PFI. They include the 'smoothing mechanism', 'deferred asset support', 'balance sheet support' and 'transitional support'. However, when the subsidies expire the hospital has to bear the full cost.

Secondly, land and property sales have been widely used to ease affordability problems by reducing the amount of money that has to be borrowed. For example, Edinburgh hospital received £15.4 million for city centre lands sales in annual fix instalments of £2.5 million between 2002 and 2006.

A third way of coping with underfunded repayment costs is by a process known as "debt sculpting". Debt sculpting involves lowering repayments in the first years of a contract and raising them in subsequent years. Arrangements of this type are frequently negotiated with private sector partners through the use of complex and very costly financial instruments known as 'swaps' (see below).

None of these measures offers a permanent solution to high repayment costs, nor are they designed to.

__________________________________________________________________________________________

29 Pollock AM, Shaoul J, Vickers N. PFI and "value for money" in NHS hospitals: a policy in search of a rationale? BMJ. 2002;324:1205-1209.

30 Mark Hellowell and Allyson M. Pollock. The private financing of NHS hopsitals: policy, politics and practice. Economic Affairs, March 2009.