Conclusion

The principles and rules by which the federal government budgets, appropriates, and accounts for capital investment-which are rooted in concepts developed in 1967 and regulated by rules promulgated in 1991-may no longer reflect the true costs and realities of our government and its agencies today. An incoming administration and a new Congress have an opportunity to explore a bipartisan, commonsense set of proposals to test new methods, explore a more comprehensive approach, and modernize the underlying concepts. Failure to do so condemns agencies and the people they serve to a higher-than-necessary cost structure, low-quality facilities, and impaired performance. Unlocking access to carefully controlled private investment could also unlock the potential for improved civic engagement and enhanced trust in government. We believe this opportunity is ready right now.

Unlike other related proposals prepared over the past several years, though, the Advisory Group does not believe that the answer is to create another loophole or carve-out. Instead, the Advisory Group believes a uniform application of the existing scoring rules would provide a more efficient means to evaluate alternatives and to fund the approach that has the highest value and lowest cost for the taxpayer.

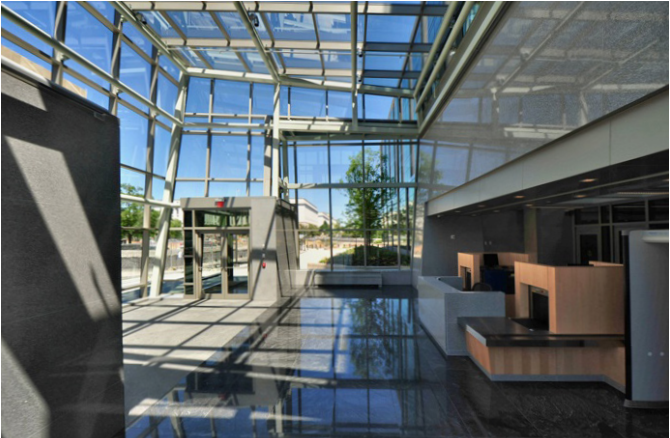

Thomas P. O'Neill Jr. Federal Office Building in Boston, Massachusetts.

Courtesy of Turner