1.2.1 PPP as an option in the procurement process

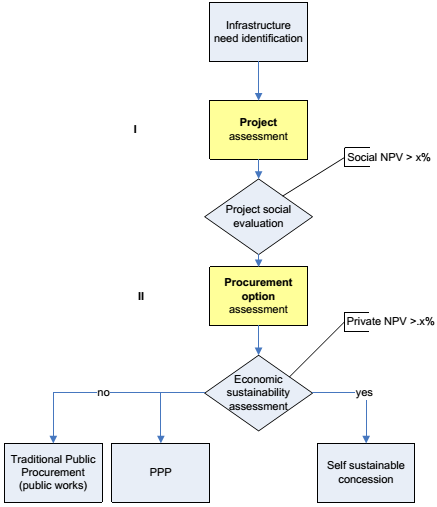

A PPP is a "procurement option" among others. This implies that the procurement process for infrastructure service delivery have been structured in way to choose the best option. This is the option providing more value, where "value" means the option generating the most allocative5, productive6 and adaptive7 efficient public investment. One first remarkable novelty of PPP has consequently emerged at the institutional level: PPP reforms impulse a new process for choosing procurement options of infrastructure services. A PPP is therefore a modality for undertaking public investments for providing an efficient response to the demand of the public (users and affected stakeholders) of an infrastructure services. A modality of investment alternative to others that imply the use of funding from tax revenue or public borrowing, such as traditional public procurement or does not imply any of the above such as in the case of self-sustainable concession.

PPP as the most valuable infrastructure service delivery option [France - Ordonnance n°2004-559 du 17 juin 2004 sur les contrats de partenariat. (Modifié par LOI n°2008-735 du 28 juillet 2008) Art.2] I. - Les contrats de partenariat donnent lieu à une évaluation préalable, réalisée avec le concours de l'un des organismes experts créés par décret, faisant apparaître les motifs de caractère économique, financier, juridique et administratif qui conduisent la personne publique à engager la procédure de passation d'un tel contrat. Chaque organisme expert élabore, dans son domaine de compétences, une méthodologie déterminant les critères d'élaboration de cette évaluation dans les conditions fixées par le ministre chargé de l'économie. Cette évaluation comporte une analyse comparative de différentes options, notamment en termes de coût global hors taxes, de partage des risques et de performance, ainsi qu'au regard des préoccupations de développement durable. Lorsqu'il s'agit de faire face à une situation imprévisible, cette évaluation peut être succincte. [Poland XXXXX} 1.Public-private partnership may be a form of implementing an undertaking, in the procedure and under the principles set out herein, if this brings benefits for the public interest that outweigh the benefits resulting from other methods of carrying out such undertaking. 2. A benefit for public interest shall mean in particular savings in expenditures of the public higher standard of the provided services, or lower inconvenience for the surroundings. |

Through the procurement process PPPs introduced a new logic for public investment decision-making. This logic works a two level: at the identification of the public investment project; and at identification of the modality for carrying out the same investment. Thus PPPs are the result of a two level decision making process for choosing the most valuable infrastructure service delivery process via a separate (1) project, and (2) procurement option assessment.

PPP introduce a methodology, a process and an institutional framework for comparing, choosing, and supervising the options of the public intervention in term of value. Specifically, "value for money" intended as the optimum combination of whole life cost and quality (or fitness for purpose) 8 of the project investment to meet the project's stakeholder requirement. Beyond the process, this novelty introduces a remarkable element of transparency and consequent accountability, which rationalize and open the decision-making route to the public. It reduces the space for unquestionable discretion and imposes justifications for the decision to be taken, which helps itself generating efficient decision-making.

__________________________________________________________

5

6

7

8 HM Treasury, Government Accounting, 2000