6.2 Building institutional and contractual mechanisms for managing change of circumstances

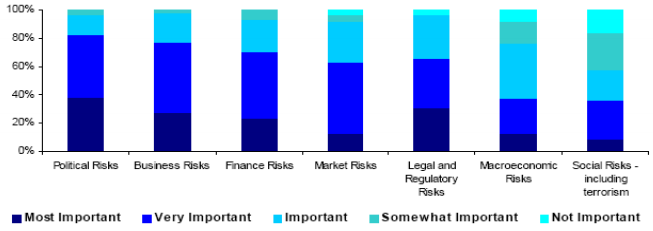

Regarding the regulatory and institutional framework, the quality of contract enforceability and governance are critical factors affecting PPP agreements. Weak institutional mechanisms, that adapt to changing circumstances, and government's lack of commitment not to renegotiate account for recurrent contract revisions. In many developing countries, there has been more interest from local and foreign investors to have complete information on the institutional requirements and the context where investments are made, particularly in PPPs. And such investments have risen dramatically in recent years. In 2007, about 15% of global FDI came from developing countries while in 1990 this figure accounted for only 5% of total global FDI. In a recent exercise by PPIAF to explore the most important aspects affecting the flow of private investment into infrastructure projects, a survey was applied to investors that engage in PPP contracts or have had experience engaging in infrastructure concessions. The responses show that the companies rated as "most" and "very important" the political and business risks (80 percent), followed by legal and regulatory risks, finance, market (70 percent), macroeconomic and social risks (38 percent) (see graph below).

Obviously many of those factors are exogenous to the contract itself. But interestingly, the business risks are highly correlated with the incentives and institutional setting provider by the contract and the regulatory agency. Other important aspects of Financial and Legal risks can well be specified in contracts in order to set clear rules between parties involved in the PPP to guarantee the minimization of costs of such risks. This is why all the institutional clauses specified in PPP and concession contracts are so important in providing solid ground and certainty in a long-run relationship. Many unforeseeable changes in circumstances cannot be taken in consideration ex ante. But many other simple resolution mechanisms can be set and specified to increase incentives from private equity owners to finance long term projects with a reasonable rate of return.

PPIAF EMIO Survey 2007. Perceptions of Risks by Importance

Political risk: | Political risk considers factors such as political stability, enforcement of government contract etc. |

Business risk: | This includes factors such as cost and availability of resources, long gestation period. Project implementation risk etc. |

Macroeconomic risk: | Factors include inflation, exchange rate volatility, low trade openness, small economy e:c. |

Finance risk: | This refers to the possibility of a Company not having adequate cash flow to meet in financial obligations, such as repayment of principle and interest on a debt. |

Market risk: | This refers to die possibility of an unfavorable market condition in terms of reduced demand for a product or service, negatively affecting a Company's revenue and profit. |

Legal and regulatory risk: | This refers to the possibility of change to laws and regulations having a negative impact on an investment. It is particularly significant when government intervention in the invested sector is high. |

Social risk: | This refers to the possibility that an intervention would create, reinforce or deepen inequity and/or social conflict, or that the attitudes and actions of key stakeholders may subvert the achievement of the development objective, or that the development objective, or means to achieve it, lack ownership among key stakeholders. |

Note: 63 respondents - error level 9.6% (90% confidence level).

Source: EMIO Surrey 2007