Renegotiation and Optimal Contract Flexibility

There are few studies that focalize theoretically (Plambeck and Taylor, 2005) and empirically (Guasch, 2005) on the links that exist between contract flexibility and renegotiations. Theoretically speaking, it has been shown that firms that obtain market demand information may benefit by renegotiating contracts to allow buyers or government facing poor market/public finance conditions to purchase less than the contractual commitment (Serrant and Ojo, 2001). The potential renegotiation of the supply of contracts has important implications for private party investments in capacity, which results in profits. Failing to anticipate renegotiation leads to contracts that contain far too much flexibility, and perform poorly relative to contracts design to anticipate renegotiations (Plambeck and Taylor, 2005; Guasch, 2005).

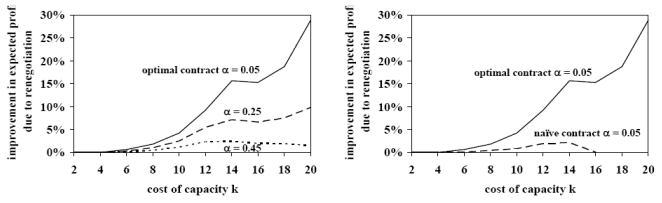

In infrastructure PPP projects an operator typically pay a reservation fee to the contract for works and construction, when there is flexibility. Such fee reflects the flexibility on information about demand distribution, cost of innovation or infrastructure upgrade, confidence, and capacity. Contract parameters of flexibility should be set to maximize the total infrastructure revenue and allocate total profits through subsidies or transfer payments. To illustrate the implications of optimal contracts with flexibility but with or without renegotiation, the figure below displays the expected profitability against capacity costs of a simulation done by Plambeck and Taylor (2005).

Beyond the technical specifics of the parameters assumed for the simulation (see Plambeck and Taylor, 2005 for further details), the simulation brought an illustrative way to verify the relationship between contract flexibility and renegotiation on profitability. On the left diagram, the increase in total expected profit due to renegotiation when the optimal contracts are used with flexibility, as a function of capacity costs and buyers' bargaining strength (alpha).

Renegotiation, Contract Flexibility and Profitability

Source: Plambeck and Taylor, 2005

Flexibility provides mechanisms to gain profitability depending on renegotiation outcomes. On the right diagram improvement in expected profit due to renegotiation when there null flexibility and without renegotiation anticipation (naïve contract). The main messages are, first, that renegotiation can greatly improve performance if contract is designed on a flexible basis to anticipate renegotiation. Second, the proportional gain from renegotiation and adequate flexibility (optimal contract design) is greatest when capacity is expensive (large scale infrastructure).