1.2.4 Monitoring private partner cash flows and project financial health

Monitoring and supervision of the operation stage of the contract by the overseeing institution entails a reliable commitment to protect consumer interests, which in turn, implies the responsibility for safeguarding the achievement of the contract's goals and objectives. However, it also implies protecting investor interests which, in this case, supposes to guarantee that they get the agreed-upon payment. Consequently, the regulatory challenge consists in maintaining the balance between the rights and obligations and the incentive scheme of the contract in the long run. In effect, there is a clear need to preserve the equilibrium between the parties so they all benefit from their mutual cooperation (see BOX 19).

BOX 19 : Contract Management - UK

It is important for all stakeholders to recognize that the contract itself should be at the heart of the process - it is the foundation upon which the relationship is built, and compliance with the contract is a fundamental measure of Best Value. The central aims of the contract management activity are to ensure that: • the local authority's agreed contractual position is protected • the agreed allocation of risk is maintained and that Best Value is achieved • monitoring of the service provider's performance against the output specification is undertaken to ensure that the financial implications of any failure to perform have been taken into consideration and appropriate action taken • payment for the service is conditional upon the quality of performance of the service provider • services are delivered in accordance with the contract • continuous improvement in contract performance and service delivery is maintained. |

Such equilibrium should be dynamic. Due to the special features of the infrastructure sector, contracts are incomplete and, therefore, ambiguities will usually arise and changes in the circumstances and disputes between the parties that will break the equilibrium. Then, new resolutions will result in new equilibriums. The quick restoration of the equilibrium depends, as mentioned in the previous section, on the degree of commitment of the regulators towards the regulatory process. It is essential that such commitment properly evidences transparency, participation and consistency principles.

This section focuses on the monitoring of the economic aspects of the contract equilibrium: costs and revenues. The costs involved are operation and maintenance (OPEX), and investment costs (CAPEX). In relation to the revenues, the analysis will be focused on the monitoring of the payment mechanism agreed-upon in the PPP contract.

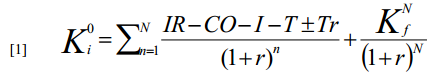

The condition to meet in order to achieve economic sustainability of the service -at the same time that monopolistic rents are avoided- can be formally expressed as follows118:

Where Ki represents the initial capital of the period; IR, revenues; CO, operating costs; I, investments; T, taxes; and Tr, transfers from the Treasury (that may be positive -explicit subsidies- or negative -payment of concession fee-). These elements represent the free cash flow received by the firm. The opportunity cost of capital - r - is located in the denominator.

The second term represents payment received at the end of period N. It is expressed separately in order to ease the analysis of the existence of different rules of termination payment (Kf) and/or duration of the concession (N), variables that may be used as instruments to restore equilibrium in distress situations. Therefore, sustainability of the firm calls for the firm's future cash flow discounted using the opportunity cost of capital rate to be equal to the invested capital.

This sustainability equation is also known as economic equilibrium of contract since it summarizes all the economic elements involved in a contract. From the point of view of the service provider, contractual obligations are represented by the operating and maintenance costs (CO) and the investments (I) that the firm has to carry out in order to meet service needs. At the same time, the revenue (IR) that the firm will obtain for service provision represents contractual rights.

The cost of capital (r) is a value -to some extent exogenous- that represents the opportunity cost of capital. In other words, it is the return that the average investor would obtain in an alternative use with similar risk levels.

From this standpoint, preserving the equilibrium implies to balance the treatment of the rules that define or determine the costs and revenues involved at the operation stage of PPPs. On the one hand, it will be necessary to control that operators minimize the cost of producing the necessary service level, that is to say, that operators are cost-efficient. On the other hand, it is necessary to verify that the revenues or payments are large enough to cover the expected efficient levels of operating expenses, depreciation and the return of past and expected investment needs (all of which implies that the level of tariffs is dynamically efficient).

____________________________________________________________________________________

118 In terms of cash flow, this equation is the same as fixing revenue to cover operating and maintenance costs, depreciations and a return on the invested capital. To check this equivalence, see Green-Rodríguez Pardina 1997.