1.4.3 Managing flexibility to meet the changes

Comparing the evidence on renegotiations submitted by Guasch with the information on projects under distress of the PPI Database, it is possible to have an idea of the effectiveness of renegotiations as a tool to solve distress problems.

Guasch presents a study based in 942 concessions in Latin America during the 1991-2001 period. The methodology adopted by this author states that: "Renegotiation has occurred if a concession contract underwent a significant change or amendment not envisioned or driven by stated contingencies in any of the following areas: tariffs, investment plans and levels, exclusivity rights, guarantees, lump-sum payments or annual fees, coverage targets, service standards, and concession periods. Standard scheduled tariff adjustments and periodic tariff reviews are not considered renegotiations."

A deep analysis of this point would require a detailed valuation of the costs and benefits of both alternatives, which is not possible within this framework. Nevertheless, it is expected that the termination or arbitration costs (both conditions are included in the distress definition in our PPI Database analysis) are substantially higher than the costs related to renegotiation.

Table 17 shows information by sector regarding the incidence of the renegotiation reported by Guasch and of the projects under distress (those terminated and those submitted to arbitration) as per the PPI Database.

Table 17: Renegotiation as to Tool to Solve Contractual Disequilibrium

| Distressed | Renegotiation | |||||

| Distressed | Total | Incidence | Renegotiated | Total | Incidence | |

| Energy | 51 | 488 | 10,5% | 23 | 256 | 9,8% |

| Telecom | 4 | 115 | 3,5% | 3 | 273 | 1,1% |

| Transport | 32 | 382 | 8,4% | 151 | 276 | 54,7% |

| Water & Sewerage | 24 | 191 | 12,6% | 102 | 137 | 74,5% |

| Total | 111 | 1.176 | 9,4% | 281 | 942 | 29,8% |

| Sources: | Distressed: Own calculations based on PPI Database Renegotiation: Guasch 2004 -Table 6.3 |

Comparing the facts presented by Guasch with the information from the PPI Database, it is evidenced that in general, renegotiation has been a relatively successful mechanism in terms of avoiding termination and/or arbitration of the infrastructure projects in Latin America. Beyond the problems related to renegotiations mentioned before, its use to avoid the termination of projects a priori appears an efficient tool.

If we add up the projects under distress from the PPI Database and the renegotiated projects from the Guasch database, we can build a group of projects with "contractual disequilibrium" 136. In these contracts, renegotiation failures mean that contracts are cancelled or submitted to arbitration, whereas the rest achieves to overcome contractual disequilibrium137 through renegotiation. An estimation is contained in Table 18.

Renegotiation effectiveness strongly varies among sectors. The energy sector has lower effectiveness, with a number of renegotiations substantially lower than the one shown in projects under distress, wherefrom only 32.9% of the contracts with disequilibrium were solved through renegotiation.

Table 18: Renegotiation as a Tool to Solve Contractual Disequilibrium

| Failed | Solved | Total | |

| Energy Telecom Transport Water & sewerage | 67,1% 57,1% 17,5% 19,0% | 32,9% 42,9% 82,5% 81,0% | 76 7 183 126 |

| Total | 28,3% | 71,7% | 392 |

On the other end, in the water and sewerage and transportation sectors, renegotiation effectiveness is very high. In both sectors, more than 80% of the contracts with problems were renegotiated successfully. The telecom sector presents an intermediate situation, with 42.9% of successful renegotiations, but since the sample is not much representative (a total of only 7 cases), the results are not solid. In the aggregate, renegotiation effectiveness is slightly higher than 70%, taking into consideration the four sectors analyzed.

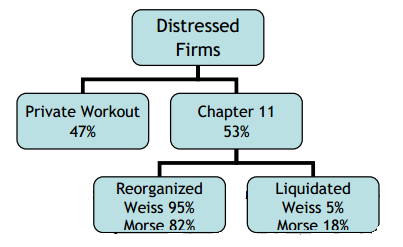

This effectiveness may be compared to the solution of distress cases in the private sector reported by Hopper Wrock. As per this author's data, when analyzing the American market, 47% of the financial distress cases are solved via a private workout, while the remaining 53% are solved under Chapter 11 of the US Bankruptcy Law138.

Source: Based on Hopper Wruck in Altman 1993139

Two studies on the evolution of companies under Chapter 11 (Weiss 1990 and Morse and Shaw 1988) show that from these companies, 95% and 82% are reorganized, whereas the remaining 5% ad 18%, respectively, are liquidated. In average, 94% of the companies achieve reorganization (including the private workout and Chapter 11 Reorganization), whereas only 6% is liquidated.

Therefore, if we compare the renegotiation effectiveness in the infrastructure sectors with the percentage of distress situations in the private sector that are solved through private agreements or through legal mechanisms (e.g.: Chapter 11) we see that there is a wide margin to improve the PPP's operation.

The report on projects under distress in the electricity sector also suggests the adoption of an integral view of the renegotiation process, and not limit such process to financial aspects: "The workout process should not be restricted to the contractual or financial issues: it should also include the formulation of a management strategy, because the performance of investors was perfectible on occasions in the area of commercial management and quality of services. These issues should be included in workout strategies for utilities and distribution companies."

The authors of the report on Power Projects Under Stress draw their conclusions in this same sense: "Risk management instruments that are expected to deal with contract compliance (including prices) do not prevent stress under extreme circumstances, though they were supposed to deal with such situations; the possibility of renegotiation of contracts under severe macroeconomic conditions should be included to ensure that the balance between the interests of the parties is maintained, even under extreme situations."

____________________________________________________________________________________

136 This assumes that renegotiations were indeed necessary; that is, they were the result of a supervening contractual disequilibrium after the contract's award and not due to a strategic behavior by the grantor or the government.

137 There is no evidence that PPI Database projects terminated or submitted to arbitration have been subject to a formal prior renegotiation process. Nevertheless, this assumption seems reasonable for the purpose of our analysis. In fact, arbitration processes such as the ICSID ones, require a prior formal renegotiation between the parties before submitting themselves to arbitration.

138 This analysis only aims at showing some hints of relative magnitude between PPP contracts and the general economy. Clearly, the rules for solving distress situations depend directly on the legal provisions -such as the Bankruptcy Law- which present very strong conceptual and practical variations among countries.

139 In the reported Morse study we have included only the cases for which there is information and omitted the 17% for which there are no data on the solution of the distress situation.