Guarantees

Another instrument available to reduce a priori the probability of distress or, at least, to reduce the costs for the investors in the project consists in the adoption of guarantees against some of the main external risks affecting the PPP projects.

There are different guarantees which cover both natural and political risks, and which may be used at the stage of design of a PPP to make an efficient allocation of project risks. These guarantees cover particular risks and, in general, they are supplementary to other forms of insurance - through contracts or explicit guarantees - based on market instruments which may be used for an optimum risks allocation between the parties.

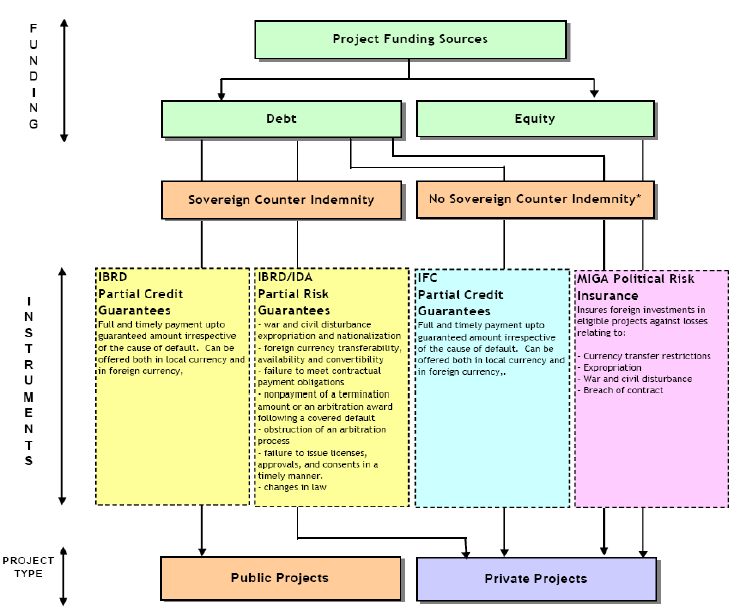

Chart 3 shows the main guarantee instruments offered by the World Bank.

The instruments available cover both public and private projects and they may be used in relation with debt and/or equity to cover both natural and political risks.

Chart 3: Guarantee Instruments by the World Bank Group

Source: Delmon 2007

It may be observed from the analysis of the PPI Database that multilateral institutions have supported the PPI projects with different instruments, such as: loans, capital investment, insurance, syndicated loans, and risk management. These instruments have been used in projects which involve more than 1 billion dollars in the 1991-2006 period. This amounts to about one third of the investment in PPI projects for the period.

Table 19: Support to infrastructure projects by multilateral institutions

|

| Agency |

| ||||

| Type of support | IBRD | IDA | IFC | MIGA | Others | Grand Total |

| Equity |

|

| 74 |

| 24 | 98 |

| Guarantee | 10 | 8 | 6 | 104 | 24 | 152 |

| Insurance |

|

| 1 | 8 | 0 | 9 |

| Loan | 37 | 33 | 198 |

| 331 | 599 |

| Quasi-equity |

|

| 37 |

| 4 | 41 |

| Risk management |

|

| 12 | 1 | 1 | 14 |

| Syndication |

|

| 106 |

| 79 | 185 |

| Grand Total | 47 | 41 | 434 | 113 | 463 | 1098 |

Source: Self-made report on the basis of PPI Database data

Out of this total of 1,000 billions, more than half of the total amount pertains to the World Bank group, while the others pertain to other international institutions. Within these instruments, guarantees appear with a relatively modest participation, since only 150 billions (out of a total of 3,600 billions) are covered by guarantees.

Guarantees, as a specific risk-mitigation instrument appear to be more effective at the time of reducing the risk of distress, than the other supports provided by multilateral institutions. If the analysis was based on this instrument, it would significantly reduce the risk of distress (Table 20) in three of the four sectors.

Table 20: Projects supported by Guarantees provided by Multilateral Institutions: Incidence of Distress per Number of Projects

| Sector | Project status |

| |

| Distressed | Others | Grand Total | |

| Energy Telecom Transport Water and sewerage | 4% 4% 0% 17% | 96% 96% 100% 83% | 98 27 21 6 |

| Grand Total | 4% | 96% | 152 |

Once again, the water sector shows different features from the rest of the sectors. Guarantees in the water and sanitation sector do not seem to be effective since the incidence of distress among projects with guarantees reaches 17% while for this sector's project; the incidence represents 10.1% (Table 23).

In some cases, the multilateral agencies' participation consists of payment obligations by the government, guaranteed by such agencies (see BOX 30).

BOX 30: Guarantees in road sector - Peru

| Over the last years, in order to attract investment in infrastructure, the Peruvian Government has incorporated private capital and technology to the construction and operation of strategic projects. The Northern Branch of the Amazonas IIRSA Axis (Regional South American Initiative) was one of those initiatives. This branch integrates northern regions of the Amazonas with the rest of the Peruvian economy, and it is one of the most important projects focused on the integration between Peru and Brazil. The Peruvian Government executed the project called Northern Branch of the Amazonas IIRSA Axis under a PPP scheme. Under such scheme, it granted a concession to a private investment group for the improvement, overhaul, maintenance and transfer of the works of said Branch, for a term of 20 years. Under the contract, the concessionaire undertook to fund the total costs of the project, and the government in turn assumed the following duties: ▪ Annual Payment for Works (PAO, for its Spanish acronym): Payable every six months, for a deferred period of 12 years. It must be paid after the conformity of the Works. ▪ Annual Payment for Maintenance and Operation (PAMO, for its Spanish accronym): Payable on a quarterly basis, upon transfer of the sections built, refurbished or improved. The toll collected by the Concessionaire is allocated to its working capital and thus discounted from the PAMO. Thus, the Government is only bound to pay the difference. The amount of such payments was the result of a competitive bidding process, where the concession was granted to the bidder that demanded the lowest present value of payments. The resources for the payment of the PAO come from the budget of the Ministry of Transportation, Communications and Housing (MTC) and are assigned by the Ministry of Economy and Finance (MEF) in each budget. As part of such funding, the Peruvian government requested from the Inter-American Development Bank a partial credit guarantee for a term not to exceed 17 years, to guarantee to the Concessionaire that the PAO payments established in the concession contract would be made in due time and manner. This guarantee also includes the recognition of partial works in the event of anticipated termination of the concession. The guarantee is backed by the Peruvian Government through the Execution of a Counter Guarantee Contract establishing that any payments made by the Bank to the Concessionaire under the partial guarantee shall automatically become long-term loans owed to the Bank by the Republic of Peru. Scheme of the Guarantee Contract

|

An original alternative of guarantees against natural phenomena is the creation of bonds specifically designed to cover the risks of catastrophes, such as the ones issued by Mexico (see BOX 31)

BOX 31: Catastrophe Bonds

| CAT bonds transfer certain risks from the sponsor to the investors. In a typical issuance of CAT bonds, the sponsor (generally a reinsurer) creates a specific purpose unit (SPU) to make an issuance and invest capital in low risk values. The performance of these investments is paid to the bond holders together with the premium paid by the sponsor (diagram A). If, upon expiration of the bonds, the specified event did not occur, the investors recover the principal, as it happens in the case of ordinary bonds (diagram B). But if the specified catastrophe occurs during the life of the bond, the investors waive all or part of their right and the SPU pays the sponsor. In other words, the risk passes on to the investors. A. Transaction

B. Possible results

Since the assets and liabilities related to the issuance of the bonds remain with the SPU, the CAT bonds are exclusively an insurance mechanisms for the sponsor and do not entail any liability. Its main advantage is to break down and transfer the risks to a large group of investors when the insurance of a single counterpart is too expensive or impossible to take. CAT bonds offer the investors a performance higher than the market rates (because they also pay a premium in addition to the low or no risk performance) and a unique opportunity to diversify their portfolio, because the catastrophic risks are seldom related to the evolution of stock or bond markets. |

Source: David Hofman, "Frente a los desastres, previsión." Finanzas & Desarrollo, March 2007.

The use of guarantees, whether from international agencies or the government or created by means of market financial instruments, allows an adequate distribution of the project's risks and, in many cases, it represents an essential element to make the project viable from a financial point of view.