Economic Equilibrium

The special technological features of infrastructure sectors hinder the operation of entry and exit mechanisms that, in competitive markets, govern the return on investment. Since these sectors are natural monopolies, there is no entry or exit of competitors from the market and, therefore, adjustment does not operate automatically. Consequently, it is the regulator's duty to preserve the contract's equilibrium, thus avoiding that the monopolist gets an excessive return (monopolistic rent) but also allowing efficient investors to recover the economic costs of service provision, including a reasonable return on the invested capital.

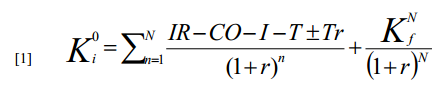

Formally, the condition to meet in order to achieve economic sustainability of the service -at the same time that monopolistic rents are avoided- can be expressed as follows154:

Where Ki represents the initial capital of the period; IR, revenues; CO, operating costs; I, investments; T, taxes; and Tr, transfers from the Treasury, which may be positive -explicit subsidies- or negative -payment of concession fee-. These elements represent the free cash flow received by the firm. The opportunity cost of capital - r - is located in the denominator.

The second term represents payment received at the end of period N. It is expressed separately in order to ease the analysis of the existence of different rules of termination payment (Kf) and/or duration of the concession (N), variables that may be used as instruments to restore equilibrium in distress situations. Therefore, sustainability of the firm calls for the firm's future cash flow discounted using the opportunity cost of capital rate to be equal to the invested capital.

This sustainability equation is also known as economic equilibrium of contract since it summarizes all the economic elements involved in a contract. From the point of view of the service provider, contractual obligations are represented by the operating and maintenance costs (CO) and the investments (I) that the firm has to carry out in order to meet service needs. At the same time, the revenue (IR) that the firm will obtain for service provision represents contractual rights.

The cost of capital (r) is a value -to some extent exogenous- that represents the opportunity cost of capital. In other terms, the return that would be obtained by an investor in an alternative use of the capital with similar risks level.

____________________________________________________________________________________

154 In terms of cash flow, this equation is the same as fixing revenue to cover operating and maintenance costs, depreciations and a return on the invested capital. To check this equivalence, see Green-Rodríguez Pardina 1997.