Economic Distress in Latin America: Empirical Evidence

A situation of economic distress requires that the project's internal rate of return be substantially and consistently lower than the opportunity cost of capital. Even though this analysis needs to be performed for each specific PPP, there are some regional studies that provide an idea of the possible relevance of this problem as far as concessions are concerned.

The study performed by Sirtaine, Pinglo, Guasch and Foster (2003) is based on a sample of 34 concessions in the period 1991 - 2001, and its purpose is to "estimate the returns that private investors in infrastructure projects in Latin America really made on their investments, to assess the adequacy of these returns relative to the risks taken, and the impact that the quality of regulation had on those returns relative to the cost of capital."

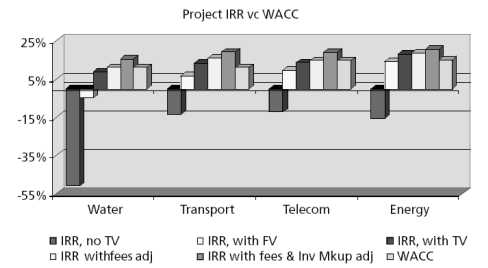

The evidence provided by Sirtaine et al shows that, in general, the projects in the sample presented returns below the opportunity cost of capital. On average, historical returns for the concessions studied in the period (IRR, no TV) were negative. Only upon the inclusion of adjustments to past returns in the analysis in order to factor in expected returns (management fees, future values and adjustment of investments) do the results reveal values that are similar to the projects' opportunity cost. The values for each sector are provided in Chart 4.

Chart 4: Returns and Cost of Capital in Latin America

Source: Sirtaine, Pinglo, Guasch, Foster, 2003

The included measures of returns are as follows:

IRR no TV: | |

IRR w/fees: | IRR and management fees |

IRR with FV | |

IRR with fees & Inv | IRR with management fee and investment markup adjustments |

IRR with TV | |

WACC | the company's (weighted) Cost of Capital |

According to these authors, and contrary to popular belief, the financial returns of private companies in the infrastructure sectors have been modest and, in many cases, below the opportunity cost of capital. On average, the energy and telecom sectors present better returns than the transport and water and sewerage sectors.

These results presented by Sirtaine et al, are, at first glance, consistent with the empirical relevance of distress projects per sectors discussed in section II. It restates the differences in sectors and the particular features of the water sector, which shows greater situations of economic disequilibrium.