1.3 Infrastructure Challenges and How PPPs Can Help

Inadequate infrastructure is a constraint on growth worldwide, particularly in developing countries. Infrastructure services are often inadequate to meet demand, resulting in congestion or service rationing. Infrastructure services are also often of low quality or reliability, while many areas are simply un-served.

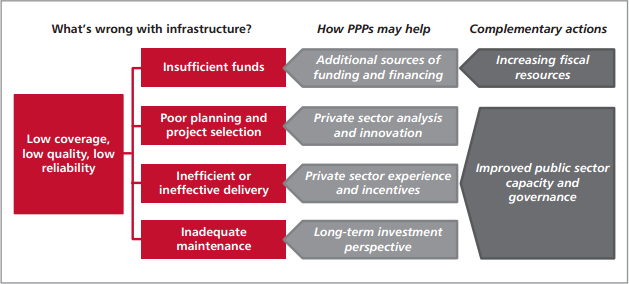

This poor infrastructure performance reflects pervasive challenges facing governments. First, most countries simply are not spending enough to provide the infrastructure needed. Secondly, poor planning and coordination, weak analysis underpinning project selection, pursuit of political gain, and corruption, mean that the limited resources are often spent on the wrong projects. Moreover, the delivery of infrastructure assets and services often disappoints-construction of new assets costs more and takes longer than expected, and service delivery is weak. Finally, infrastructure assets are often poorly maintained, increasing costs and reducing benefits.

How PPPs can help

This section examines whether and how PPPs can help overcome some of these pervasive challenges, as illustrated in Figure 1.3: What's Wrong with Infrastructure and How PPPs Can Help. Under the right circumstances, PPPs can mobilize additional sources of funding and financing for infrastructure. By subjecting assumptions to the market test of attracting private finance, PPPs can go some way to improving project selection. Countries with relatively long PPP histories have found that PPPs manage construction better than traditional procurement, with projects coming in on time and on budget more often-typically attributed to the incentives created by the PPP structure. Finally, the longer-term investment perspective under PPP contracts can also help to ensure adequate maintenance keeps assets in a serviceable condition.

Figure 1.3: What's Wrong with Infrastructure and How PPPs Can Help

The mechanisms by which PPP can help improve infrastructure delivery are often summarized as 'value drivers'-that is, how using PPPs to provide infrastructure can achieve value for money. These value drivers- as described in Box 1.2: PPP Value Drivers are often integrated into PPP policies.

PPP limitations, pitfalls, and complementary measures needed

There are problems that PPPs cannot solve, or that PPPs may exacerbate. First, PPPs may appear to relieve funding problems more than is actually the case, as the government's fiscal commitments to PPPs can be unclear. This can lead to governments accepting higher fiscal commitments and risk under PPPs than would be consistent with prudent public financial management. While PPPs can contribute to better project analysis and adoption of innovative ideas and practices, responsibility for planning and project selection still remains primarily with the public sector-moreover, the unclear fiscal costs and contractual inflexibility of PPPs can make these tasks more difficult. The advantages of private sector efficiency in managing infrastructure, and improved incentives to carry out regular maintenance, also depend on effective PPP contracting and procurement by the government.

These limitations mean that PPPs cannot be seen as a panacea to solve infrastructure performance problems. Figure 1.3: What's Wrong with Infrastructure and How PPPs Can Help also highlights other important ingredients for improved infrastructure delivery. Sound public decision-making resulting from adequate capacity and governance are necessary prerequisites for successful PPPs or public investment projects. Evidence suggests that improved management could go a long way to reducing infrastructure shortfalls, by making better use of existing infrastructure and more efficient use of public resources on new projects. Ultimately many governments may simply need to commit more resources to investing in infrastructure.

This section describes each of the four problems with infrastructure project implementation shown in Figure 1.3: What's Wrong with Infrastructure and How PPPs Can Help describing whether and how PPPs may be able to help, as well as PPP limitations or pitfalls that may exacerbate the problem.

Box 1.2: PPP Value Drivers PPP 'value drivers' are the ways in which PPP can improve value for money in infrastructure provision. They include the following: • Whole-of-life costing-full integration, under the responsibility of one party, of up-front design and construction with ongoing service delivery, operation, maintenance and refurbishment, can reduce total project costs. Full integration incentivizes the single party to complete each project function (design, build, operate, maintain) in a way that minimizes total costs • Risk transfer-risk retained by the Government in owning and operating infrastructure typically carries substantial, and often, unvalued cost. Allocating some of the risk to a private party which can better manage it, can reduce the project's overall cost to government • Upfront commitment to adequate maintenance, and predictability and transparency of whole-of-life costs-a PPP requires an upfront commitment to the whole-of-life cost of providing the asset over its lifetime, building in appropriate maintenance. This both provides budgetary predictability over the life of the infrastructure, and reduces the risks of funds not being made available for maintenance after the project is constructed • Focus on service delivery-allows a sponsoring department or agency to enter into a long-term contract for services to be delivered when and as required. Management in the PPP firm is then focused on the service to be delivered without having to consider other objectives or constraints typical in the public sector • Innovation-specifying outputs in a contract, rather than prescribing inputs, provides wider opportunity for innovation. Competitive procurement of these contracts incentivizes bidders to develop innovative solutions for meeting these specifications • Asset utilization-private parties are motivated to use a single facility to support multiple revenue streams, reducing the cost of any particular service from the facility • Mobilization of additional funding-charging users for services can bring in more revenue, and can sometime be done better or more easily with private operation than in the public sector. Additionally, PPPs can provide alternative sources of financing for infrastructure, where governments face financing constraints • Accountability-government payments are conditional on the private party providing the specified outputs at the agreed quality, quantity, and timeframe. If performance requirements are not met, service payments to the private sector party may be abated. The Partnerships Victoria's Practitioner's Guide [#19] published in 2001 clearly set value drivers as the basis for the State of Victoria, Australia's PPP program. PricewaterhouseCoopers (PWC)'s paper on the "PPP promise" [#208, pages 13-34] and Deloitte's paper on PPPs [#68, pages 5-9] both succinctly describe these benefits of PPP. |