1.4.1 Finance Structures for PPP

The private party to most PPP contracts is a specific project company formed for that purpose-often called a Special Purpose Vehicle (SPV). This project company raises finance through a combination of equity-provided by the project company's shareholders-and debt provided by banks, or through bonds or other financial instruments. The finance structure is the combination of equity and debt, and contractual relationships between the equity holders and lenders.

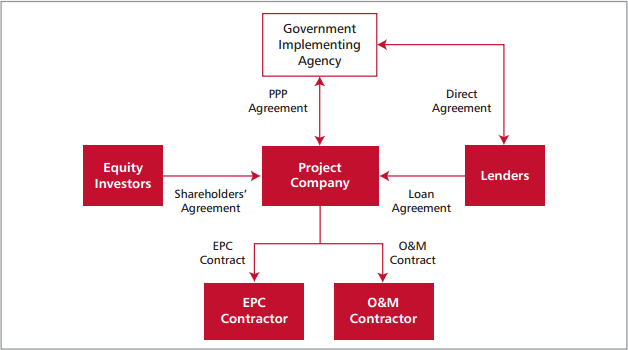

Figure 1.4: Typical PPP Project Structure shows a typical finance and contract structure for a PPP project. The Government's primary contractual relationship is with the project company. This may be complemented by a direct agreement between contracting authority and lenders; although often this relationship is limited to the provisions in favor of the lenders included in the PPP agreement, such as step-in rights or senior debt repayment guarantees.

The initial equity investors, who develop the PPP proposal, are typically called project shareholders. Typical equity investors may be project developers, engineering or construction companies, infrastructure management companies, and private equity funds. Lenders to PPP projects in developing countries may include commercial banks, multilateral and bilateral development banks and finance institutions, and institutional investors such as pension funds.

As shown in Figure 1.4: Typical PPP Project Structure, the project company in turn contracts with firms to manage design and construction (usually known as an Engineering, Procurement and Construction, or EPC contract), and operations and maintenance (O&M). These contractors may be affiliated with the equity investors. Yescombe's book on PPP finance includes examples of PPP structures for different types of PPP [#295, section 1.4].

Figure 1.4: Typical PPP Project Structure

As described in Farquharson et al's chapter on PPP financing [#271, page 53], equity investment is 'first in, last out'-that is, any project losses are borne first by the equity investors, and lenders suffer only if the equity investment is lost. This means equity investors accept a higher risk than debt providers, and require a higher return on their investment.

The aim of the project shareholders and their advisors in developing the finance structure is typically to minimize the cost of finance for the project. Because equity is more expensive than debt, project shareholders use a high proportion of debt to finance the project.