MODULE 2 Establishing the PPP Framework

PPPs can be implemented on a one-off basis, without any specific supporting policy framework. However, most countries with a successful PPP program have built that program on a sound PPP framework. The 'PPP framework' means the policy, procedures, institutions, and rules that together define how PPPs will be implemented-that is, how they will be identified, assessed, selected, budgeted for, procured, monitored, and accounted for.

Establishing a clear PPP framework publicly communicates the government's commitment to PPPs. It also defines how projects will be implemented, helping ensure good governance of the PPP program-that is, promoting efficiency, accountability, transparency, decency, fairness, and participation in how PPPs are implemented, as described in Box 2.1: Good Governance for PPPs below. This will help generate private sector interest, and public acceptance of the PPP program.

| Box 2.1: Good Governance for PPPs The United Nations Economic Commission for Europe (UNECE) Guidebook on Promoting Good Governance in PPPs defines governance as 'the processes in government actions and how things are done, not just what is done'. All elements of the PPP Framework described in this module contribute to the governance of the PPP program. UNECE further describes 'good governance' as encompassing the following six core principles: • Efficiency-use of resources without waste, delay, corruption, or undue burden on future generations • Accountability-the extent to which political actors are responsible to society for their actions • Transparency-clarity and openness in decision-making • Decency-development and implementation of rules without harming people • Fairness-equal application of rules to all members of society • Participation-involvement of all stakeholders. One of the aims of establishing a sound PPP framework is to ensure these principles of good governance are followed in the implementation of PPP projects. For further description of good governance in the context of PPPs, see the UNECE Guidebook on Promoting Governance for PPPs [#262, pages 13-14] Section 2.1: Principles of Good Governance in PPPs. |

Defining the 'PPP framework'

There is no single 'model' PPP framework. A government's PPP framework typically evolves over time, often in response to specific challenges facing the PPP program. In the early stages of a program the emphasis may be on enabling PPPs, and creating and promoting PPP opportunities. On the other hand, where many PPPs have already been implemented on an ad-hoc basis, concern about the level of fiscal risk in the PPP program may be the impetus for strengthening the PPP framework. In this case, the focus may be on strengthening control over how PPPs are developed, or improving public financial management for PPPs, as for example in South Africa. [#38]

Often this initially involves introducing PPP-specific processes, rules, and institutions to ensure PPP projects are subject to similar discipline as public investment projects. Gradually, as experience with PPP grows, these PPP frameworks may re-integrate with normal public investment and infrastructure planning, procurement, and fiscal management processes, with PPPs as one particular option among several other options for implementing public investment projects.

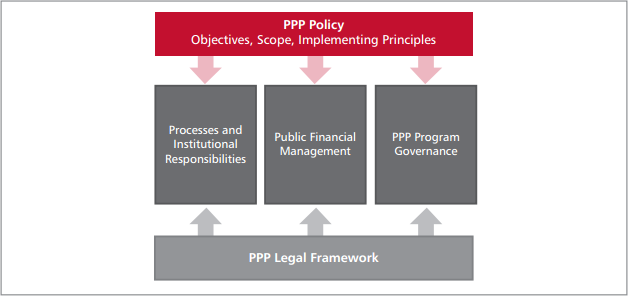

The best solutions to similar challenges will likely also vary between countries-depending among other things on the country's existing legal framework, investment environment, government institutions, and capacity. Figure 2.1: PPP Framework Overview illustrates the possible components of a 'comprehensive' PPP framework into component parts, while Box 2.2: The PPP Framework of Chile and Box 2.3: The PPP Framework of South Africa below provide brief overviews of the PPP frameworks in South Africa and Chile- both countries with well-respected PPP programs.

Figure 2.1: PPP Framework Overview

As shown in Figure 2.1: PPP Framework Overview, the components of a comprehensive PPP framework can include the following:

• Policy-articulation of the government's intent to use PPPs to deliver public services, and the objectives, scope, and implementing principles of the PPP program

• Legal framework-the laws and regulations that underpin the PPP program-enabling the government to enter into PPPs, and setting the rules and boundaries for how PPPs are implemented. This can include PPP-specific legislation, other public financial management laws and regulations, or sector-specific laws and regulations

• Processes and institutional responsibilities-the steps by which PPP projects are identified, developed, appraised, implemented, and managed; and the roles of different entities in that process. A sound PPP process is efficient, transparent, and is followed consistently to effectively control the quality of PPP projects

• Public financial management approach-how fiscal commitments under PPPs are controlled, reported, and budgeted for, to ensure PPPs provide value for money, without placing undue burden on future generations, and to manage the associated fiscal risk

• Broader governance arrangements-how other entities such as auditing entities, the legislature, and the public participate in the PPP program, and hold those responsible for implementing PPPs accountable for their decisions and actions. The sections of this module describe each of these elements of a PPP framework, providing examples and guidance for practitioners.

In practice, these elements are closely inter-related. For example a well-controlled process for developing PPPs that considers their fiscal consequences and builds in Finance Ministry control is central to sound public financial management of the PPP program. Comprehensive public reporting of fiscal commitments to PPPs in turn enables effective oversight of the PPP program. These linkages are highlighted throughout this Module.

For more on the typical components of a PPP framework, see Farquharson et al [#95, pages 15-16], and Yong [#296, page 30], which both provide brief overviews. The OECD's recommendation on public governance of public-private partnerships (2012) [#196] also sets out guiding principles for its member governments on managing PPPs, covering three areas: establishing a clear, predictable, and legitimate institutional framework supported by competent and well-resourced authorities; grounding the selection of PPPs in value for money; and using the budget process transparently to minimize fiscal risks and ensure the integrity of the procurement process. These built on earlier OECD principles for private sector participation in infrastructure (2007) [#193].

Detailed assessments of PPP frameworks in a range of countries are available in the following:

• The Economist Intelligence Unit (EIU)'s Infrascope index publications, which evaluate the PPP environment in a set of countries against measures designed to assess the countries' readiness to carry out sustainable PPPs. These measures include many of the PPP framework elements described above, as well as the country's operational experience with PPPs, the availability of finance and financing support mechanisms, and the overall investment climate. The series includes EIU Infrascope index for Latin America and the Caribbean [#67], commissioned by IADB's Multilateral Investment Fund (MIF); EIU Infrascope index for the Asia-Pacific region, commissioned by the Asian Development Bank (ADB) [#151]; and EIU Infrascope index for Eastern Europe and the Commonwealth of Independent States, commissioned by the European Bank for Reconstruction and Development (EBRD)

• Irwin and Mokdad's paper on managing contingent liabilities in PPPs [#162], which describes the PPP approval, analysis and management approach in Australia, Chile, and South Africa, with a focus on fiscal management.

| Box 2.2: The PPP Framework of Chile Chile is a country with substantial PPP experience, and a well-defined PPP framework. As of 2013, Chile had awarded 69 projects in roads, airports, jails, reservoirs, urban transport, hospitals, and other sectors, with a total investment value of USS$14 billion. The use of PPP in Chile was enabled in 1991 by Decree 164, which set out much of the framework still in use today. This law was updated in 2010 by the Concessions Law, to address some of the challenges Chile had faced in its PPP program to date. The Concessions Law sets out the institutional responsibilities and processes for developing and implementing PPPs. The Concessions Unit of the Ministry of Public Works (MOP) acts as implementing agency for all PPPs in Chile. The MOP may receive proposals from government agencies or private investors, and follows a clearly-defined process to appraise the project. If the project is a good PPP candidate, the MOP Concessions Unit prepares the detailed tender documents, carries out a tender process, and selects and announces by decree the winning bidder. The Unit then manages the PPP contract over the project lifetime, receiving regular reports from the concessionaire-with the ability to request additional audits to check the information received-and managing any changes needed to the contract. The National Planning Authority must review and approve the technical and economic analysis of the project. The Concessions Council-led by the Minister of Public Works, with an advisor selected by the MOP, and four other advisers representing the Civil Engineering, Economics and Management, Law, and Architecture departments of the University of Chile-must approve the initial decision to carry out the project as a PPP. The Ministry of Finance must approve PPP tender documents before they can be published, any changes made during the tender process, and any significant changes made through the lifetime of the contract. The Minister of Finance must also sign the decree awarding the PPP contract to the winning bidder. To manage these oversight responsibilities, the Ministry has established a Contingent Liabilities Unit, which reviews all projects in detail prior to approval, and calculates the value of the government's liabilities initially and throughout the contract. Chile publicly discloses its commitments to PPP projects in a detailed annual contingent liabilities report. Information on the PPP program is also included in budget documentation. The Treasury makes all the payments established in the PPP contract in accordance with the procedures and milestones stipulated in the PPP contract. The payments incorporated in the contract were previously approved by the Ministry of Finance during the project approval phase. Payment commitments are structured where possible to reduce fiscal risk-for example, demand guarantee payments are typically due the year after a demand shortfall, once the amount is known. Disputes that emerge during the implementation of the project can be brought by either party to a Technical Panel. If the solution proposed by the technical panel does not resolve the problem, the parties may bring up the Arbitration Commission or the Appeals Court of Santiago. Source: Ministerio de Obras Públicas (2010) Ley y Reglamento de Concesiones de Obras Públicas, Santiago, Chile; Ministerio de Obras Públicas (2010) Historia de la Ley N.20410: Modifica la Ley de Concesiones de Obras Públicas y otras normas que indica, Santiago, Chile |

| Box 2.3: The PPP Framework of South Africa South Africa is another country with substantial PPP experience. From 2000 to April 2014, South Africa has implemented 24 national and provincial level PPP projects totaling over US$8.35 billion of total investment. The legislation governing national and provincial PPPs is the Treasury Regulation 16, issued under the Public Finance Management Act of 1999-it broadly sets out the PPP process, requirements and approvals, and institutional responsibilities of involved entities. Municipal PPPs are governed by the Municipal Finance Management Act and the Municipal Systems Act. There are also municipal PPP regulations that roughly mirror the requirements of Treasury Regulation 16. PPP processes and institutional responsibilities are established in a detailed PPP Manual. This manual describes how the Treasury regulations should be interpreted, and provides detailed guidance at every step in the PPP process, each in a separate module. Each module of the manual is issued as a Practice Note of the National Treasury, and can be updated separately. A similar manual, the Municipal Service Delivery and PPP Guidelines, provides instructions for municipal PPPs. Responsibility for implementing PPP projects rests with the contracting authority. Contracting authorities must identify and appraise PPP projects, and manage the tender process to select the winning bidder, following the detailed guidance and requirements (including checklists for each stage and standard forms) set out in the manuals. The contracting authority is responsible for managing PPPs through the contract lifetime, which includes ensuring the project meets performance standards, resolving disputes, and reporting on the PPP in the institution's/ municipality's annual reports. PPP approvals are made by the Treasury at the national and provincial levels. Municipal PPPs will be subject to Treasury's "views and recommendations". Projects are submitted for approval at four points, after: (1) the feasibility study has been completed, (2) the bid documents have been prepared, (3) bids have been received and evaluated, and (4) negotiations have concluded and the PPP contract is in its final form. The Treasury established a PPP Unit in 2004, to review all PPP submissions and recommend the PPP for approval. The Treasury's evaluation focuses particularly on the value for money and affordability of the PPP project. Payments for PPP commitments are made through the annual appropriations process. The Accounting Standards Board of South Africa has published guidelines for public sector accounting for PPPs. The PPP Manual also sets out the auditing requirements for PPP. The Auditor General's annual audits of contracting authorities should check that the requirements of the PPP regulations have been met, and the financial implications are reflected in the institution's/ municipality's accounts. The Auditor General may also conduct forensic audits if any irregularity is suspected. Sources: National Treasury (2004) Public Private Partnership Manual: National Treasury PPP Practice Notes issued in terms of the Public Finance Management Act, Johannesburg, South Africa; Tim Irwin & Tanya Mokdad (2010) Managing Contingent Liabilities in Public-Private Partnerships: Practice in Australia, Chile, and South Africa, World Bank; P. Burger (2006) The Dedicated PPP Unit of the South African Treasury, Paris, France: Organization for Economic Cooperation and Development |

Instituting the PPP framework

A PPP framework can be instituted in different ways. The options available typically depend on the legal system of the country, and on the norm for establishing government policies, procedures, institutions, and rules. They can include:

• Policy statement-common in developed countries with Westminster-style governments, PPP policy statements typically set out at least the objectives, scope, and implementing principles of the PPP program-as described further in Section 2.1: PPP Policy. Policy statements may also outline procedures, institutions, and rules by which the objectives and principles will be put into practice

• Laws and regulations-as described further in Section 2.2: PPP Legal Framework, civil law countries typically require legislation to enable PPPs to be pursued, and set out the rules for how PPPs will be implemented; many common law countries also introduce PPP legislation as a more binding form of commitment to a PPP framework. This can be a dedicated PPP law, a component of broader public financial management law, subordinate legislation such as executive orders, presidential decrees, regulations, or a combination

• Guidance materials, such as manuals, handbooks, and other tools. These may be used to establish PPP procedures upfront, or developed over time to supplement policy statements or legislation, as a codification of good practice. Module 3 of this Reference Guide provides examples and draws from many examples of good-quality guidance material from national PPP programs.

In addition to cross-sector PPP frameworks, policies or laws at the sector level can enable the use of PPPs and create a framework for PPPs within the sector. Many PPP programs use a combination of these approaches.

| Overview References: PPP Framework | |

| Reference | Description |

| United Nations Economic Commission for Europe (2008) Guidebook on Promoting Good Governance in Public-Private Partnerships, Geneva | This guide for policymakers provides a detailed direction on how to improve governance for PPP programs. The guide also gives insight into what are the key challenges and possible frameworks for solutions |

| Tim Irwin & Tanya Mokdad (2010) Managing Contingent Liabilities in Public-Private Partnerships: Practice in Australia, Chile, and South Africa, World Bank | Describes the approach in the State of Victoria, Australia, Chile, and South Africa, to approvals analysis, and reporting of contingent liabilities (and other fiscal obligations) under PPP projects, and draws lessons for other countries |

| Farquharson, Torres de Mästle, and Yescombe, with Encinas (2011) How to Engage with the Private Sector in Public-Private Partnerships in Emerging Markets, World Bank/PPIAF | This guide for public sector practitioners describes how to develop and implement a PPP successfully, by developing a marketable project and attracting the right private partners. Section 3 focuses on setting the PPP framework |

| Yong, H. K. (Ed.) (2010) Public-Private Partnerships Policy and Practice: A Reference Guide. London: Commonwealth Secretariat | This report provides a comprehensive review of PPP policies worldwide, including guidance to practitioners about key aspects of designing and implementing PPP policy and projects. Chapter 4 provides guidelines for public-sector appraisal of PPP projects |

| Economist Intelligence Unit (2013) Evaluating the Environment for Public-Private Partnerships in Latin America and the Caribbean: The 2012 Infrascope: Index guide London, UK (Spanish Version: Evaluando el entorno para las asociaciones público-privadas en América Latina y el Caribe Infrascope 2012: Guía del índice y metodología) | This publication, Infrascope, sets out an index for assessing countries' readiness to carry out sustainable PPPs, and uses the index to evaluate the PPP environment in 19 countries in the region. The 2013 edition, as well as previous editions, are freely available at the IADB website. See also the versions for Asia-Pacific and for Eastern Europe and CIS, based on similar methodologies. |