3.2 Appraising PPP Projects

Appraising a PPP project means checking it makes sense to develop the project, and to implement it as a PPP. Many successful PPP programs establish PPP 'appraisal criteria'-these are the criteria used to decide whether or not a proposed PPP project is a good investment decision. As Box 3.3: PPP Project Appraisal Criteria sets out, appraisal criteria typically require at least four questions to be addressed: Does the project make sense at all-that is does it meet standard project appraisal criteria such being technically feasible and cost-benefit justified? Is the PPP opportunity commercially attractive to the market? Will the project deliver more value for money if done as a PPP than under conventional procurement? Is the project fiscally responsible?

Box 3.3: PPP Project Appraisal Criteria In deciding whether to pursue a project as a PPP, governments need to assess whether the PPP is a good use of resources. This typically involves assessing the project and proposed PPP against four key criteria: • Feasibility and economic viability of the project-whether the underlying project makes sense, irrespective of the procurement mode. First, this means confirming that the project is central to policy priorities and sector and infrastructure plans. It then involves feasibility studies to check the project is possible, and economic appraisal to check the project is cost-benefit justified, and the least-cost approach to delivering the expected benefits. This appraisal may be carried out prior to identifying the project as a possible PPP, or as part of the PPP development process • Commercial viability-whether the project is likely to be able to attract good-quality sponsors and lenders by providing robust and reasonable financial returns. This is subsequently confirmed through the tender process • Value for money of the PPP-whether developing the project as the proposed PPP can be expected to best achieve value for money, compared to the other options. This can include comparing against the alternative of public procurement (where that would be an option). It can also include comparing against other possible PPP structures, to check that the proposed structure provides the best value (for example that risks have been allocated optimally) • Fiscal responsibility-whether the project's overall revenue requirements are within the capacity of users, the public authority, or both, to pay for the infrastructure service. This involves checking the fiscal cost of the project-both in terms of regular payments, and fiscal risk-and establishing whether this can be accommodated within prudent budget and other fiscal constraints. These criteria (with some variations) are described in more detail in "Public-Sector Investment Decision" chapter in Yescombe's book on PPPs [#295, Chapter 5], "Selecting PPP projects" in Farquharson et al [#95, Chapter 4], and "Project identification" chapter in the EPEC "Guide to Guidance" [#83, Chapter 1]. |

This Section describes how PPP practitioners can assess a proposed PPP against each of the criteria described in Box 3.3: PPP Project Appraisal Criteria; Section 3.2.1: Assessing Project Feasibility and Economic Viability; Section 3.2.2: Assessing Commercial Viability; and Section 3.2.3: Assessing Value for Money.

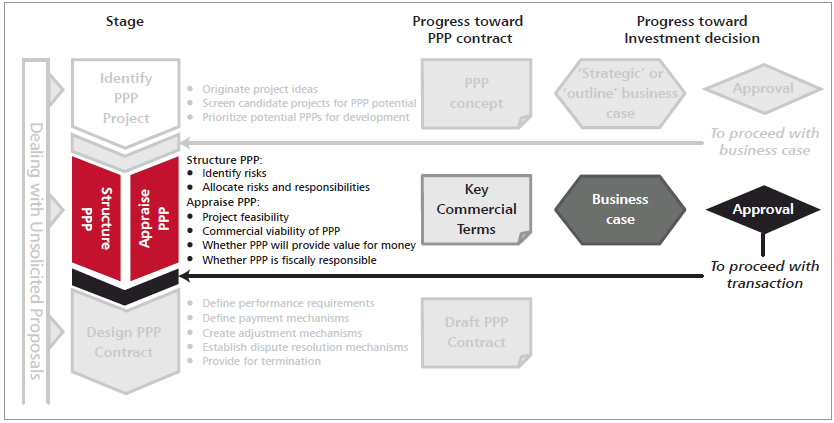

Figure 3.3: Appraise PPP Projects shows how project appraisal fits in to the overall PPP process. Initial assessment against each criterion is typically done at the project identification and initial screening stage, as described in Section 3.1: Identifying PPP Projects. Detailed appraisal is typically first done as part of a detailed 'business case', alongside developing the PPP project structure as described in Section 3.3: Structuring PPP Projects. For example, assessing the value for money of the PPP depends on risk allocation, which is an important part of PPP structuring. An initial risk allocation could be assessed for whether it will provide value for money, which assessment might result in changes to the risk allocation.

PPP appraisal is typically re-visited at later stages. In particular, the final cost (and so, affordability and value for money) is not known until after procurement is complete, when the government must make the final decision to sign the contract. Many governments require further appraisal and approval at this stage.

Figure 3.3: Appraise PPP Projects