3.3 Structuring PPP Projects

'Structuring a PPP project' means allocating responsibilities, rights, and risks to each party to the PPP contract. This allocation is defined in detail in the PPP contract. Project structuring is typically developed iteratively, rather than drafting a detailed contract straight away. The first step is to develop the initial project concept into key commercial terms-that is, an outline of the required outputs, the responsibilities and risks borne by each party, and how the private party will be paid. The key commercial terms are typically detailed enough to enable practitioners to appraise the proposed PPP, as described in Section 3.1: Identifying PPP Projects, before committing the resources needed to develop the draft PPP contract in detail.

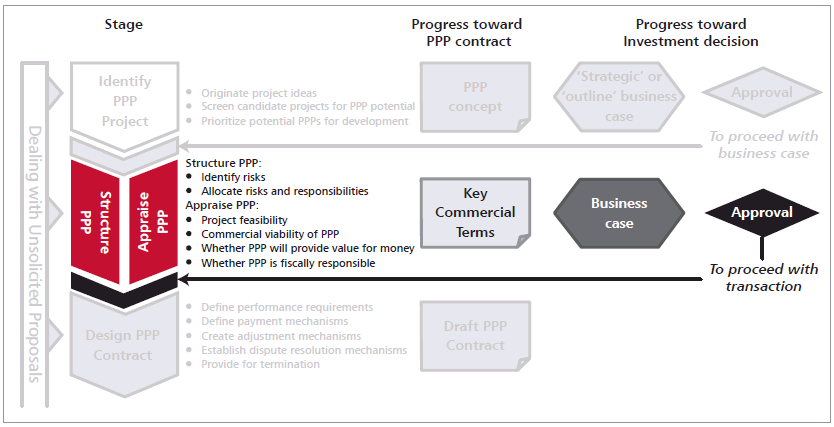

Figure 3.4: Structuring PPP Projects

Figure 3.4: Structuring PPP Projects shows how PPP structuring-to the level of key commercial terms-fits into the overall development process. As described in the introduction to this Module, PPP structuring and PPP appraisal are in practice parallel and iterative processes. Information from the feasibility study and economic viability analysis is a key input to PPP structuring-for example, identifying the key technical risks, and providing estimates for demand and users' willingness to pay for services. The PPP structure then feeds into commercial viability, affordability and value for money analysis-which may find that changes are needed to the proposed risk allocation. The aim is typically to structure a PPP that will meet the relevant appraisal criteria set out in Box 3.3: PPP Project Appraisal Criteria-that is, be technically feasible and economically viable, commercially viable, fiscally responsible, and provide value for money.

The starting point for PPP structuring is the project concept: that is, the project's physical outline, the technology it is expected to use, the outputs it will provide, and the people it will serve. These are often developed before deciding whether to implement the project as a PPP, as described in Section 3.1: Identifying PPP Projects.

The detailed specification of output req uirements, for inclusion in the PPP contract, is described further in Section 3.4: Designing PPP Contracts. Most resources on PPP project structuring focus on identifying and allocating project risks. This makes sense, since appropriate risk allocation is behind many of the PPP Value Drivers described in Box 1.2: PPP Value Drivers. Following this approach, the other elements of the PPP structure-such as the allocation of responsibilities and the payment mechanism-stem from the risk allocation. For example, construction risk may be allocated to the private party, on the basis that the private party is best-qualified to manage construction. This means that the private party should also be allocated the responsibility and right to make all construction-related decisions. The mechanism for allocating commercial risk to the private party may be to define a 'user-pays' payment mechanism.

This section follows the literature, starting with identifying and prioritizing project risks (3.3.1: Identifying Risks) then describing how risks are allocated (3.3.2 Allocating Risks) 3.3.3 Translating Risk Allocation into Contract Structure then describes how the risk allocation relates to the other aspects of project structure.