Thematic Coverage

Benchmarking PPP Procurement presents cross-economy analysis of 82 economies on issues affecting the procurement of PPPs. The standardized survey instrument includes 50 questions organized by areas, which were selected with guidance from a review of academic literature9 and input from the expert consultative group (ECG).

The areas covered by the survey instrument are as follows:

> Regulatory and institutional framework for PPPs: This introductory section aims to identify the extent to which the regulatory frameworks in the measured economies cover PPPs. It highlights alternative approaches to regulate PPPs that different economies have adopted. It also attempts to capture a general understanding of the overall institutional arrangement for PPPs, such as who the procuring authorities are and whether a specific PPP unit or other government agency with similar functions exists.

> Preparation of PPPs: This section covers the period and activities that precede and inform the decision to launch a PPP procurement process. It explores whether the identification of a potential PPP project happens within the broader context of public investments and thereby its consistency with government priorities. It also examines which assessments are required or conducted to define key features of the PPP project and its feasibility. In addition, it considers other activities that lead to the procurement of the PPP project (that is, activities undertaken before publishing the public tender notice, such as preparing the draft contract or obtaining land and permits).

> Procurement of PPPs: This section focuses on the process for selecting a private partner to undertake the responsibility of developing the PPP project. The range of topics in this section reflects recognized good practices in selecting private partners and examines whether different regulatory frameworks adhere to them. The transparency and fairness of the process, evaluation criteria for bids, and specific provisions regarding lack of competition are major themes in this section.

> Unsolicited proposals for PPPs: This section first defines whether the regulatory framework allows for the submission of unsolicited proposals (USPs). When applicable, it examines whether a specific procedure is in place to evaluate their feasibility and their consistency with other government priorities. In addition, it assesses whether a competitive procedure is required to select the private partner. It also explores what compensation mechanisms are in place for USPs.

> PPP contract management: This section considers the existence of a well-established and comprehensive contract management framework to facilitate smooth implementation of a PPP project. It assesses the monitoring and evaluation systems for PPPs, as well as the regulatory provisions regarding PPP contract modification and renegotiation, dispute resolution, lender step-in rights, and termination.

Benchmarking PPP Procurement provides de jure and de facto data:

> De jure data capture the characteristics of laws and regulations encompassing PPP procurement rules, other legal texts of general application, and judicial decisions and administrative rulings setting precedents in the procurement of PPPs.

> De facto data assess actual practice in connection with some of the de jure data points covered in the survey. A subset of relevant regulatory questions is followed by questions that capture the extent to which the legal requirements are respected in practice, according to the survey respondents. A number of questions capture contributors' perceptions of the time required to complete relevant stages of the PPP procurement process, based on their significant and routine experience in PPP transactions.

On the basis of the lessons learned from the pilot exercise released in June 2015, which covered 10 economies, the Benchmarking PPP Procurement team refined the methodology.10 Since its inception, the team has relied on extensive research regarding the latest PPP practices, along with frequent consultations with PPP experts. An extensive review of the academic literature was conducted to identify internationally accepted good practices as well as recognized issues that private operators face when entering into PPP transactions. Concurrently, the team consulted with and was guided by the project's ECG,11 which includes renowned PPP specialists, academics, and representatives from private organizations. The consultation process, along with the academic literature review, enabled the team to refine the survey instrument, generating a set of questions that measures the good practices and allows for a valid cross-economy analysis.

PPP procurement is usually carried out by different levels of government within each economy and is sometimes carried out along sectoral lines. Because of resource considerations, the study has looked at situations in which the procuring authority is national or federal (with two exceptions; figure 1) and has used the transport sector (highways) where sector-specific considerations are assumed (box 1). In addition, some economies have separate regimes for concessions (usually defined as user-pays projects) and PPPs (defined as government-pays projects). In such cases (Brazil, France, Senegal, Togo, and the Russian Federation), both regimes were evaluated.

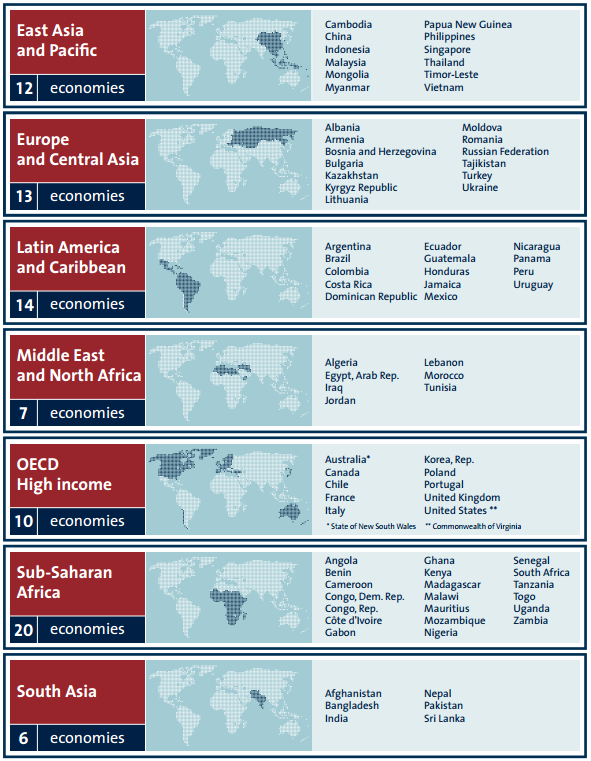

Figure 1 Economies covered in Benchmarking PPP Procurement 2017

Note: Benchmarking PPP Procurement uses the World Bank Group regional and income group classifications, available at http://data.worldbank.org/about/country-and-lending-groups. Regional averages presented in figures and tables in the Benchmarking PPP Procurement 2017 report include economies from all income groups (low, lower middle, upper middle and high income), though high income OECD economies are assigned the "regional" classification OECD high income. PPP = public-private partnership. The scope of the assessment is limited to infrastructure projects developed by procuring authorities at the national or federal level. However, in the cases of Australia and the United States, the study focuses on measuring only the State of New South Wales and the Commonwealth of Virginia, respectively.

Source: Benchmarking PPP Procurement 2017