Unsolicited Proposals

USPs are an alternative to government-initiated projects. In a USP, a private sector entity approaches the government with a proposal to develop a specific infrastructure project without the government first having identified and assessed the suitability of the project. Private sector companies-generally developers, suppliers, or financiers-fund studies to establish the basic project specifications and then approach the relevant procuring authority to receive approval. There are merits in establishing provisions for considering unsolicited project proposals. Often, such proposals are based on innovative project ideas. By allowing USPs, governments can benefit from the knowledge and ideas of the private sector and can promote innovation. However, in some cases, economies promote the submission and use of USPs precisely because of a lack of experience and capacity in preparing infrastructure projects. As a consequence, the use of USPs does not come without challenges.59 The difficulty rests in getting the right balance between encouraging private companies to submit innovative project ideas without losing the transparency and efficiency gains of a competitive tender process. Key implications to consider are ensuring the consistency of USPs with other government priorities and ensuring competition so that USPs will deliver economically beneficial infrastructure with the greatest possible value for money.

Determining how to respond to unsolicited bids so as to both protect transparency in the procurement process and recognize the initiative of the proponent is typically difficult. Economies have approached the challenge of USPs differently. In 32 percent of the economies measured, there are no specific provisions regulating USPs. In theory, this implies that if the private sector had an idea not already contemplated by the public sector, a procuring authority would have to incorporate that idea into its investment pipeline and follow all the procedures required for any other infrastructure project. The lack of regulations may be a consequence of an express desire on the part of the public sector not to use USPs as a source of infrastructure project proposals (this is usually the case in more mature PPP markets such as Canada). In other economies, however, the lack of regulations merely indicates that the subject has not been considered yet because the PPP regulatory framework is still nascent. That being said, even in economies that do expressly regulate USPs, public authorities may not encourage their use (as is the case in South Africa). The following analysis is thus limited to the 56 economies that do explicitly regulate USPs.

To assess whether the PPP framework provides for sound practices regarding USPs, this section evaluates a set of relevant issues. In particular, it looks at whether USPs are subject to proper evaluation by the public sector before being approved and whether, once approved, a competitive procedure is required to select the private sector partner that will develop the infrastructure. Governments should evaluate USPs to ensure that they are consistent with existing economic priorities. Also, procuring authorities that do not use transparent and competitive procedures to select the final private sector partner when developing a USP run the risk of not achieving the best value for money.60 The recognized good practices in managing USPs are summarized in box 5.

Box 5 Good practices in unsolicited proposals of PPPs |

Good practices to ensure transparency and competition during the procurement of projects originated as USP are: |

• The procuring authority assesses the merits of the USP and ensures that it is aligned with the government investment priorities. |

• If the USP is justified, the procuring authority initiates a competitive procurement procedure to select the private partner. |

• The procuring authority grants at least 90 days to all potential bidders (besides the proponent) to submit their proposals. |

Note: PPP = public-private partnership; USP = unsolicited proposal.

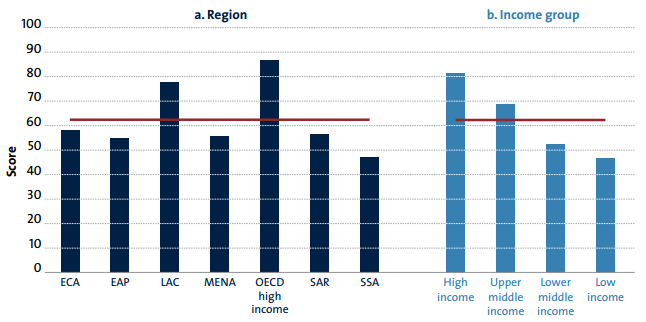

Benchmarking PPP Procurement shows regional and income group differences in the average score for USPs (figure 12). The OECD high income and LAC regions stand out from the rest of the regions. SSA region presents the lowest average score with large score variation among economies within the region, ranging from 17 to 92 points. When the data are disaggregated by income level, there is a clear pattern showing that the lower the income group level, the lower the average scores on USPs.

Figure 12 USPs, score by region and income group (score 1-100)

Note: EAP = East Asia and Pacific; ECA = Europe and Central Asia; LAC = Latin America and the Caribbean; MENA = Middle East and North Africa; OECD = Organisation for Economic Co-operation and Development; SAR = South Asia; SSA = Sub-Saharan Africa; USP = unsolicited proposal.

Source: Benchmarking PPP Procurement 2017

The following analysis focuses on the assessment to evaluate USPs and whether there is a competitive procedure when dealing with USPs. In addition, it provides preliminary findings on the use of mechanisms to compensate the original proponent of a USP.