Dispute Settlement Mechanisms

The provisions discussing dispute resolution mechanisms are intended to prevent the need for renegotiation by allowing changes to be made and problems to be resolved within the framework provided by the contract. Given that the stakes are high in PPP projects, investors, contractors, and lenders will be more encouraged to participate in projects in economies where they have confidence that any disputes arising out of PPP contractual obligations will be resolved fairly and efficiently.92 Similarly, effective procedures for avoiding disputes or settling them expeditiously will facilitate the exercise of the contracting authority's monitoring functions and reduce the contracting authority's overall administrative cost.93

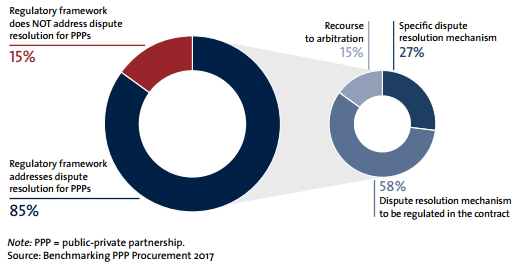

As shown in figure 19, 15 percent of the economies do not make any reference to dispute settlement mechanisms in their PPP regulatory frameworks.94 Among the economies that explicitly address dispute resolution mechanisms, the majority (58 percent) make only a general reference to the need to establish a dispute resolution system in the contract without further specification, whereas others either offer the parties the choice of having recourse to arbitration or impose a specific dispute resolution mechanism that applies to all PPP contracts.

Figure 19 Dispute resolution mechanisms for PPPs (percentage; N = 82)

Note: PPP = public-private partnership.

Source: Benchmarking PPP Procurement 2017

Chile is an example of the general approach: the regulatory framework identifies a technical panel for reviewing disputes, yet resort to this panel requires the parties' mutual consent.95 In Guatemala, the law stipulates the creation of an ad hoc commission for the resolution of disputes arising from the execution of PPP contracts.96

In Uruguay, regulations explicitly establish that for the settlement of disputes arising in connection with the application, interpretation, execution, performance, and termination of PPP contracts, the parties shall have recourse to arbitration.97 The same is true in Pakistan, where the law requires parties to have recourse to arbitration, while leaving the details of the dispute resolution mechanism to the discretion of the parties.

Box 7 Lenders' step-in rights Lenders' step-in rights allow the lenders to select, with the consent of the procuring authority, a new concessionaire to perform an ongoing PPP project in cases when the initial private partner is at risk of default. This instrument provides lenders with additional security against default by the private partner, and it improves their capacity to act as external guarantors of performance on the PPP project. At the same time, it provides the procuring authority with an opportunity to avoid the disruption entailed by terminating the project agreement, thus maintaining continuity of service. |

Despite its potential relevance, lender's step-in rights are rarely addressed by PPP regulatory frameworks. More than half of the surveyed economies (42) do not have any provision in this respect. In only 13 economies (Brazil, Chile, Colombia, India, Italy, Mongolia, Morocco, the Philippines, Tajikistan, Tunisia, Uruguay, Vietnam and Zambia), does the PPP regulatory framework establish the lender's step-in right in the legislation. In the remaining economies, the regulatory framework either defers to the contract to regulate that matter or refers to the need to reach a direct agreement with the lenders. |