2. The Rise of Private Participation in Transport

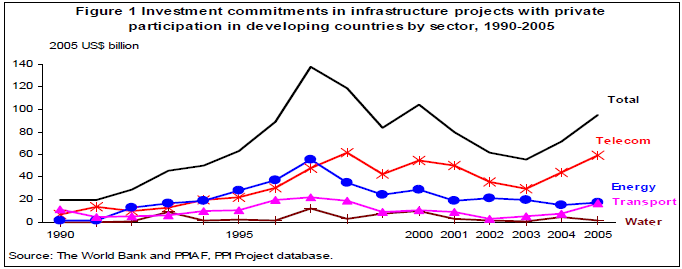

The rise of PPPs in transport has its roots in broader worldwide privatization initiatives during the 1990s. While the catalyzer may have been the dramatic changes introduced by the Thatcher administration in the UK, the bulk of the transactions actually took place in developing countries. Figure 1 provides a snapshot of the dramatic increase in the involvement of the private sector in the development and funding of public facilities and services across infrastructure activities during the 1990s. It shows that transport benefited from a relatively small share of the private commitments to the sector (about 15% of the US$1000 billion or so committed between 1990 and 2005 to all infrastructure sectors). It is also a relatively small share of the investment needs of the sector since the commitments made for this 15 years period represent very roughly the investment needed in 1 year in transport in the developing world.

While the amounts do not represent a huge share of the investment needs of the sector, they are very significant. On average, these deals represent about US$10 billion annually in the developing world alone and about twice as much when developed countries are considered. This is about 55 projects a year across transport sub-sectors in developing countries alone. There is no strictly comparable data for developed countries but most estimates turn around 20 large projects a year on average over the last 20 years, with a growing number of projects in the last 5 years or so.

The distribution of projects across sectors and regions is also of interest. About two-thirds of the projects are in roads, about 18% in rail, 12% in airport and less than 7% in ports. The average project size also varies significantly across sectors ranging from about US$ 105 million in ports to about US$307 million in rail. The average project in roads and airports is roughly US$180 million.

At the regional level, Europe captures about a third of the projects, Asia/Oceania and North America capture about a quarter each and Latin America about a fifth. Africa and the Middle East do not seem to attract many transport PPPs. Within developing countries, about half of the projects of the last 15 years of so were signed in Latin America and about a quarter in East Asia. The largest projects tend to be in East Asia with an average project size of about US$250million, followed by Latin America with projects of about US$ 190 million on average. In the other regions the average projects are less than US$ 80 million on average.

There are many forms of private participation in transport, including:

• Greenfield projects such as Build, Operate, Transfer (BOT) projects, where the private sector has the primary responsibility for financing, developing, and operating the facility for a fixed period of time, which should be sufficient to both repay debt and provide the required return on investment. At the end of the concession, assets are transferred to the government under terms agreed to in the contract. Perhaps the most familiar form of participation in transport infrastructure, this has been employed in many different variations.5 There are alternative versions of these contracts such as Build, Own, and Operate (BOO), where the private sector obtains the ownership and control of the facilities, with no transfer to the public sector.

• Concessions, where the private sector receives the mandate to operate and expand an existing network and in the process is asked to take on most of the commercial risks associated with the business. Often these contracts are done as joint ventures, in which the public and private sectors share responsibility for financing and operation of public facilities; often also, these contracts include a greenfield project subcontract which covers the additional investment obligations to be delivered under the concession contract

• The contracting out of services, where the private sector is contracted to provide services on behalf of the government for compensation, either in terms of a share of revenue, profit, or payments form the government. In general, contracting out does not involve financing risk, although it may involve revenue risk.

Concession contracts, followed by greenfield projects tended to dominate the large scale PPPs over the last 15 years or so. They represented over 70% of all contracts signed in developing countries in the sector. Divestitures are much less common than in energy or in telecoms for instance but they do take place in all sectors, in particular airports, a sector for which management contracts are also relatively more common than in the other transport subsectors.

_________________________________________________________________________________________________

5 These include Build-Own-Operate-Transfer (BOOT), Build-Lease-Transfer (BLT), Build-Transfer-Operate (BTO), Design-Build-Finance-Operate (DBFO), and Design-Construct-Manage-Finance (DCMF).