Private finance for public sector projects

1.2 The Infrastructure and Projects Authority (IPA) has identified a need for more than £300 billion of investment in social and economic infrastructure in the five years to 2020-21. The government can pay for infrastructure in several ways. In the past, the majority of finance for infrastructure investment came from tax receipts and/or government borrowing, and the government still plans to spend 1.0% to 1.2% of gross domestic product (GDP) each year on economic infrastructure between 2020 and 2050.2 However, a significant proportion of the planned infrastructure will also be privately financed. One private financing route is a Public Private Partnership (PPP) such as PFI and PF2. There are over 700 PFI and PF2 projects in the UK. Over the last 20 years capital investment using PFI and PF2 has averaged around £3 billion a year - this is relatively small in comparison to publicly financed government capital investment which currently amounts to around £50 billion a year.

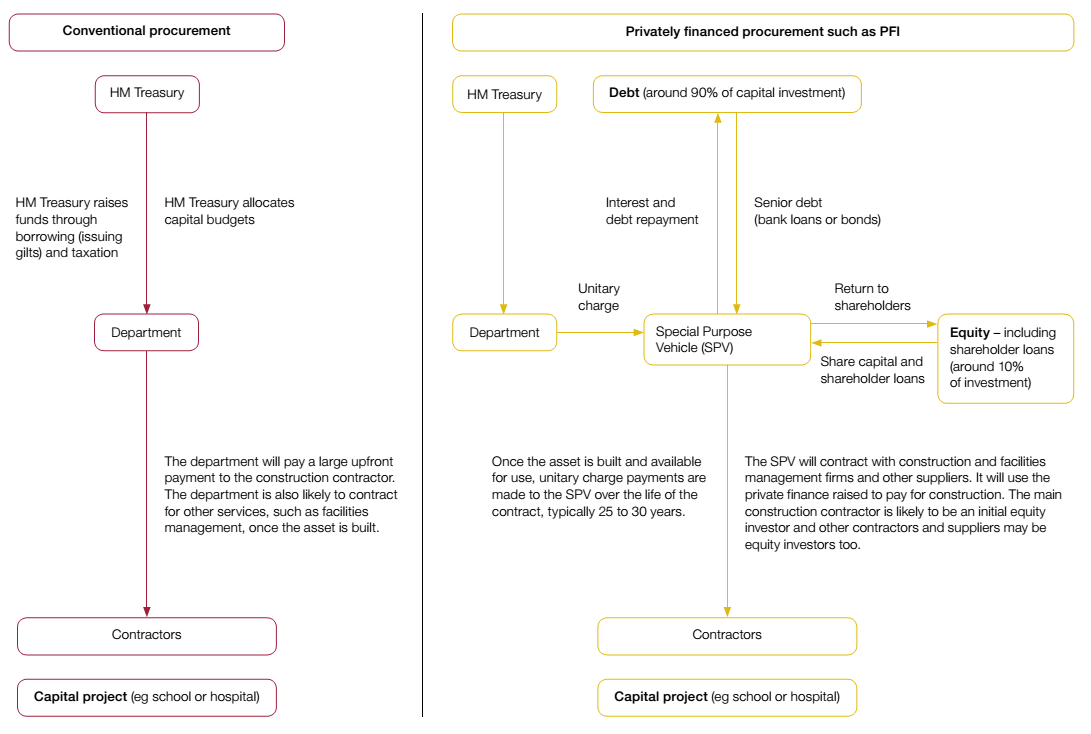

1.3 The fundamental difference between conventional public procurement and PFI procurement for capital investment relates to which party raises finance for the asset's construction (Figure 1). In conventional procurement the private sector is still involved (private contractors build the asset) but the public sector provides the finance. When the public sector procures an asset using PFI, a private company - a Special Purpose Vehicle (SPV) - is formed and it raises finance from debt and equity investors to pay for construction. Once the asset is constructed and available for use the taxpayer makes 'unitary charge' payments to the SPV over the contract term, usually 25 to 30 years. This charge includes debt and interest repayments, shareholder dividends, asset maintenance, and in some cases other services like cleaning. These payments will be agreed at the start of the contract and some or all of them will be linked to inflation. All of these aspects remain in the PF2 model which replaced PFI in 2012 (see Part Three); the costs and benefits of PFI discussed in this section also apply to PF2.

Figure 1 Comparison between private finance and conventional procurement |

Source: National Audit Office analysis |

1.4 HM Treasury made the introduction of PFI possible in 1989 when it retired the 'Ryrie-Rules' (which had discouraged public sector projects from being privately financed) and announced that it would allow additional privately financed investment in roads. In 1992, the use of PFI was extended to other sectors and the name 'Private Finance Initiative' was used for the first time.3 Other changes were later introduced to allow for PFI to be used within local bodies, for example the Department of Health and Social Care provides a Deed of Safeguard for PFI health deals which guarantees PFI payments.

___________________________________________________________________________________________

2 Infrastructure and Projects Authority, National infrastructure and construction pipeline analysis, December 2016, available at: www.gov.uk/government/uploads/system/uploads/attachment_data/file/574523/2905918_NIC_Pipieline_pdf_v9.pdf

3 Grahame Allen, The Private Finance Initiative, House of Commons Library, Research Paper 03/79, 21 October 2003.