Private finance can be attractive to government in the short- to medium-term and may be public bodies' only option for investment

1.14 Each year HM Treasury publishes data on every PFI and PF2 project, including the capital value and future unitary charges.13 However, most private finance debt is off-balance sheet for National Accounts purposes.14 This results in short-term incentives for the government and public bodies to use private finance procurement. This is because private finance:

• Results in lower recorded levels of government debt and public spending in the short term

Unlike conventional procurement, debt raised to construct assets does not feature in government debt figures, and the capital investment is not recorded as public spending even though it is for the public sector.

• Allows public bodies to invest in capital projects when they do not have sufficient capital budgets

HM Treasury's budgeting rules mean that most private finance deals do not score upfront against budgets: costs are spread out over time. Five of six departments that were able to answer our survey question said that their capital budgets would not have been sufficient to cover new investment had they not used PFI. PFI was also the only option for some capital investment projects undertaken by departments.

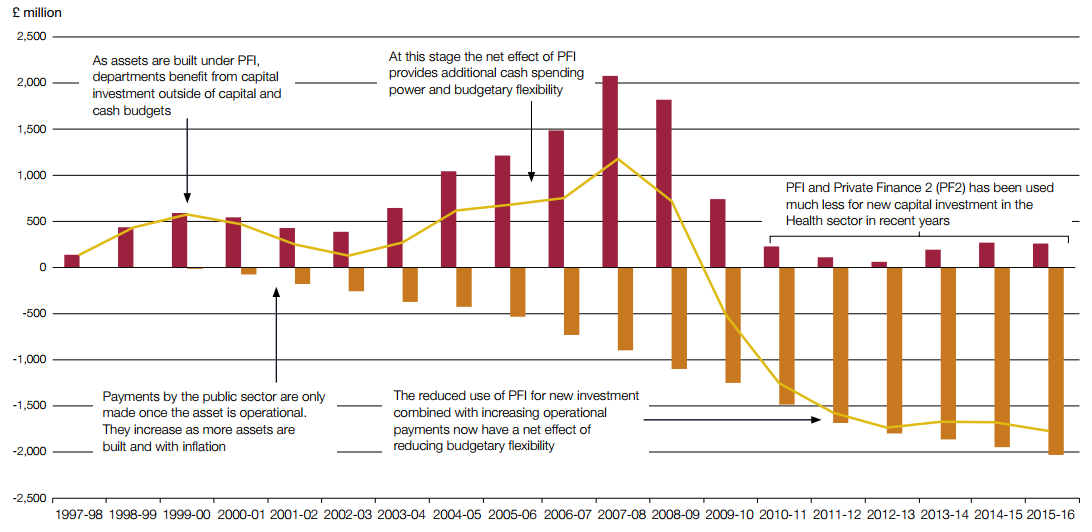

1.15 Private finance increases departments' budget flexibility and spending power in the short term, as no upfront capital outlay is required. But departments face a long-term financial commitment - any additional investment will need to be paid back. For example, in the first 12 years of PFI use in the health sector, PFI resulted in extra capital investment for the Department of Health and Social Care (the Department) of around £0.9 billion each year on average: £0.5 billion a year more than the average annual spending of the Department on operational PFI projects over the same period. However, in recent years PFI has been used much less by the Department and the operational PFI contracts, which cost over £2 billion a year, have reduced the Department's budget flexibility (Figure 2).15 Most government capital investment is publicly financed: HM Treasury provides the cash to public bodies and manages any debt or interest payments centrally. However, when private finance is used for investment, departments have to use their own cash budgets to repay debt and interest. HM Treasury told us that public bodies had to analyse and be satisfied that future costs were affordable over the life of a contract (25-30 years). However this may be a challenge for public bodies given that HM Treasury only provides certainty over their budgets to a maximum of five years in advance.

1.16 The Office for Budget Responsibility's (OBR's) July 2017 fiscal risks report cited the use of off-balance sheet vehicles like PFI as an example of a "fiscal illusion". Most PFI debt finance raised to construct the asset is transparently reported to Parliament, where the debt is considered to be on-balance, via departmental financial statements and the Whole of Government Accounts (WGA).16 The debt is recorded as a financial liability but as noted by the OBR "most public and political attention, and the government's fiscal rules, still concentrate on the National Accounts measures of PSND (Public Sector Net Debt) and PSNB (Public Sector Net Borrowing)", which does not reflect fully PFI liabilities (see paragraph 1.14).17 PFI can be attractive to government as recorded levels of debt will be lower over the short to medium term (five years ahead) even if it costs significantly more over the full term of a 25-30 year contract.

Figure 2 PFI impact on the Department of Health's budget flexibility |

The Private Finance Initiative (PFI) increases budget flexibility in the short term but in the long term budgets are constrained by the annual PFI payments

Additional capital investment made possible through PFI

Additional capital investment made possible through PFI

PFI payments for operational deals

PFI payments for operational deals

In-year net impact on departmental budget flexibility

In-year net impact on departmental budget flexibility

Notes

1 The additional annual capital investment has been estimated by taking the capital value of Department of Health and Social Care projects from HM Treasury's PFI database and assuming the investment took place within around two years after the date of financial close.

2 The Department of Health became the Department of Health and Social Care in January 2018.

Source: HM Treasury PFI database; National Audit Office analysis |

___________________________________________________________________________________________

13 HM Treasury publishes data on all PFI and PF2 projects that have either reached financial close, are under construction or currently operational. The dataset includes information such as the date of financial close, the capital value of projects and the anticipated future unitary charge payments such as capital, interest and service costs, over the life of each project. The data are provided by government departments and updated on an annual basis. HM Treasury does not audit these data.

14 Most PFI debt is scored as off-balance sheet under the European system of accounts (ESA), which determines government debt levels. However, under the International Financial Reporting Standards (IFRS), used to produce departmental financial accounts and the Whole of Government Accounts, most PFI debt is on-balance sheet.

15 There are many pressures on departmental budgets; however PFI deals are contractual commitments that are very difficult to reduce (see paragraphs 2.7-2.9).

16 Departmental financial statements are produced using the International Financial Reporting Standards (IFRS). These rules classify nearly all PFI/PPP assets as "on-balance sheet", for financial accounting and reporting purposes. This is because assets and liabilities are recorded on the balance sheets of whichever entity is deemed to have effective control. Ongoing payments such as interest and the service charges are expensed as current spending as they are paid, therefore most of the £199 billion future unitary charge payments are not yet reported to Parliament in the financial statements. The Whole of Government Accounts (WGA)-a consolidation of all the audited accounts across the public sector-is also produced using IFRS. The IFRS rules differ to the rules used to produce departmental budgets and PSND (see Figure 18).

17 Office for Budget Responsibility, Fiscal risks report, July 2017, paragraphs 7.65 to 7.67.