Other adjustments

1.31 We have criticised the use of adjustments in the VfM assessment model, such as "optimism bias" and "risk transfer", that were not evidenced and increased the relative cost of the public sector comparator more than the private finance option. An important part of these adjustments relates to the benefits of transferring construction risk but there is little evidence that overall construction cost is lower under PFI (paragraphs 1.6-1.7). Another adjustment was for tax - we noted that the estimate of additional tax paid under PFI was significantly higher than the estimates of the total tax paid in other more accurate financial models.34

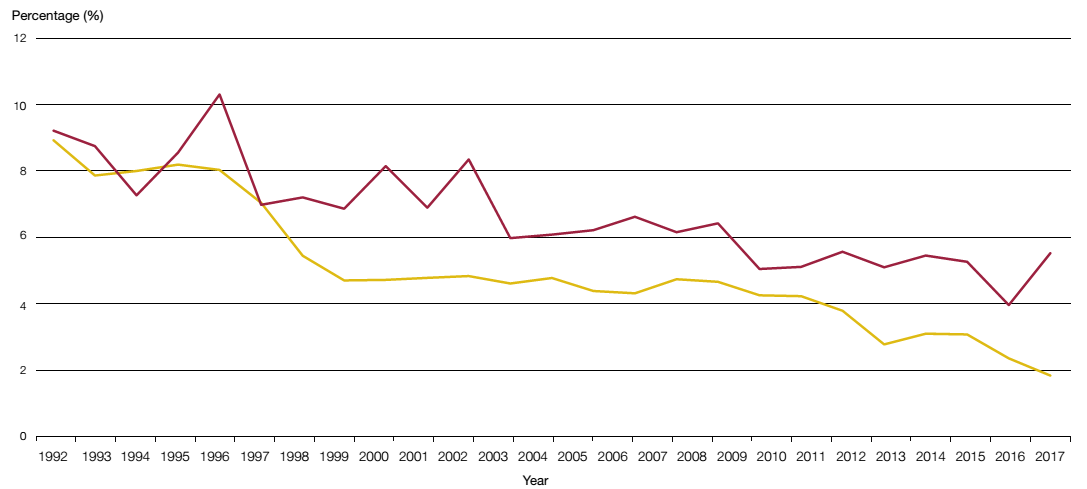

Figure 5 Government cost of borrowing compared with the government discount rate |

The government's discount rate has been higher than the actual cost of borrowing for the last 19 years - higher discount rates result in more Private Finance Initiative (PFI) deals being assessed as better value for money than a public sector comparator

Government's Nominal Social Time Preference Rate

Government's Nominal Social Time Preference Rate

Cost of government borrowing (yield on 20-year gilt)

Cost of government borrowing (yield on 20-year gilt)

Notes

1 The government cost of borrowing represents the yearly average cost of government borrowing using a generic 20-year government gilt. The yields are based on the last price per day during the day, averaged out per trading calendar year.

2 The real Social Time Preference Rate (STPR) of 3.5% has been adjusted to a nominal rate using GDP deflator at market prices.

3 Value-for-money quantitative models used by departments will often apply a long-tern average inflation rate of 2.5% to the real STPR, resulting in a discount rate of 6.09%.

4 The real STPR was 6% prior to 2003 when it was lowered to 3.5%.

Source: National Audit Office analysis; Bloomberg; Office for National Statistics |

___________________________________________________________________________________________

34 See footnote 30, paragraphs 3.30 to 3.35, Figure 8.