PFI cost reductions are difficult to achieve

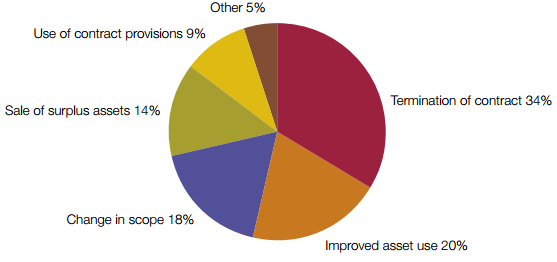

2.7 The government has sought to identify and deliver savings from operational PFI contracts. In July 2011, HM Treasury launched the Operational PFI Savings Programme aimed at delivering £1.5 billion of savings across operational PFI projects. By June 2013, departments had reported £1.6 billion of signed savings.44 Figure 10 shows the split of the different types of savings achieved. By the end of 2016, puplic bodies had provided information to HM Treasury reporting a further £1.6 billion of unaudited savings. We have not assessed the additional £1.6 billion of savings as part of this report.

2.8 Some of the identified savings do not actually reduce spending on PFI projects but instead provide other efficiencies, for example through more intensive use of PFI offices. We estimate that the total reduction in unitary charges achieved represents around one per cent of the future total charges for all deals.

2.9 PFI deal structures make it challenging to achieve savings. Rather than dealing directly with suppliers, savings initiatives must often be agreed with the SPV's management and investors, and in some cases with dept providers. In older PFI contracts, there are sometimes insufficient information access rights, so the public body cannot access cost information unless the SPV owners provide it.

Figure 10 Split of £1.6 billion signed savings from operational PFI deals |

34% of operational savings have been generated from terminating Private Finance Initiative (PFI) contracts

Note

1 Savings figures represent total signed savings identified by HM Treasury in 2013, of which 80% have been audited by the National Audit Office. The remaining £1.6 billion of signed savings, which have been identified between 2013 and 2016, are not included.

Source: National Audit Office analysis of HM Treasury's operational savings data |

2.10 Contracts have mechanisms which allow savings to be shared (such as the insurance and refinancing gain-share) and market testing and benchmarking provisions to ensure that the public sector is paying a fair price for services. However there is sometimes little incentive for investors to cooperate. Also SPV investors can be unresponsive and in the case of insurance savings some public bodies have told us that the SPVs are not complying with their contractual obligations to share savings.

2.11 Some of the ways that savings (which reduce cash costs) can be achieved, and associated challenges, are discussed below.

___________________________________________________________________________________________

44 Comptroller and Auditor General, Savings from operational PFI contracts, Session 2012-13, HC 969, National Audit Office, November 2013.