Equity returns

3.12 In some PFI deals, equity investors have been able to generate high investment returns, particularly when equity was sold after construction. For example our analysis of a recent equity sale in the M25 PFI contract showed that, over an eight-year period, equity holders have realised returns of around thirty-one per cent a year (Figure 15). This high return on the sale is likely to be because the new investor is willing to have a lower return as the project is in a lower risk operational phase, but may also mean that the project is more profitable than originally forecast. High equity returns realised during a sale do not mean that the costs for the public sector have increased. However, there is risk that high equity returns may represent inefficiencies in the initial pricing of contracts, although the NAO has not specifically examined if this was the case under the M25 PFI deal. The Committee of Public Accounts has criticised the level of investor returns achieved on some projects and the NAO has previously concluded that inefficient pricing of equity has contributed to high returns.61 As part of the development of the new PF2 model HM Treasury considered several options to address concerns about the high level of equity returns. These included a cap on returns, introducing a restriction on the amount of equity that could be sold, and an equity gain-share mechanism. However, HM Treasury documents stated that these options were rejected as they could potentially reduce investor demand.

Figure 15 Case study: Equity sale of M25 project equity |

In 2009 Highways England signed a 30-year private finance contract for widening two sections of the M25 motorway, and maintaining the entire 125 mile length of the road, including the Dartford Crossing. The project had a total capital investment value of around £1 billion.

The winning bidder was Connect Plus (M25) - it had four shareholders: Balfour Beatty and Skanska both had a 40% stake and Atkins and Egis both had a 10% stake.

At the start of the project the four shareholders invested a nominal amount for the share capital of the company and during construction phase provided shareholder loans which amounted to £200 million in total. The rest of the initial investment was provided in the form of bank loans.

Between 2009-10 and 2015-16 the shareholder loans had paid out total interest of £113 million and dividends (which started in 2013-14) of £44 million.

In 2016-17 two of the original investors, Skanska and Atkins, sold their investment amounting to 50% of the project, for £330 million.

Taking into account the timings of the cash flows we estimate an annual rate of return of around thirty-one per cent (including interest, dividends and sale proceeds) over the eight-year period from 2009-10 to 2016-17, on the investment of £100 million.

Highways England is forecast to pay the Connect Plus around £350 million a year on average from 2017-18 until 2039-40 (£8 billion in total). This will pay for ongoing operational and maintenance work, provide a return to shareholders and also repay the bank loans which currently amount to around £1 billion.

Note

1 Highways England are due to pay £8 billion (in nominal terms) cash between 2017-18 and 2039-40 according to the HM Treasury PFI database. This amounts to an average of £350 million per year over the same period. The cash figure for 2016-17 is £265 million.

Source: National Audit Office analysis; HM Treasury PFI database; Connect Plus (M25) financial accounts |

3.13 Rather than limiting or trying to regulate equity returns HM Treasury chose instead to increase transparency over returns and also introduce equity funding competitions for one of the PF2 deals. PF2 contracts will require the private sector provider to make actual and forecast equity returns available for puplication. Figure 16 overleaf gives data for the six PF2 projects. Under PF2, the government also plans to use a competition for part of the equity stake to reduce returns. The Midland Metropolitan Hospital is the only PF2 project to have used an equity funding competition so far. There were five bidders for a 40% equity stake. The expected return of 8.6%, bid for by the winning bidder, resulted in a reduction in the price of the project equity from 12% to 10%, reducing future costs for the taxpayer.62

Figure 16 Equity rates of return across PF2 projects |

The North West Priority School Building Programme (PSBP) batch is expected to generate an equity rate of return of 12.4% - the highest of all the new PF2 deals

PF2 project | Expected equity rate of return |

| (%) |

PSBP schools - South | 10.3 |

PSBP schools - North East | 12.0 |

PSBP schools - North West | 12.4 |

PSBP schools - Midlands | 11.7 |

PSBP schools - Yorkshire | 11.2 |

Midland Metropolitan Hospital | 10 |

Note

1 The rates of return for the PSBP schools do not include the equity included in the aggregator (Aggregator Vehicle PLC).

Source: National Audit Office analysis; HM Treasury equity returns data |

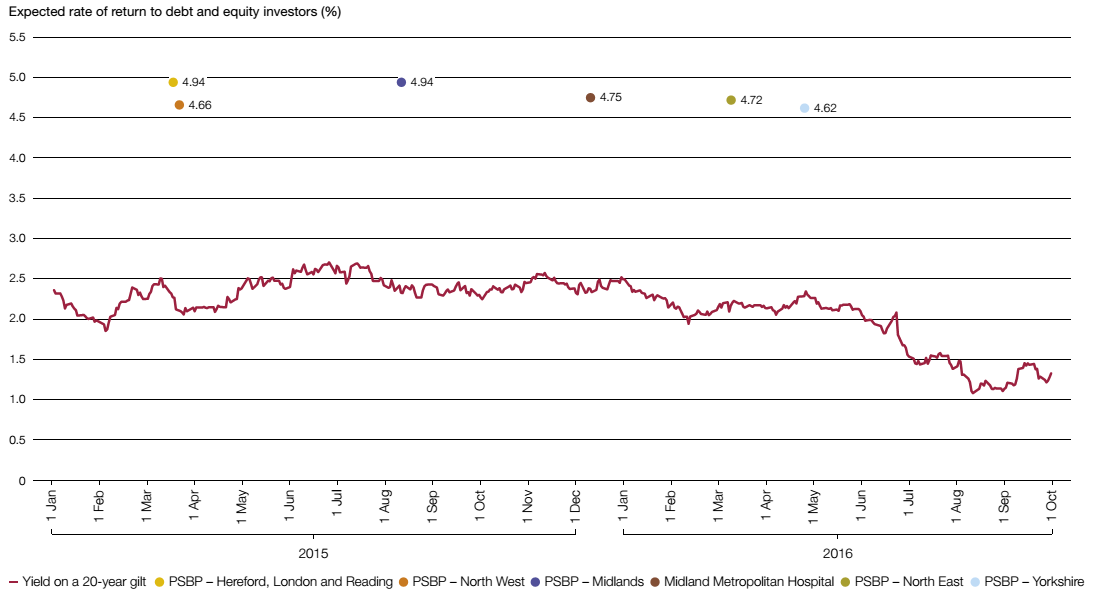

3.14 While any reduction in the cost of equity provides savings for taxpayers, equity typically makes up just 10% of the financing structure. The other 90% is provided in the form of senior debt. It is therefore important to consider the debt costs in order to calculate the overall return to investors and costs for taxpayers. Information on debt costs and total return to investors is collected by the IPA but is not published. The projected return to investors (debt and equity) after tax for the six PF2 deals agreed so far is between 4.5% and 5% - approximately double the cost of government borrowing at the time these deals were agreed (Figure 17).

3.15 As debt interest is tax deductible, the high levels of debt in the PFI structure (including the use of shareholder loans for the majority of the equity investment) reduce corporation tax payments. New measures introduced in April 2017 will limit the ability of companies to use excessive interest payments to reduce taxable profits. However PPP deals, like PFI and PF2, will be able to elect to be exempt from some of these new rules although in any new deals interest on shareholder loans will not be a tax deductible expense.63

Figure 17 Expected rate of return to debt and equity investors of PF2 deals compared with government borrowing costs |

The projected return to investors (debt and equity) after tax for the six new Private Finance 2 (PF2) projects is approximately double the cost of government borrowing at the time the deals were agreed

Notes

1 The line represents 20-year government borrowing costs, which is a 'risk free' rate. The average life of the debt financing these projects is less than 20 years.

2 The PF2 project returns represent the forecast post tax Internal Rate of Return (IRR) in the base case model. The actual returns may differ depending on how the project performs.

3 The Priority School Building Programme (PSBP) will deliver 46 schools, in 5 batches, using PF2.

Source: Departmental financial close forms |

___________________________________________________________________________________________

61 Comptroller and Auditor General, Equity investment in privately financed projects, Session 2010-12, HC 1792, National Audit Office, February 2012

62 The winning bidder for the 40% stake was Richardson's. The government holds 10% of the equity and Carillion, the primary contractor, holds the other 50%.

63 HM Revenue and Customs, Policy paper - Corporation Tax: tax deductibility of corporate interest expense, 5 December 2016, available at: www.gov.uk/government/publications/corporation-tax-tax-deductibility-of-corporate-interest-expense/corporation-tax-tax-deductibility-of-corporate-interest-expense