The European Investment Bank has been involved in financing PF2 and other PPP deals

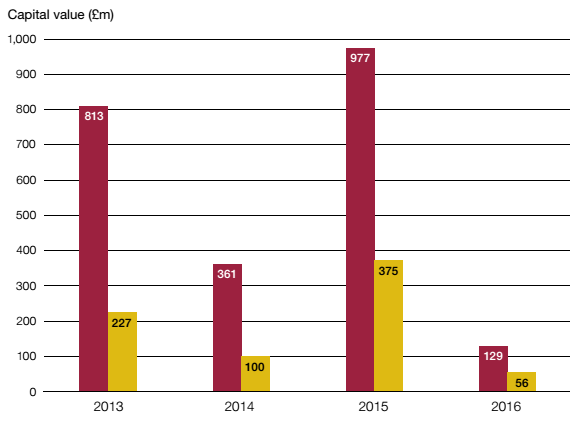

3.21 PFI and PF2 deals have benefited from European Investment Bank (EIB) financing, which is provided at a lower cost than commercial bank debt. Figure 19 shows that the EIB has provided £758 million of financing for 11 PFI and PF2 projects since 2013. As UK banks are still reluctant to provide long-term infrastructure financing, owing to tighter capital restrictions under the new Basel III requirements,64 UK privately financed infrastructure deals increasingly rely on investment from overseas banks such as the EIB. The impact that leaving the EU will have on UK access to the EIB financing is uncertain. HM Treasury and IPA have told us that they are actively considering this issue.

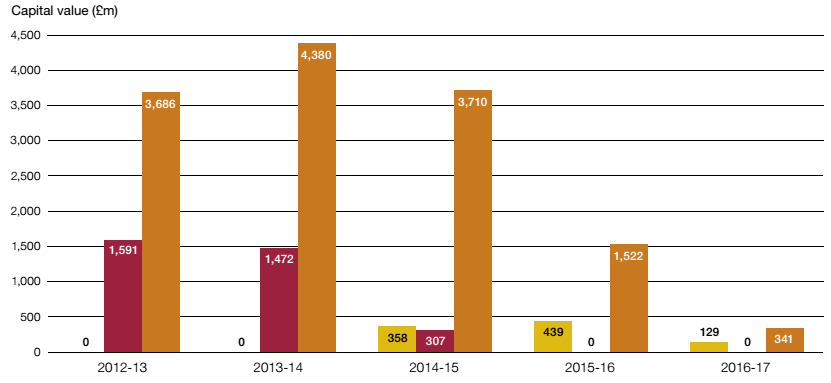

3.22 Delivering infrastructure investment using private finance is an important part of the government's infrastructure plan. As well as using PF2 it also uses other forms of PPP. Over the last five years these other PPP deals have delivered more investment than PF2 (Figure 20 on page 48) and include, for example, local government waste deals, off-shore wind transmission infrastructure, university accommodation, and the Department for Transport's purchase of rolling stock (accounting for over £6 billion of investment between 2012-13 and 2014-15). These deals, which also often access EIB financing, are similar in structure to PFI and PF2 and have long-term cost implications for taxpayers and consumers. There is less transparency about the costs of these wider PPP deals. HM Treasury used to collate and publish information on these deals but has not done so since 2010. Also, unlike new PF2 deals the expected and actual equity investor returns are not disclosed.

Figure 19 European Investment Bank (EIB) financing in UK PFI and PF2 projects since 2013 |

Between 2013 and 2016 the EIB has provided nearly £800 million of financing for UK Private Finance Initiative (PFI) and Private Finance 2 (PF2) projects

Capital value of PFI and PF2 with EIB funding

Capital value of PFI and PF2 with EIB funding

Value of EIB funding

Value of EIB funding

Source: InfraDeals; HM Treasury's PFI database |

Figure 20 |

Since 2012 capital investment in other PPPs has been higher than the use of PFI and PF2

Private Finance Initiative (PFI)

Private Finance Initiative (PFI)

Public Private Partnerships (PPP)

Public Private Partnerships (PPP)

Private Finance 2 (PF2)

Private Finance 2 (PF2)

Notes

1 Where the capital values of deals differ between HM Treasury's PFI database and the InfraDeal database, the values in the HM Treasury database have been used.

2 The value of PPP deals represents total capital value, with some deals being part financed by the public sector in the form of a capital grant.

Source: National Audit Office analysis of InfraDeals and HM Treasury's PFI database |

________________________________________________________________________________________

64 Basel III is a set of reform measures, developed by the Basel Committee on Banking Supervision, to strengthen the regulation, supervision and risk management of the banking sector.