Submission Requirements

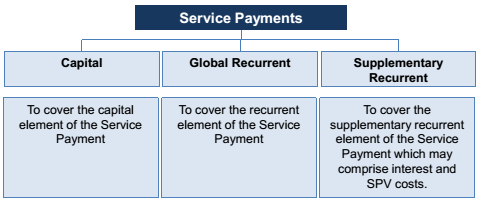

Availability PPP cash flows and their call on budgets are materially different to those under traditional procurement. Availability PPP Service Payments need to be factored into forward budgets and considered as part of the State's broader financial management framework. To support this reporting requirement, at financial close, an Availability PPP should no longer be reported on a traditional basis but on the basis of the anticipated future liabilities of the Relevant Entities as set out in the diagram below.

Relevant Entities are required to submit PPP Data Tables in accordance with the budget process timeline. The PPP Data Tables provide information on the anticipated future liabilities of the Relevant Entities in relation to a specific Availability PPP.

PPP Data Tables should capture, at relevant stages of the project lifecycle, the following information:

■ Initial TAM expenditure profile: As agreed at investment decision

■ Asset recognition profile as at financial close

■ Forecast PPP Service Payments pre and post financial close: Provision of the forecast total service payment expenditure broken down into:

- Capital element

- Interest element and Interest Rate Adjustments

- Recurrent service payment element

- SPV costs

- Any other cost categories agreed with the Treasury analyst (e.g. insurance)

■ Capital Contributions: Where these have been committed to be made during the Construction Phase

■ Conditional Debt Pay Down (CDPD) amounts: Where these have been committed to be made during the Operational Phase subject to agreed conditions being met

■ Actual PPP Service Payments: Reflecting actual payments made by the Agency including any market adjusted amounts

PPP Data Tables should provide all information available for the project over the entire life of the PPP (including that beyond the normal 10 year capital project budgeting cycle). It is noted that the PPP Data Tables are intended to be output schedules and can be tailored to each Project. Any calculations required to inform the PPP Data Tables should be carried out separately.

It is noted that the Forecast PPP Service Payments and the related accounting entries for the Availability PPP will be informed by the Budget and Accounting Model (B&A Model). The B&A model is intended for budgeting purposes and may also be used for other annual reporting purposes. It will be developed and updated in accordance with the following steps:

■ The Infrastructure and Structured Finance Unit (ISFU) within Treasury will work with the Relevant Entity during procurement to develop a tailored B&A Model. If the Relevant Entity has an existing model that is consistent with the B&A Model, then this may be used instead.

■ At financial close the model is updated to reflect the financial close model and protocols are agreed for annual updates.

■ Throughout delivery and operations:

- If using the B&A Model, ISFU updates the model and provides the model's forecasts to the relevant Agency, Budget and Policy (ABP) analyst within Treasury for review in line with existing budget approvals.

- If using the Relevant Entity's own model, ISFU reviews this model and its forecasts for consistency.

■ Relevant Entities complete the Data Tables. Treasury reviews these before being reflected in the Budget and Forward Estimates for the final Allocation Schedule prior to the annual State Budget.

Relevant Entities are required to submit quarterly Construction Progress Reports and annual Operational Progress Reports to the relevant ABP and ISFU analysts. If Treasury is represented on the relevant Project Steering Committees than this reporting requirement is optional. The reports provide information on the progress and performance of the Availability PPP project. To avoid duplication the Relevant Entities may draw upon information used in other reports that are consistent and for similar purposes. There is no prescribed template for the reports, however all information must be presented as a single document.

Quarterly Construction Progress Reports should capture:

■ Progress of the construction of the asset against the planned program including reporting against milestones

■ Any cost variances that have an impact on the cost of the project to the agency (It is noted that all changes and variations must go through formal approval processes)

■ Key issues and risks associated with the project

■ Expected completion date

■ Expected date/timeframe for asset recognition

Annual Operational Progress Reports should capture:

■ Summary of the SPV's performance in relation to the asset

■ Summary of abatements for availability and performance

■ Operational issues and performance against KPIs

■ Major lifecycle work undertaken

■ Description of any variations, refinancing or any other changes (note these may require formal approval by the relevant authority)

■ Any significant issues raised in relation to the contract by the Relevant Entity or the SPV in that year

The Data Tables, Budget & Accounting Model and associated guidance will be regularly reviewed and updated by Treasury.

Note: The information should be sourced from the most accurate source possible, typically proxy financial models developed during the procurement phase by the agency and bidders and the financial close model described in the PPP Project Agreement and/or that used for calculation of service abatements. Performance information is typically sourced from the SPV reporting documents as stipulated in the Project Deed.