Assessments of PPPs

A sound appraisal of a PPP project ensures a project of optimal quality, most likely to attain financial closure and to yield positive results during its implementation. Furthermore, assessments may serve as proof of the procuring authorities' understanding of the key elements of the project, enabling them to properly structure the project and design the draft PPP contract.

Given the importance of appraisals, the Procuring Infrastructure PPPs 2018 survey inquires whether the following assessments are undertaken during the preparation phase: (1) a socioeconomic analysis;14 (2) a fiscal affordability assessment; (3) identification, allocation, and assessment of risks; (4) a comparative assessment with traditional procurement alternatives (or value-for-money assessment); (5) a financial viability or bankability assessment; (6) market sounding for potential investors;15 and (7) an environmental impact assessment. This last type of assessment was introduced in this edition of the report to capture governments' capacity to assess the direct impacts that a potential PPP project might have on the environment.

The Procuring Infrastructure PPPs 2018 survey not only identifies which assessments are conducted (identifying those cases in which a regulatory requirement is clearly in place) but also whether a methodology has been developed for each of those assessments. A methodology provides guidance and consistency across different PPP projects. It sets objective criteria that are uniform, publicly available, and easy to use for multiple PPP proposals, helping make the government more transparent and building capacity. A methodology may take the form of supporting materials or methodological guidelines, including guides for the design and evaluation of investment projects.

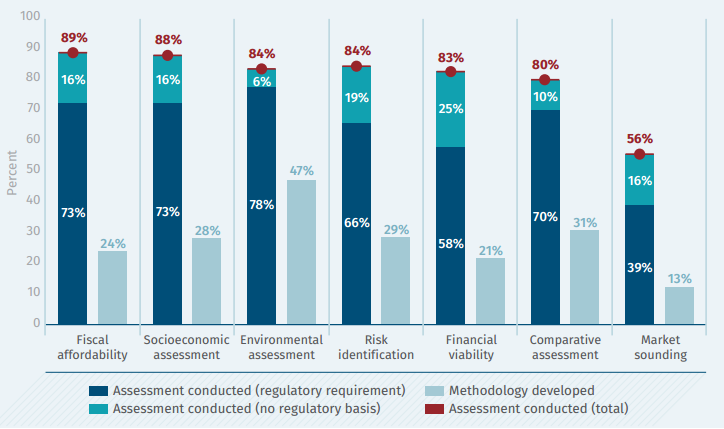

Figure 5 Assessments during the PPP preparation phase (percent, N = 135)

Source: Procuring Infrastructure Public-Private Partnerships 2018.

Note: Some numbers in the figure may not add up due to rounding

In more than 80 percent of the economies surveyed, six of the seven assessments are performed (the exception is market sounding) (Figure 5). However, less than one-third of the economies have developed specific methodologies for conducting such assessments, and an even smaller percentage of economies (just slightly over 20 percent) make those assessments available online.

Only 11 economies among the 135 economies surveyed provide specific methodologies for all seven assessments measured by the report: Canada, Germany, Ireland, Lithuania, Netherlands, New Zealand, Peru, Philippines, Slovakia, South Africa, and the United Kingdom. On the other end of the spectrum, Somalia does not require any of the assessments to be prepared. This pattern points to considerable room for improvement.

Data compiled for this year's report identify the fiscal affordability and socioeconomic impact of a potential PPP project as the two assessments most commonly conducted (89 percent and 88 percent, respectively, although only 73 percent of the economies have a regulatory basis requiring the assessments). Through these assessments, the government conducts a cost-benefit analysis that weighs the public interest and social return against the cost of the project and measures the long-term fiscal and budgetary impact. However, only 28 percent and 24 percent of the economies, respectively, have developed a specific methodology for how to perform these assessments. Only in two areas-environmental assessment and the comparative assessment with traditional procurement (sometimes referred to as the value for money assessment)-have more economies developed specific methodologies. A good example of a country that conducts thorough socioeconomic impact assessments is Austria, which enumerates a comprehensive set of variables to be assessed: "In any event, the financial, economic, environmental, consumer protection effects as well as the effects on children and youth and the administrative cost to citizens and to businesses including in social respects and, in particular, also on actual equality of the genders, shall be considered."16

With the environmental impact assessment, the government accounts for environmental externalities that may not have been captured in the economic cost-benefit analysis. Moreover, the exercise allows risk mitigation measures to be identified that could be implemented during the life of the project. A legal requirement to conduct an environmental impact assessment exists in 78 percent of the economies assessed, making it the assessment for which the most economies have introduced a legal requirement. In another 6 percent of economies, including Chad and Haiti, while no regulatory basis requires it, contributors indicated that an environmental impact assessment is also carried out. It is therefore surprising that even in this case, only 47 percent of all economies have developed an environmental impact assessment methodology.

Commonly, environmental impact assessments of PPP projects are elaborated upon in the national environmental laws, which generally apply to PPPs. In some economies, the PPP law explicitly mentions a requirement to conduct environmental assessments, but the details are provided in a separate regulation. For example, in Côte d'Ivoire, the PPP Decree requires that the feasibility study include environmental aspects of a project; and the Environment Code17 states that every project likely to have environmental consequences shall be preceded by an impact study. The method to assess such impact is provided by a specific decree.18 In the PPP Law of Burundi,19 the assessments of a public-private partnership contract can be prepared only if the evaluation conducted by the PPP Agency demonstrates the advantage of the PPP option compared to other procurement alternatives. This evaluation includes measures for the protection of environment and sustainable development.

Market sounding stands out as the least commonly performed assessment among the surveyed economies. It is conducted in only 56 percent of the economies (including 16 percent that do so without a legal requirement). Moreover, only 13 percent have developed a specific methodology for this type of appraisal. For example, in Canada, details of the market sounding are part of the Business Case Development Model. In addition, the Procurement Options Analysis Guide requires the procuring authority to (1) outline the overall strategy for engaging with market sounding participants; (2) describe the process used to identify market sounding participants to ensure that selected participants are appropriate; (3) describe the process used to conduct market soundings; and (4) provide information on the plan for follow-up consultations and refreshes.20 Other economies where specific methodologies for this assessment have been developed include Germany, New Zealand, the Philippines, Singapore, South Africa, and the United Kingdom.

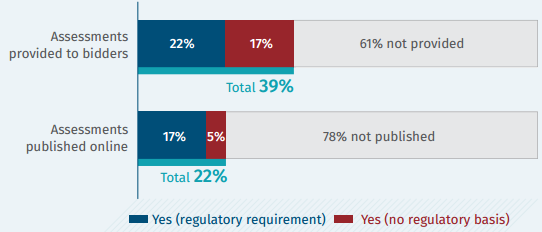

The preparation assessments are primarily a source of information for the procuring authorities. However, further disclosure and publication of the assessments allow all stakeholders to fully understand the project. Moreover, the transparency achieved by publishing the assessments is likely to exert pressure on the procuring authority to choose the right project, narrowing the space for inefficiencies and potential corruption. Similarly, disclosing the assessments results to potential bidders through information memorandums or similar documents included in the tender documentation or request for proposal (RFP) can help bidders make an informed bidding decision and submit better prepared bids. For these reasons, this year's survey also inquired about whether the required assessments are made available to the public and published online, and whether the results of the assessments are included as part of the tender documents shared with potential bidders (Figure 6).

Figure 6 Disclosure of preparation assessments to bidders and the public (percent, N = 135)

Source: Procuring Infrastructure Public-Private Partnerships 2018.

About 39 percent of the economies include the completed assessments in the documents provided to potential bidders. In 22 percent of the economies, this is done in accordance with an express mandate contained in the regulatory framework, while an additional 17 percent of the economies also include the assessments as part of a general practice recognized by the survey contributors. In Australia, for example, the New South Wales PPP Guidelines consider it a good practice to provide bidders with a summary of the Public-Sector Comparator (PSC) to assist them in preparing their bids.21 Moreover, the same PPP guidelines require the procuring authority to make the analysis of legislative and regulatory impacts, feasibility studies, land use considerations, geological information, and demand estimates available to the short-listed bidders.22 Contrary to this commendable example, in over 60 percent of the economies, the assessments are performed exclusively for the benefit of the procuring authority and they are not necessarily shared with the bidders. This may hinder the capacity of some bidders to fully understand the scope and requirements of the project and consequently to prepare the most informed and accurate bids. It may also introduce differences among the bidders if some of them were to obtain better access than others to the analysis prepared by the government.

Similarly, despite the enhanced transparency it provides for stakeholders, only around one-fifth of all surveyed economies publish the results of at least one assessment. Seventeen percent of the surveyed economies have a regulatory provision requiring publication, while in another 5 percent (seven economies), this is done in practice and despite the lack of regulatory requirement, according to the survey contributors. For example, in China, PPP project information should be disclosed during the project identification and preparation phase, including the risk allocation framework, the value-for-money evaluation report, and the financial affordability assessment report.23 In Paraguay, the PPP law requires the Public-Private Partnership Project Unit at the Technical Secretary of Planning to publish the pre-feasibility and feasibility studies carried out before procuring a PPP.24 Once again, aside from a few remarkable examples, most economies (over three-quarters of those surveyed) do not consider publishing the assessments required for PPP preparation. At the very least, this implies a missed opportunity to fully engage all potential stakeholders by providing them with the full picture of the scope and implications of the PPP project. Finally, the lack of publication makes it more difficult to ensure that the assessments are meaningfully completed, also making it more difficult to hold the procuring authorities accountable.