CASE STUDY 3 BUILD UK

| "circa 75% of all output is not in the government's direct control and there is not enough coordinated engagement with private clients of the industry" |

Build UK provides a strong collective voice for the construction supply chain, bringing together Main Contractors and the leading Trade Associations representing over 11,500 Specialist Contractors. The most recent evolution has been to bring large construction clients to the table with Almacantar, Argent and Great Portland Estates leading the way here. This will hopefully start addressing the lack of integration between clients and the construction industry that this review highlights.

Build UK focuses on key industry issues that can deliver change and enable the construction supply chain to improve the efficiency and delivery of construction projects for the benefit of the UK economy.

Providing influential and dynamic leadership, Build UK ensures a joined up approach from the supply chain as the 'go to' representative organisation for industry stakeholders around issues such as pre-qualification, payment and the wider industry image.

Founded in 2015, Build UK continues to grow on the back of successes in driving change in the industry, such as the Training Standards programme launched to address the skills shortages highlighted in this Review.

The Safety Helmet Colours initiative has highlighted Build UK's commitment to improving health and safety on construction sites and professionalising the image of construction. Highways England has confirmed it will adopt the Safety Helmet Colours Standard from 2017, demonstrating not only Build UK's reach but also the willingness of the industry to present a more joined-up approach across different construction sub-sectors.

|

| Black: | Supervisor |

| |

|

| Orange: | Slinger/Signaller | ||

|

|

| Site Manager | ||

|

| Blue: | All those coming to site who do not fall into any of the above categories |

Safety Helmet Colours introduced April 2016

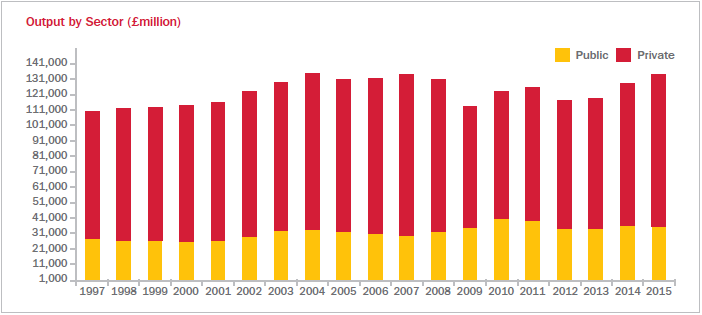

Figure 8: Output in the Construction Industry, Table 2A, Office for National Statistics, July 2016

The conclusion is that despite a large infrastructure led pipeline and government interest in that, circa 75% of all output is not in the government's direct control and there is not enough coordinated engagement with private clients of the industry, including real estate developers, investors, developing occupiers and to a lesser extent, housebuilders. This is a structural issue which limits the ability for overall strategic change to be achieved other than in pockets, often in isolation from other parts of the construction sector. Unless the whole spectrum of private and public clients are involved in effecting change, it is suggested that the industry will not be able to transform itself in response to client demand changing.

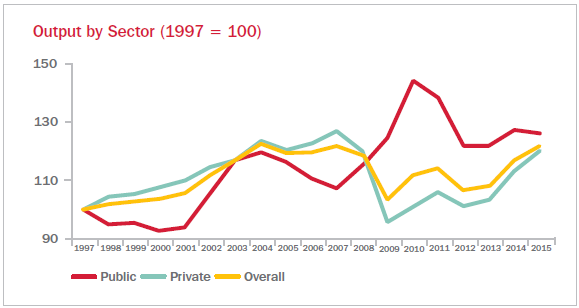

Figure 9: Output by sector rebased to 1997, Output in the Construction Industry, Table 2A, Office for National Statistics, July 2016

The Construction Industry Training Board (CITB) has a specific leadership role that is important to describe and review. The CITB's implementation issues are covered in more detail on page 25, but in a leadership context, it clearly has responsibility for leading both training and external industry promotion on behalf of the businesses that it collects levy from. The fragmentation and lack of joined up thinking highlighted above is exemplified by the separate series of initiatives that CITB has been forced to launch in partnership with individual trade and representative bodies. Although they are all trying to create better outcomes, the fact that they are being led by fragmented coalitions is not conducive to single point ownership of modernisation across a supply chain that is many instances shared between house building and general or specialist contracting. The concern here would be the danger of insular 'sub-sector' thinking that starts to compartmentalise industry due to the inherent inability of CITB through its terms of reference, available infrastructure and the fractionalised nature of its 'industry partners'. This fundamentally undermines CITB's ability to lead a true industry-wide change agenda that spans house building, civil engineering, commercial construction, building services engineering and also has the voice of clients' needs sitting behind it.

There is also a realisation from the evidence this review has seen and heard that specialist interest groups or small minorities trying to change wider industry behaviour are battling a tide of industry scale and lethargy. This conclusion is a hard one to accept but reflects the challenge faced. The recently announced merger between Constructing Excellence and The Building Research Establishment (BRE) signifies a greater potential impact of these important bodies through aggregation and scale but all of this still requires 'hard wiring' into the mainstream industry and its clients to maximise its scalable impact. Similarly, Buildoffsite has done good work trying to promote the importance of a modern, pre-manufacture led industry and has in particular made significant inroads to the fundability / warranting of off-site construction through its 'Buildoffsite Property Assurance Scheme (BOPAS). Its ability to lead a wider and compelling message to market though on behalf of its members is limited by the conservatism of many clients and often the scepticism of their advisors.