Lack of R&D & Investment in Innovation

The level of investment in industry innovation including associated links to driving a digital led skills and training agenda appear to be very low. Industry drawdown of R&D Tax Relief in engineering and construction relative to all claims made is neglible. Of a total of £1.75 billion offered to SME's in the UK through the R&D Tax Credits Scheme, only 324 construction businesses have taken advantage of the scheme17 - The amount claimed is undefined but likely to be a very small amount. This is symptomatic of a lack of interest in or incentive to consider modernisation in the industry despite meaningful tax offsets being offered.

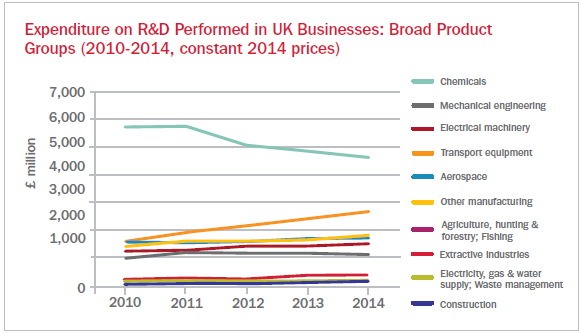

It can be seen immediately that the UK is at the lower end of the spectrum in terms of its proportionate share relative to other developed economies. Figure 17 shows construction as the lowest performing industry when comparing R&D spend across different UK industry sectors. It is said that measurement and classification errors may arise in official statistics due to innovation being undertaken but not formally accounted for as R&D. However this data suggests construction R&D is running in the order of only 0.1% of output

This review heard evidence from businesses that are investing in innovation but appear to meet problems in getting new products and propositions to market at any scale. This is often due to a deep-seated perception of risk within the wider supply chain, advisors and designers, commissioning clients, building control inspectors and ultimately, insurers and funders. The barrier seems to be a need to see a robust, if not guaranteed benefits case before adoption. Negative perceptions have in turn led to many innovative approaches to construction design and construction processes immediately being considered as high risk. This is not helped by the numerous financial failures of businesses who have invested heavily in different approaches that would have benefited both construction productivity and predictability but were never adopted by clients at scale. The industry therefore seems to be locked into a self-fulfilling 'chicken and egg' impasse when it comes to investing in, technically and commercially proving (for industry and clients) and then deploying innovation at scale.

Figure 17: Research and Development in UK Businesses, 2014 - Datasets, ONS

It is clear that the higher the sunk costs in R&D or fixed physical costs such as machinery and equipment, the more the pressure exists to drive volume to underpin return on that investment. The cyclicality of construction demand is difficult enough to navigate for low overhead flexible businesses, but that fluctuation is amplified if you have not even managed to secure client confidence in a new product or approach which has been invested in and has to compete with more traditional solutions.

There is evidence that institutional funders, despite seeing superficial benefits in exploring pre-manufactured solutions, do not have enough technical reference points to get past seeing this area as an unnecessary risk. This is perpetuated by some client side technical advisors and also by a lack of awareness of or mainstream uptake of new insurance and warranty mechanisms specifically designed for manufacture led construction.

There is also evidence that senior debt providers lending development finance also do not see a reduced risk profile in delivery and have not modified term sheets to allow such projects to be easily procured though a combination of lump sum off site based procurement with early payments, and site based traditional trades that 'integrate' the final solution. Defaulting to a single lump sum contract owned by a conventional main contractor with only circa 20% of the cost directly owned and the majority of the balance pre-manufactured off-site, is not an effective value chain for clients who will likely pay a premium for such 'forced' lump sum ownership.

Terminology such as 'modern methods of construction or 'prefabrication' are often viewed with suspicion due to historical associations with insolvency risk, poor technical or quality issues, and a need to collaborate early by committing to a specific technical solution rather than follow a traditional sequential tendering process and choosing the lowest price based on an 'apples with apples' comparison. The latter situation is reinforced by the non-collaborative culture within the industry.

Many that have pioneered businesses in the pre-manufactured sector have, for whatever reason, not been successful in proving the benefits case to the industry and clients at large. There are few evidence points of where a new product or process innovator has been able to empirically convince its end demand market leading to wide-scale adoption based on a proven business case compared to traditional approach. There would appear to be insufficient, quantified evidence for robustly comparing a pre-manufactured approach to a site labour intensive one that shows a strong overall quantitative and qualitative benefits case factoring in all variables of certainty, speed, quality, 'smart' technological enablement, capex and opex. Clients and Main Contractors therefore often view the concept as being in the 'too difficult' box. Addressing this situation must, by implication, be a priority for those looking to offer new solutions to the construction industry and its clients.

At the time of writing this review, there is considered to also be a danger that the current apparent increase in awareness, media interest and to an extent, the actual physical adoption of 'off-site' or 'modular' pre-manufactured solutions, is being driven by some clients having an immediate need for a cheaper, quicker outcomes at a time in the cycle when labour costs have been high and project delivery failures have increased in frequency. There is a chance this appetite for new approaches may wane if the labour market cools and build costs reduce. The benefits case for cost, time, quality and predictability compared to traditional techniques therefore needs to be step-changed as a structural benefit for all parties if wider, long-term adoption is to be achieved and a window of opportunity is not to be missed.

It has also been observed that concern over pursuing more manufacturing led techniques is often fuelled by a current lack of scale and capacity in the pre-manufactured market that might mean that any reasonable uplift in demand without parallel capacity building measures and investment will lead to similar market failure as seen in the traditional site based labour model. It is therefore critical that initial capacity building precedes higher demand. How this can happen before large scale supply and demand is firmly linked together thereby de-risking the initial investment, is a major challenge and perhaps represents that biggest structural barrier to wholesale modernisation in construction.

There are some signs that foreign corporates may force the issue here and some businesses, notably from Asia, are starting to see pre-manufactured solutions as a way of overcoming the many barriers to entering the traditional physical production side of the UK construction market with associated requirements for access to local supply chains, market intelligence and expertise. This can be seen as a much needed solution to increasing our industry's capacity but surely also as a lost opportunity to domestically grow a new sector and retain the gross value add within the UK economy. It may however need new international competitor / disruptor activity to reactively spur the UK industry into action but it would surely be preferable for this to be a planned and proactive response to an obvious opportunity.

Ultimately, innovation led modernisation continues to be inhibited at all levels by the lack of industry-wide strategic leadership with a more integrated client and industry agenda. It is also critically undermined by a fundamental unwillingness to collaborate if this involves divulging competitive advantage or intellectual property. There are deep-seated perceptions in the supply chain of short-term threats to market share and dilution of returns. The reality is that pre-manufacturing and traditional site orientated working will always co-exist across the industry. It is the relative proportions that need to change if we are to achieve meaningful modernisation.

Despite Building Information Modelling (BIM) being a critical change agent for the industry completely intertwined with the move to manufacturing led approaches discussed above, there appears to also be a large scale reality gap related to the industry's BIM adoption strategy. The government's own measures to lead this agenda as a client of the industry have not reached significant parts of the design and construction world, which unfortunately includes the majority of housebuilders and private developers. Investment in and adoption of BIM is being stymied, with some notable exceptions, by all of the issues highlighted already around lack of willingness to invest, collaborate and the inability to see the bigger picture business case. The industry's route map to collaboration and high efficiency new delivery models can only be underpinned by BIM and the importance of its adoption cannot be overestimated.

____________________________________________________________________________________________

17 Russell Eggar. October 2015. Disruption in Construction Blog. https://www.cibcomms.co.uk/blog/disruption-in-construction#.V8bCc-n2aUk