ROOT CAUSES

Rather than immediately proposing potential solutions to all of these issues it is first necessary to diagnose the root causes that are sitting behind the 'symptoms' identified.

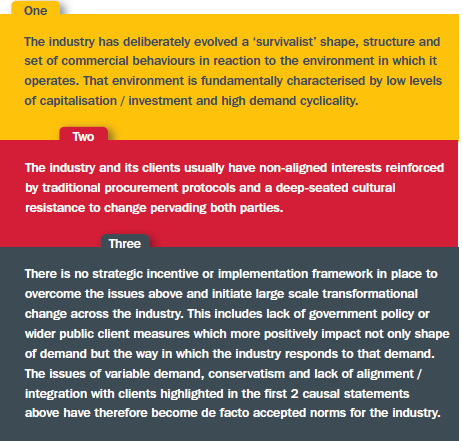

It is clear that there are multiple linkages between the strands above. However, the review concludes that there are 3 core issues that go to the heart of understanding why the industry is dealing with the performance challenges highlighted above.

The third point is critical as addressing it could be the potential 'initiator' for change which then addresses the preceding two points.

Looking at this last point in relation to housing, any government measures aimed at land and planning, development funding or demand stimuli initiatives that are disconnected from influencing how the construction industry upon which it relies actually delivers are potentially flawed. They will tend to exacerbate capacity problems and the associated symptoms by increasing demand rather than influencing the physical delivery platform. This issue is mirrored at regional and local government level. As such, there is a significant lost opportunity to harness wider economic and social benefits from a fully integrated approach to modernising delivery of housing as part of government policy setting.

As outlined in Case Study 13, Singapore is a good example of a government that is setting a progressive construction productivity and modernisation agenda linked to housing delivery through specific policy measures.

Building on the potential strategic influencers for modernisation that might break or evolve the established causal links identified above, there is clear evidence that a significant opportunity has presented itself in the UK residential sector through new institutional sources of private finance looking to invest in income producing housing assets, driven by a private rental model. This so-called 'Build to Rent' sector, characterised by aspirations to build large, professionally managed and branded portfolios has, to date, struggled to deploy funds into construction at the full scale of its potential. This is partly down to the real estate dynamics of the financial model for rental versus for sale. It is also impacted by an unwillingness for most funds to take development risk, and their need for quick, predictable construction solutions that have embedded longevity and quality. Some of this money is being deployed opportunistically through housebuilders or developers who are relying on the existing industry supply chain to deliver their core products. This supply base is already capacity constrained and is largely biased towards traditional forms of construction. Therefore the conclusion is that without incentivisation or intervention, this new institutional money is in danger of being recycled through models that will not drive innovation or long-term thinking and may exacerbate labour shortages. Post-Brexit, we are likely to see this tenure model being used increasingly to partially de-risk housebuilder market cyclicality. If the opportunity is not viewed strategically, this unique and large scale new source of capital will not drive the long-term benefit to the supply chain and wider industry that is so desperately needed.

A good example of how a new Build to Rent developer is approaching the construction industry in a different way is Essential Living's use of a pre-manufactured solutions on their Greenwich Creekside Wharf scheme (Case Study 14) with a view to this potentially being rolled out across their wider development programme. It is suggested as part of this review that the connection between institutional finance in the residential sector and the investment needed to pump prime a new manufacture led construction sector is completely logical and scalable.

In summary, addressing the three causal issues identified above (in the reverse order of how they are presented) is critical in the opinion of this review to modernising the industry and ensuring it does not go into long-term decline.