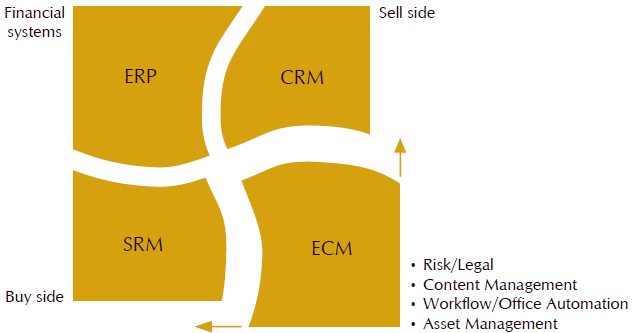

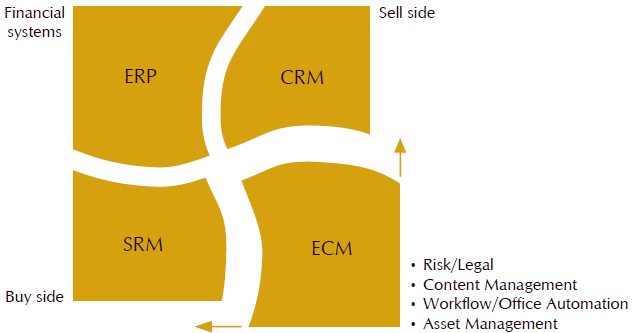

| There is a wide range of solutions from a host of different types of vendors | Contract management solutions include in-house developed systems, and products from a range of software vendors Several of the organisations we spoke to have developed in-house systems. These typically use a spreadsheet or database to record the key details of the contract, its location and key dates. | In-house solutions have the advantages of low cost. But they may be cumbersome, inflexible and have limited accessibility and weak functionality, lacking-for example-e-mail, document management, rules-based alerting, workflow, open integration and analytics. All of the companies we interviewed who had developed an in-house system said their solution had serious limitations. | "Our in-house database of IT supplier contracts just does not allow us to be proactive" A large financial organisation | | Various software vendors are approaching contract management from different angles. Enterprise Resource Planning () vendors including SAP, PeopleSoft and Oracle are large established players offering stable solutions with global systems support. For simple terms and conditions their contract management modules are integrated with the wider enterprise solution, linking contracts with the order and payment cycle. | | However, despite these advantages they do have limitations. Tim Cummins of believes that the systems are too inflexible and do not cope with business realities. In a recent public statement John van Decker of Meta Group stated that he does not believe solutions are comprehensive enough for contract management. A number of firms we spoke to with an solution in their company had nevertheless decided to use a specialist vendor. | " solutions only cover 20%-30% of the needs of most enterprises" Time to manage those contracts! Goldman Sachs. | Vendors of Customer Relationship Management () systems, and of Supplier Relationship Management () which includes Supply Chain Management, Procurement and Sourcing, have extended their offering to include CM capability. Vendors include i2, Manugistics, Ariba, CommerceOne, Diligent, Emptoris and Mindflow. solutions incorporate contract information into sourcing optimisation analysis, and are strong on customer preference and forecasting. Clearly solutions tend to focus on the buy side and solutions on the sell side. They may lack the enterprise-wide approach that is so important for effective risk management and streamlined processes involving board, finance and legal.

|

| | A further alternative is to use a document management solution. Their disadvantages are that they lack contact relationships, records management, event-driven workflow, financial planning and contract intelligence. Managing contracts is not about managing documents, but about managing the process. The diagram below outlines a possible evolution of contract management solutions. Up to now, management has largely been via filing cabinets and in-house developed electronic methods. However, we are now at the point where robust commercial enterprise solutions will begin to take hold, eventually elevating contract management to the same level of automated support as today's financial systems. | " bridges the gap between and /. It allows us to relate purchase orders to original contractual specifications and payment terms-so the supplier/seller knows what to deliver and when, and the customer/buyer knows when he has to pay what" A major manufacturer of electronic equipment |

| | | Tools | | Filing Cabinet Spreadsheets | | Collection of point tactical solutions inc. bespoke MS-Access | | Bespoke CM extensions to , & | | ECM | | Integrated | | | | | | | | | | | | | | Year Due | | <2000 | | 2000 | | 2003 | | 2005 | | >2005 | | | | | | | | | | | | | | Functions | | Store & Retrieve + Manual Processes | | Records & Reminders | | Department-wide automated processes | | Enterprise-wide automated processes | | End-to-end contract systems | | | | | | | | | | | | | | Contracts Today | | 70% | | 15% | | 10% | | 4% | | <1% | | For companies looking to manage complex contracts and adopt an enterprise approach involving the board, legal and finance, the speciality vendors provide the most flexible solutions, with the widest range of features. Europe has MEMBA and a few other players. The USA has a large number of competitors including Accruent, CMSI, DiCarta, Ecteon, I-many, Nextance and UpsideSoftware. A few of these now have European operations. | | These vendors have domain expertise in complex situations, and tend to be innovative but less long-established. Some are from a content management background, some from workflow/office automation, and some from asset management. MEMBA and ARM Group approach from a risk management perspective. Some are sell side or buy side focused even though contract management is clearly a generic enterprise-wide problem for all forms of contract-including buy side, sell side, lending, and employment contracts. | "US vendors are exploiting the opportunity opened by Enron and Worldcom to solve the problem of revenue recognition. European vendors have a more generic approach to managing contracts, commitments and related risks." MEMBA | | But whatever their specific capabilities, the fact is that there are now commercially available tools from established vendors in a market which Andy Kyte of Gartner estimates could be worth US$20 billion by the end of 2007. CSFB expects corporate spending on contract and trade management applications to grow at a 80% compound average growth rate over the next 5 years. Such figures demonstrate the speed with which contract management is now rising up the board agenda. | |