Debt

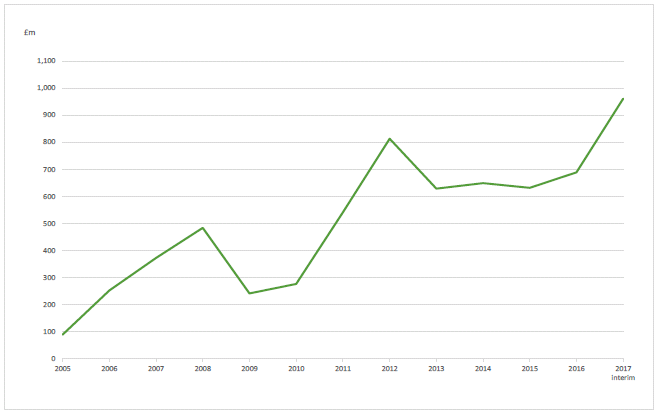

8. Carillion rejected opportunities to inject equity into the growing company and instead funded its spending spree through debt. Borrowing increased substantially between 2006 and 2008 as Mowlem and Alfred McAlpine were bought.61 It then almost trebled between 2010 and 2012 to help fund the Eaga purchase. The accumulation of debt, and inability to reduce it, caused concerns among Carillion's investors. Standard Life Investments began selling its shares in the company from December 2015 onwards,62 citing a high debt burden that was unlikely to reduce in the near term due to acquisitions and a high dividend pay-out.63 As we discuss later in this chapter, in early 2015 UBS claimed total debt was higher than Carillion were publicly stating, triggering a big increase in investors short selling, or betting against, Carillion's shares.64

Figure 1: Carillion's total borrowing

Source: Carillion plc Annual Report and Accounts 2005-2017

9. Carillion's growing net debt appeared to be of little concern to the board until the company was in dire straits. Keith Cochrane, non-executive director from July 2015 until becoming interim Chief Executive in July 2017, described net debt and the pension deficit as "lesser concerns" in 2015.65 Looking back, however, company directors acknowledged that their position was unsustainable. Philip Green, non-executive director from June 2011 and Chairman since May 2014,66 told us that he regretted the board "did not reduce net debt sooner" and conceded that they were too slow to explore the opportunity of raising equity rather than relying on debt.67

____________________________________________________________________

61 Mowlem cost £350 million - Carillion plc, Annual Report and Accounts 2006, p 74 and Alfred McAlpine £565 million, Carillion plc, Annual Report and Accounts 2008, p 101

62 Standard Life Investments merged with Aberdeen Asset Management in August 2017 to form Standard Life Aberdeen

63 Letter from Standard Life Aberdeen to the Chairs, 2 February 2018

64 Carillion plc, Minutes of a meeting of the Board of Directors, 2 April 2015

65 Q233 [Keith Cochrane]

66 Philip Green is not to be confused with Sir Philip Green of Arcadia and, previously, BHS.

67 Letter from Philip Green to the Chairs, 21 February 2018