Dividends

15. Carillion's final annual report, Making tomorrow a better place, published in March 2017, noted proudly "the board has increased the dividend in each of the 16 years since the formation of the Company in 1999".81 This progressive dividend policy was intended to "increase the full-year dividend broadly in line with the growth in underlying earnings per share".82 The board, most of whom were shareholders themselves,83 were expected to take into account factors including:

• the level of available distributable reserves;

• future cash commitments and investment needs to sustain the long-term growth prospects of the business; and

• net profits, to provide "dividend cover",

when determining dividend payments.84

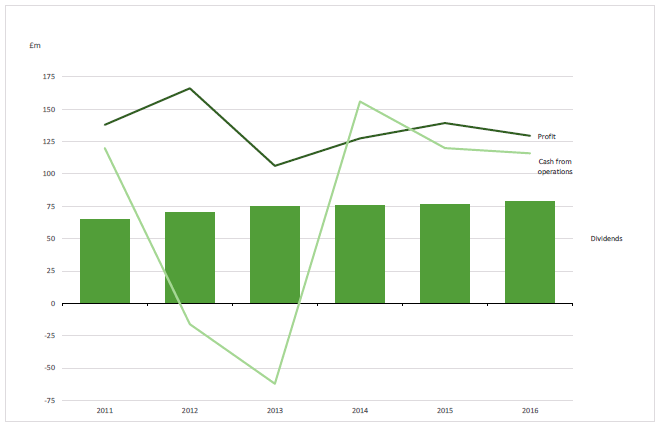

16. In reality, Carillion's dividend payments bore little relation to its volatile corporate performance. In the years preceding its collapse, Carillion's profits did not grow at a steady rate, and its cash from operations varied significantly. In 2012 and 2013, the company had an overall cash outflow as its construction volumes decreased.85 But in these years the board decided not only to continue to pay dividends, but to increase them, even though they did not have the cash-flow to cover them.86

Figure 2: Carillion's dividend payments

Source: Carillion plc annual reports and accounts 2011-2016

17. Remarkably, the policy continued right up until dividends were suspended entirely as part of the July 2017 profit warning.87 The final dividend for 2016, of £55 million, was paid just one month before on 9 June 2017.88 Former members of Carillion's board told us that there was a "wide ranging discussion"89 and "lengthy debate" in January and February 2017 on whether to confirm that dividend.90 January 2017 board minutes show that Zafar Khan, then Finance Director, proposed withholding it to conserve cash and reduce debt. However, he faced opposition from Andrew Dougal, the Chair of the audit committee,91 and Keith Cochrane, then the Senior Independent Non-Executive Director and later interim Chief Executive. Both men expressed concerns about the message holding dividends would have sent to the market. Mr Cochrane suggested "it may be appropriate to send a message to the market about debt reduction at the right time".92 He told us that "management were committed to reducing average net debt after paying the dividend".93 It is clear, however, that all other considerations, including addressing the company's ballooning debt burden, were over-ridden. The minutes of the February 2017 board meeting provide no detail of any further discussion of the dividend, but simply confirm that the board recommended a dividend of 18.45p per share.94 The right time to "send a message to the market" did not appear to come until the board issued its profit warning just over four months later.

18. Richard Adam, Finance Director from April 2007 to December 2016, told us that Carillion's objective in dividend payments was "balancing the needs of many stakeholders", including pensioners, staff and shareholders.95 We saw little evidence of balance when it came to pensioners' needs. Over the six years from 2011-2016, the company paid out £441 million in dividends compared to £246 million in pension scheme deficit recovery payments.96 Despite dividend payments being nearly twice the value of pension payments, Keith Cochrane denied that dividends were given priority.97 When offered the analogy of a mother offering one child twice as much pocket money as the other, he merely noted that was an "interesting perspective".98 Richard Adam's defence was that from 2012-2016, dividends increased by only 12% whereas pension payments increased by 50%.99 He omitted to mention that, across his ten year stint as Finance Director, deficit recovery payments increased by 1% whereas dividends increased by 199%.100 Setting aside selective choosing of dates, there is a simpler point: funding pension schemes is an obligation.101 Paying out dividends is not. We are pleased that the Business Secretary has confirmed that his Department's review into insolvency and corporate governance will include considering "whether companies ought to provide for company pension liabilities, before distributing profits" through dividends.102

19. Nor was it clear that shareholders agreed that Carillion achieved Richard Adam's balance. Some investors, such as BlackRock, invested passively in Carillion because it was included in tracking indices. For them, the suspension of dividends, as with significant falls in the share prices, could lead to a company being removed from indices and trigger an automatic obligation to sell shares.103 Active investors took a more nuanced view. Standard Life Aberdeen told us that while "the dividend payment is an important part of the return to shareholders from the earnings" it was not in the investor's interests to encourage the payment of "unsustainable dividends."104 In December 2015, Standard Life Investments (as it then was) took the decision to begin divesting from Carillion in part because they realised Carillion's insistence on high dividends meant it was neglecting rising debt levels.105 Murdo Murchison, Chief Executive of Kiltearn Partners, another active investor, said dividend payments that were "not sustainable" was a factor in his company choosing to divest Carillion shares:

In our analysis we baked in a dividend cut. When the market is telling you a dividend is not sustainable the market is usually right and, again, it is quite interesting in this context as to why the management were so optimistic about the business they were prepared to take a different view.106

Ultimately, any investors who held on to their shares found them worthless.

20. Mr Murchison said that, while dividends should be "a residual", payable once liabilities had been met, there was a problem with "corporate cultures where a lot of management teams believe dividends are their priority".107 Carillion's board was a classic such case, showing:

desire to present to investors a company that was very cash generative and capable of paying out high sustainable dividends. They took a lot of pride in their dividend paying track record.108

Such an approach was inconsistent with the long-term sustainability of the company.

21. The perception of Carillion as a healthy and successful company was in no small part due to its directors' determination to increase the dividend paid each year, come what may. Amid a jutting mountain range of volatile financial performance charts, dividend payments stand out as a generous, reliable and steady incline. In the company's final years, directors rewarded themselves and other shareholders by choosing to pay out more in dividends than the company generated in cash, despite increased borrowing, low levels of investment and a growing pension deficit. Active investors have expressed surprise and disappointment that Carillion's directors chose short-term gains over the long-term sustainability of the company. We too can find no justification for this reckless approach.

____________________________________________________________________

81 Carillion plc, Annual Report and Accounts 2016, p 43

82 Carillion plc, Annual Report and Accounts 2016, p 7

83 In the Annual Report and Accounts 2016, p 71, Philip Green, Richard Howson, Zafar Khan, Richard Adam, Andrew Dougal and Alison Horner are listed as shareholders. Keith Cochrane and Ceri Powell are not.

84 Carillion plc, Annual Report and Accounts 2016, p 43

85 Q603 [Richard Adam]

86 Q602 [Richard Adam]

87 Carillion plc, H1 2017 Trading Update, 10 July 2017

88 This payment was the final dividend payment for 2016, announced in May and paid on 9 June 2017. Stockopedia, Carillion, accessed 1 May 2018

89 Q383 [Keith Cochrane]

90 Q292 [Zafar Khan]

91 Mr Dougal held 5,000 shares in the company. Carillion plc, Annual Report and Accounts 2016, p 71

92 Carillion plc, Minutes of a meeting of the Board of Directors, 26 January 2017

93 Q383 [Keith Cochrane]

94 Carillion plc, Minutes of a meeting of the Board of Directors, 28 February 2017

95 Q604 [Richard Adam]

96 Analysis of Carillion plc's Annual Report and Accounts cashflow statements 2011-2016

97 Q388 [Keith Cochrane]

98 Q390 [Keith Cochrane]

99 Q605 [Richard Adam]

100 Analysis of Carillion plc's annual report and accounts cashflow statements 2007-2016

101 Pensions are deferred pay and pension deficits are responsibilities of the employer. See TPR, Annual funding statement for defined benefit pension scheme, April 2018, p 11.

102 Letter from the Secretary of State for Business, Energy and Industrial Strategy to the Chairs, 30 April 2018

103 Letter from BlackRock to the Chairs, 8 February 2018, Q1118 [Amra Balic]

104 Q1115 [Euan Stirling]

105 Letter from Standard Life to the Chairs, 2 February 2018

106 Q1116 [Murdo Murchison]

107 Q1115 [Murdo Murchison]

108 As above.