July 2017 trading update

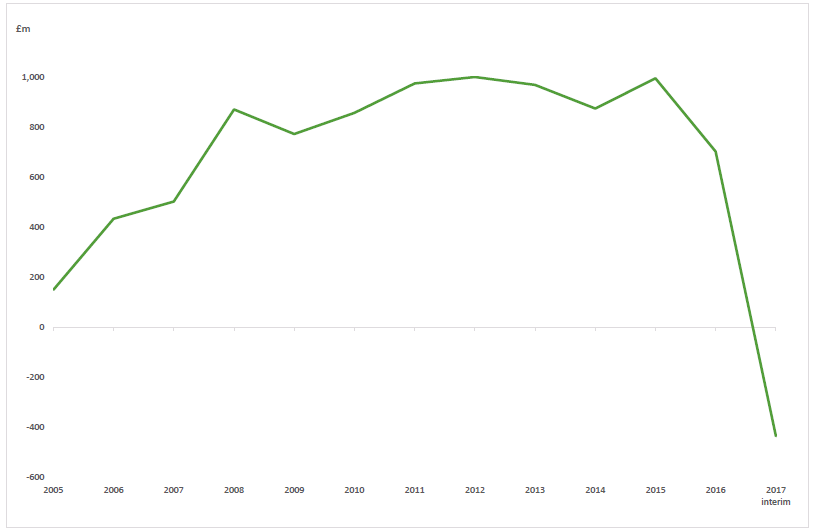

79. On 10 July 2017, Carillion issued a sudden profit warning. It announced that it would reduce the value of several major contracts by a total of £845 million in its interim financial results, due in September.274 When those results were published, the write-down went further: £200 million extra was added, completely wiping out the company's last seven years of profits and leaving it with net liabilities of £405 million. Borrowing had risen dramatically again, to £961 million. The goodwill recognised on the balance sheet was reduced by £134 million and the company's working capital ratio fell to 0.74.275 The announcement was an extraordinary reassessment of Carillion's financial health.

Figure 5: Carillion's last 7 years' profits wiped out by 2017 provision

Source: Analysis of Carillion plc's annual report and accounts 2010-2017

Figure 6: Carillion's total equity

Source: Carillion plc's Annual Report and Accounts 2005-2017

80. The stock market did not wait for the full interim results to pass judgement; the share price fell by 70% from 192p on Friday 7 July to 57p by Wednesday 12 July. The share price never recovered, falling to 14p by the time the company eventually filed for liquidation on 15 January 2018.276

____________________________________________________________________

274 Carillion plc, H1 trading update, 10 July 2017

275 Carillion plc, Financial results for the six months ended 30 June 2017, 29 September 2017

276 London Stock Exchange, Carillion share price, accessed 1 May 2018