Non-audit services

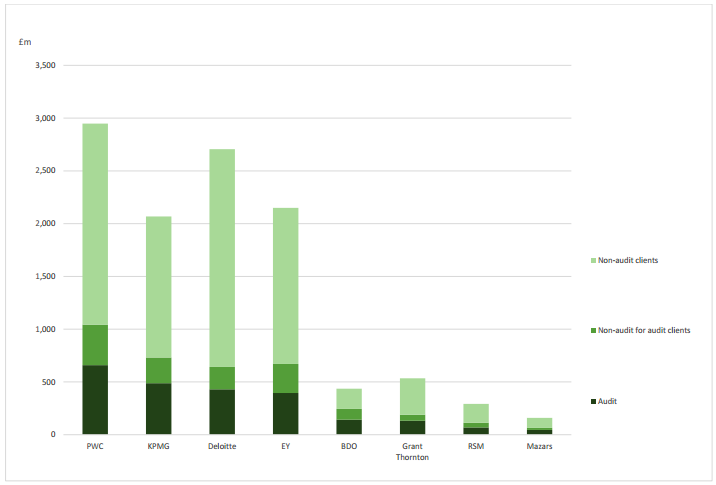

203. The Big Four offer a wide range of professional services in addition to audit. In 2016, combined Big Four income from audit services was £2 billion. Their income from non-audit services was £7.9 billion, four times as much. This included £1.1 billion of fees for non-audit services for audit clients.544 When non-audit fee income is included, the difference between the Big Four and potential rivals is even more stark.

Figure 10: The Big Four and the next four - 2016 fee income

204. It is often reported that audit services are used as a "loss-leader" by accountancy firms.545 By bidding for audit work at relatively low rates, firms can establish contacts and reputation in a company or industry and increase their chances of winning lucrative non-audit consultancy work. This would act as a barrier to smaller and more audit-focused firms competing on audit pricing. Oxera found the ability to offer additional services on top of the audit gave the Big Four further advantages over smaller firms.546 The Competition Commission considered the "bundling" of audit and non-audit services in its inquiry. It found it could not separately identify profit made from different services, partly because of the difficulty of attributing costs within broad corporate structures.547 It did not find sufficient evidence to conclude that bundling harmed competition.548

205. There is, however, a simpler explanation of how the dominance of a few giant audit and professional services firms can inhibit competition. A company may be unable or unwilling to appoint one or more members of the Big Four as auditor for a variety of reasons. For example, a firm may:

• be providing substantial non-audit services to the firm, such as internal audit, or advice on corporate transactions or tax;

• have conflicts of interest arising from close links to the finance director or audit committee chair;

• act as auditor to a major competitor; or

• in the opinion of the company, lack sufficient expertise or have a poor track record.

When there are only four options, the removal of one, two or even three firms from the equation leaves very few options left. In both the Oxera and Competition Commission reviews, financial services industry bodies reported that companies could have no effective choice of alternative auditor.549

206. This concern was very evident in Carillion. While KPMG provided external audit services, the company was similarly lucrative for the other Big Four firms. Deloitte provided internal audit services. EY was drafted in to try to restructure the company, and one of its partners was seconded onto the Carillion board. In other struggling companies, the names of the same giant companies appear, albeit often in different roles. As we set out in Chapter 2, when the Official Receiver needed a large firm to act as Special Manager to the liquidation of Carillion at short notice in January 2018, it sought a firm that was "not conflicted".550 Despite having carried out more than £17 million of work on Carillion between 2008 and 2018, for the company, its pension schemes, and for government, PwC was the least conflicted Big Four firm.551 It was appointed Special Manager as a monopoly supplier, underwritten by the taxpayer. Given that privileged position, it was perhaps unsurprising that PwC was unable or unwilling to provide an estimate of how long its work would take, or what the eventual bill would be.552

____________________________________________________________________

544 Financial Reporting Council RC, Key Facts and Trends in the Accountancy Profession, July 2017, p 37

545 See, for example: "Does the big four alumni stifle competition?", ICAEW Economia, 11 October 2012; "Carillion's demise shines a light on an auditor expectation gulf", City A.M., 31 January 2018; "Audit Reform: The Conflict Minefield" AccountancyAge, 7 July 2016.

546 Oxera, Competition and choice in the UK audit market, April 2006, p i

547 Competition Commission, Statutory audit services for large companies market investigation, October 2013, para 10

548 Competition Commission, Statutory audit services for large companies market investigation, October 2013, para 29

549 Oxera, Competition and choice in the UK audit market, April 2006, p i; Competition Commission, Statutory audit services for large companies market investigation, October 2013, para 9.33-9.34

550 Letter from David Chapman, Official Receiver, to the Chairs, 5 February 2018

551 Work and Pensions Committee, Committees publish responses from Big Four on Carillion, 13 February 2018. Note that the original total quoted here for PwC work was £21.1 million. PwC subsequently informed us that out of a total of £4.6 million that they gave us for work done on the Electric Supply Pension Scheme, only £200,000 related to Carillion. Letter from PwC to the Chairs, 23 February 2018

552 Q1333 and Q1367 [David Kelly]