2.2 Overview of PPP model used on recent rail projects

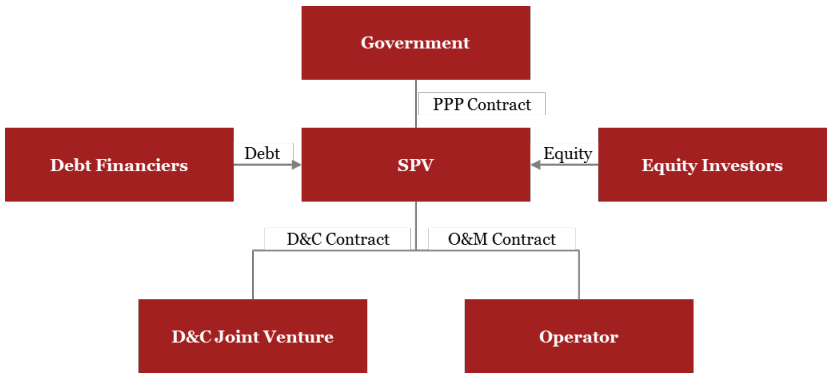

The basic contractual structure that was adopted for Sydney Metro Northwest and the light rail projects in the Sydney CBD, the Gold Coast and Canberra, is shown in figure 1.

Figure 1: Basic PPP structure for recent rail projects

In each case, the relevant government agency entered into a PPP contract with a special purpose vehicle (SPV) established by the successful bidder. The PPP contract requires the SPV to finance, design and construct the rail system (including the rolling stock) and then to operate and maintain it through to the expiry of the PPP contract. In return, the government agency agreed to pay a capital contribution during the construction phase, and monthly service payments during the operation phase. The government agency was also responsible for providing access to site during the construction phase, and a lease or licence of the project site during the operations phase.

The SPV enters into a fixed price Design and Construct (D&C) contract, under which it subcontracts its obligation to design and construct the rail system (including the rolling stock) to an unincorporated joint venture between one or more major civil engineering contractors and, in the case of each light rail project, a light rail vehicle and systems supplier (the D&C Joint Venture). In the case of Sydney Metro Northwest, the rolling stock and rail systems supplier was a subcontractor to the D&C Joint Venture, rather than a member of it. This difference is not material to the analysis that follows.

The SPV also enters into an Operation and Maintenance (O&M) contract under which it subcontracts its obligation to operate and maintain the rail system to an Operator. The Operator either performs the maintenance activities itself, if it has the capability to do so, or it subcontracts these activities to the rolling stock and systems supplier and perhaps one or more members of the D&C Joint Venture.

The SPV raises the finance it needs to fulfil its contractual obligations by entering into:

• an Equity Subscription Agreement with each Equity Investor, under which each Equity Investor agrees to contribute a fixed amount of equity into the SPV; and

• a Loan Facility Agreement with the Debt Financiers, under which the Debt Financiers agree to lend a capped amount to the SPV.

The SPV uses this finance (and the capital contributions it receives from the government agency under the PPP contract) to pay the monthly progress payments due to the D&C Joint Venture under the D&C contract.

When construction is completed and operations commence, the SPV receives monthly service payments from the government agency under the PPP contract, which it uses to:

• pay the fee payable to its Operator for the provision of the operation and maintenance services under the O&M contract;

• meet its interest and principal repayment obligations to the Debt Financiers under the Loan Facility Agreement; and

• if surplus funds exist after making the above payments, distribute the surplus to the Equity Investors as a return on their equity investment.

The service payment payable by the government agency under the PPP contract is performance-based, meaning it is reduced in accordance with an agreed formula in the event the passenger services are not provided to the required standards (for example where services run late).

As already mentioned, fares are set, collected and retained by government on each project. The SPV has no entitlement to the fare revenue collected.

Further details of the contracting structures for Sydney Metro Northwest, and the light rail projects in Sydney, the Gold Coast and Canberra light rail, are provided in the case studies at the end of this paper.