4. Promoting a new funding mechanism to deliver infrastructure

The BWG welcomes the acceleration of infrastructure delivery by investing in brownfield projects and using a new funding mechanism similar to temporary privatization. In such PPP schemes, usually called "Buy/ Lease - Develop - Operate" or "Limited Concession Schemes", the private party leases or buys a facility from the public sector for the purpose of modernizing or expanding it. The private party then manages the facility under contract with a public agency for a period of time that is sufficient to repay the investment and obtain a sufficient rate of return. For its part, the public sector uses the capital generated by this transaction to finance a new project or develop another less-performing asset.

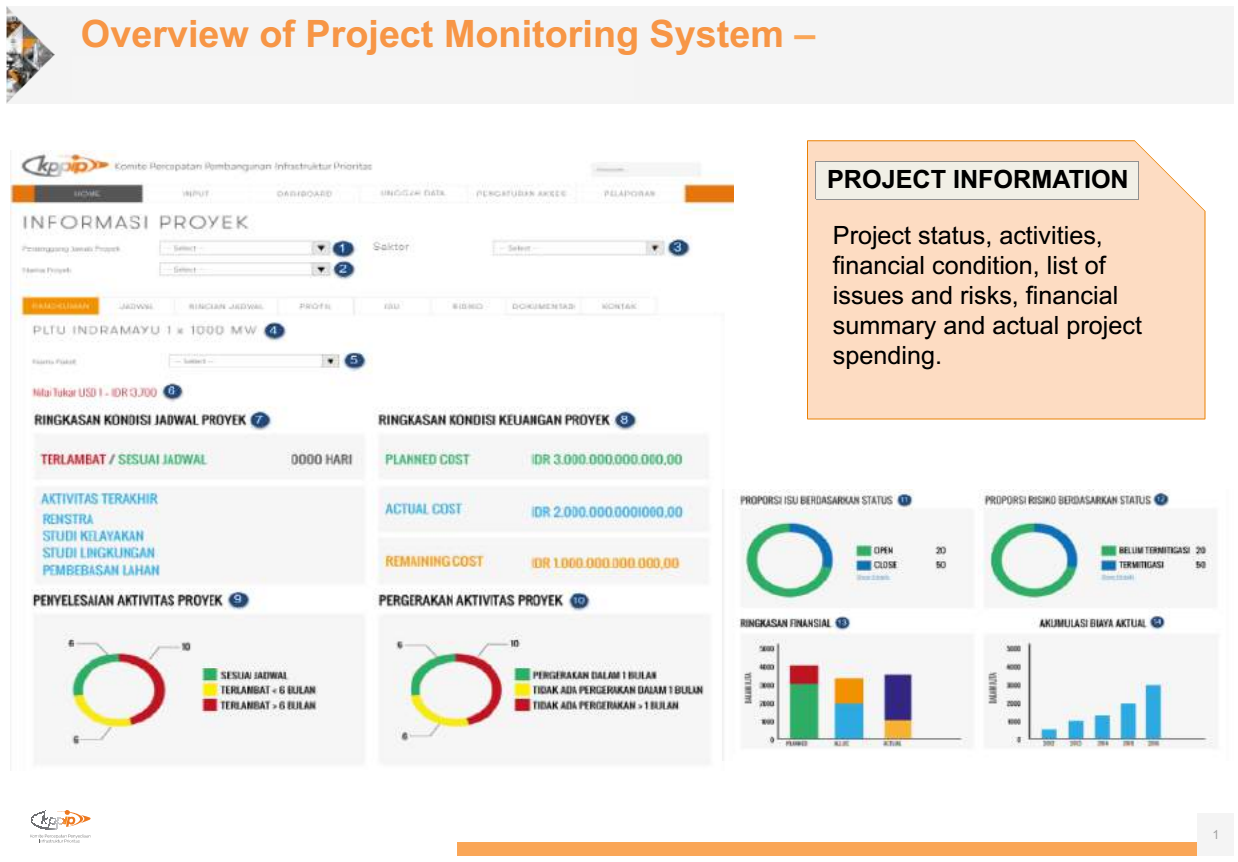

Source: Committee for Acceleration of Priority Infrastructure Delivery (KPPIP)

This asset-recycling model appears to avoid most of the issues related to greenfield project financing and as such presents tremendous potential for accelerating project delivery in Indonesia. The BWG noted two critical ingredients needed to confirm the validity of this model:

- Asset ownership structure may be perceived as an issue, hence respect for various political sensitivities and buy-in from local communities will be essential

- Early involvement of SOEs in the process will be critical. This collaboration should be seen as a commercial partnership with a clear understanding of SOE objectives (upfront payment/ concession payments/ ongoing dividends, and so on).