2. Definitions and Concepts

There is no standard universally accepted definition of the concept of PPP. All proposed definitions of PPP have been influenced by the lens/approach through which one would explore the concept of PPP, namely, the governance or managerial, financial management, developmental, or discursive approach to PPP. The context of past PPP evaluations conducted by the EIB (2005), Danida (2008), the Asian Development Bank, the World Bank Group's Independent Evaluation Group (2014) and the various bilateral and multilateral donor agencies such as the IMF, the OECD led to suggest operational definitions. Although these definitions vary from one agency to another, they appear to have common characteristics (see Annex 1: Towards an operational definition). These are: i) A cooperation agreement between the private and public entities; ii) A risk-sharing between these entities; iii) The efficiency and effectiveness in producing goods and services; and iv) the longer term commitment of the entities involved in the partnership.

PPP refers to a mechanism which involves the public and private sectors working in co-operation to provide infrastructure and services. It is fundamentally about bringing together the expertise of the private and public sectors and allowing each sector to do what it does best in order to deliver projects and services in the most efficient manner. One of the most commonly used forms of PPP involves an arrangement between public and private sector entities for delivering a service, traditionally provided by the public sector, on a long term basis usually involving major capital investment. PPPs have a wide multitude of shapes and forms such as Service Contract, Management Contract, Affermage or Lease Contract, Concession, Build-operate-transfer (BOT) and Joint Venture.

Such an arrangement usually involves a concession where a private sector partner takes on the responsibility for providing a public service, including construction, maintenance and sometimes operation of the necessary infrastructure. However, the former definition does not include the element of balanced risk-sharing between the public contracting authority and the private partner which is the most important factor in the success of PPP ventures. A more explicit definition, albeit congruent in substance with the afore-mentioned, is the following by EBRD of 2007: "An infrastructure PPP is a long-term contractual agreement between a public agency (federal, state or local) and a private sector party to secure the funding, construction or refurbishment, operation and maintenance of an infrastructure project and the delivery of a service that traditionally has been provided by the public sector." And, "A balanced transfer of risk between the public contracting authority and the private partner is a key feature of successful PPPs where individual risk components of the project are ideally allocated to the party best able to manage them."3

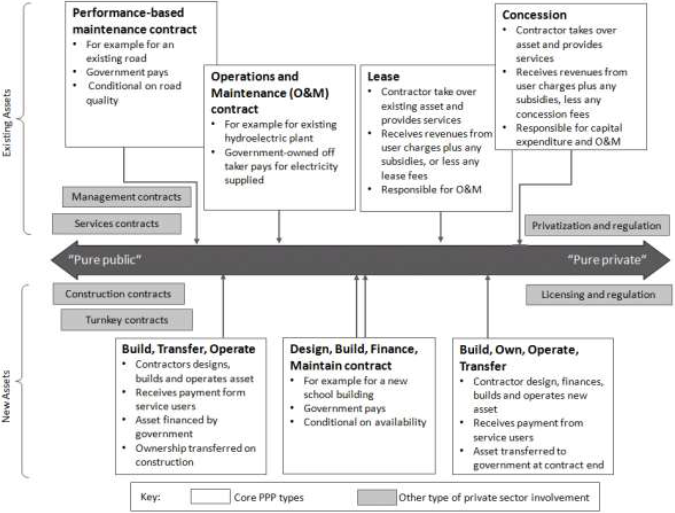

Figure 1: PPP Trajectory from Public to Private

Sources: WBI 2012; World Bank Institute and Public Private Infrastructure Advisory Facility 2012 (http://www.ppiaf.org/sites/ppiaf.org/files/documents/Note-One-PPP-Basics-and-Principles-of-a-PPP-Framework.pdf).

The World Bank Group Support to Public-Private Partnerships - Lessons from Experience in Client Countries, FY02-12 (http://ieg.worldbank.org/Data/reports/chapters/ppp_eval.pdf) also annotates that "This definition appears to be a common denominator across the PPP concepts of the World Bank Group, International Monetary Fund, and the Organization for Economic Co-operation and Development (WBI 2012; IMF 2004; OECD 2008) and translates into a well-defined spectrum of contractual arrangements.

These arrangements have in common that they are long term, usually bundling design, construction, and maintenance and possibly operation, and contain performance-based elements with private capital at stake." This definition is congruent with AfDB's governance department (OSGE)'s definition: "PPP refers to a form of financing mechanism where the public and private sectors come to an agreement in jointly establishing and/or operating a public investment project or activity". More detailed definitions are presented in Annex 1 of the Inception Report's Volume 2 (Technical Annexes).

For the purpose of this Evaluation, the same definition was used to validate the list of Bank-financed PPP projects under the public as well the private sector windows4. The following three minimum criteria were used to determine whether a project is considered as a PPP:

1. The private entity interacting with the government for delivery of a public infrastructure service. Projects with state-owned companies acting as operators are excluded.

2. The existence of long term cooperation agreement (in a concession, contract management, or implementation arrangement as defined in Annex 1 of the Volume 2 of the Inception Report- Technical Annexes).

3. A mutually accepted risk-sharing principle between the two entities that clearly states the contractual arrangements of the partnership.

The list of PPP projects using these criteria is presented in Annex 3 of the Volume 2 of the Inception Report (Technical Annexes).

____________________________________________________________________________________

3 EBRD Information Paper of March 2007: Public Private Partnership and EBRD

4 PPP sector reforms financed through Budget Support Operations as well as PPP-related Institutional Support Operations (ISP) will be also considered for this evaluation.