Defining Public-Private Partnerships

12. Public-Private Partnership (PPP) is a concept that has become widely used despite the absence of a clear definition. Most people think of PPPs as an arrangement whereby services or infrastructure traditionally provided exclusively by the public sector are provided by the private sector under a contractual arrangement. A review of the literature reveals numerous variations on this theme. For instance, the OECD defines a PPP as:

… an agreement between government and one or more private sector partners (which may include the operators and the financers) according to which the private partners deliver the service in such a manner that the service delivery objectives of the government are aligned with the profit objectives of the private partners and where the effectiveness of the alignment depends on a sufficient transfer of risk to the private partners (OECD, 2008).

13. Within this relationship, the government specifies the quality and quantity of the service it requires from the private partner(s). The private partner may be tasked with the design, construction, financing, operation and management of a capital asset to deliver a service to the government or directly to end users. Furthermore, the private partner will receive either a stream of payments from the government or user charges levied directly on the end users, or a combination of both. Any payments from the government may depend on the private partner's compliance with government specifications for quality and quantity (OECD, 2011).

| Box 1. Different country definitions of public-private partnerships There is no widely recognised definition of PPPs and related accounting framework. Eurostat, IASB, IMF, IFRS and others work with different definitions. As illustrated below there is variation between countries. Korea defines a public-private partnership project as a project to build and operate infrastructure such as road, port, railway, school and environmental facilities - which have traditionally been constructed and run by government funding - with private capital, thus tapping the creativity and efficiency of private sector. South Africa defines a public-private partnership as a commercial transaction between a government institution and a private partner in which the private party either performs an institutional function on behalf of the institution for a specified or indefinite period, or acquires the use of state property for its own commercial purposes for a specified or indefinite period. The private party receives a benefit for performing the function or by utilising state property, either by way of compensation from a revenue fund, charges or fees collected by the private party from users or customers of a service provided to them, or a combination of such compensation and such charges or fees. The United Kingdom defines a public-private partnership as "…arrangements typified by joint working between the public and private sectors. In their broadest sense, they can cover all types of collaboration across the private-public sector interface involving collaborative working together and risk sharing to deliver policies, services and infrastructure." (HMT, Infrastructure Procurement: Delivering Long-Term Value, March 2008). The most common type of PPP in the United Kingdom is the Private Finance Initiative. A Private Finance Initiative is an arrangement whereby the public sector contracts to purchase services, usually derived from an investment in assets, from the private sector on a long-term basis, often between 15 to 30 years. The State of Victoria (Australia) defines a public-private partnership as relating to the provision of infrastructure and any related ancillary service which involve private investment or financing, with a present value of payments for a service to be made by the government (and/or by consumers) of more than AUD 10 million during the period of a partnership that do not relate to the general procurement of services. Source: OECD (2012), Principles for Public Governance of Public-Private Partnerships. |

| Box 2. Other definitions of public-private partnerships In this book, the OECD defines a public-private partnership as an agreement between the government and one or more private partners (which may include the operators and the financers) according to which the private partners deliver the service in such a manner that the service delivery objectives of the government are aligned with the profit objectives of the private partners and where the effectiveness of the alignment depends on a sufficient transfer of risk to the private partners. According to the International Monetary Fund (IMF, 2006:1 and 2004:4), public-private partnerships (PPPs) refer to arrangements where the private sector supplies infrastructure assets and services that traditionally have been provided by the government. In addition to private execution and financing of public investment, PPPs have two other important characteristics: there is an emphasis on service provision, as well as investment, by the private sector; and significant risk is transferred from the government to the private sector. PPPs are involved in a wide range of social and economic infrastructure projects, but they are mainly used to build and operate hospitals, schools, prisons, roads, bridges and tunnels, light rail networks, air traffic control systems, and water and sanitation plants. For the European Commission (EC, 2004), the term "public-private partnership" is not defined at Community level. In general, the term refers to forms of co-operation between public authorities and the world of business which aim to ensure the funding, construction, renovation, management and maintenance of an infrastructure of the provision of a service. Standard and Poor's definition of a PPP is any medium-to long-term relationship between the public and private sectors, involving the sharing of risks and rewards of multisector skills, expertise and finance to deliver desired policy outcomes (Standard and Poor's, 2005). For the European Investment Bank (EIB, 2004:2), "public-private partnership" is a generic term for the relationships formed between the private sector and public bodies often with the aim of introducing private sector resources and/or expertise in order to help provide and deliver public sector assets and services. The term PPP is thus used to describe a wide variety of working arrangements from loose, informal and strategic partnerships, to design-build-finance-and-operate (DBFO) type service contracts and formal joint venture companies. Source: OECD (2008), Public-Private Partnerships: In Pursuit of Risk Sharing and Value for Money. |

14. Part of the difficulty when defining PPPs is the broad spectrum of arrangements that can rightly be considered PPPs. There is a continuum of service delivery options available to governments, from pure public delivery to full privatisation. These include relatively simple management contracts where the private sector manages and operates a pre-existing asset, concession agreements under which the government grants rights to a private-sector entity to operate, or build and operate, a facility for a fixed period of time, and Private-Finance Initiative (PFI) type arrangements that see the private sector design, build, finance, maintain and operate a facility for a fixed-term covering usually 25 to 30 years. All of the possible arrangements between pure public delivery and full privatisation can rightly be thought of as PPPs.

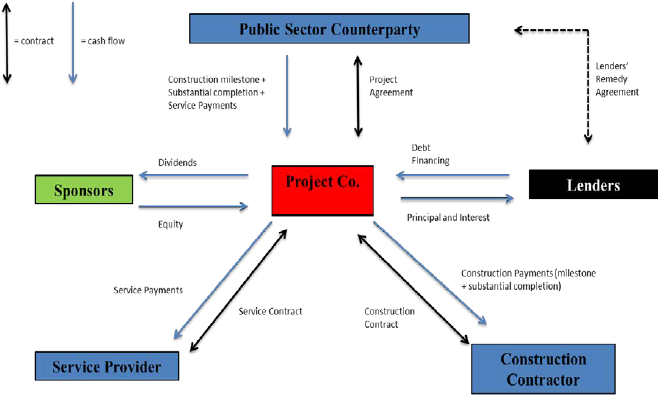

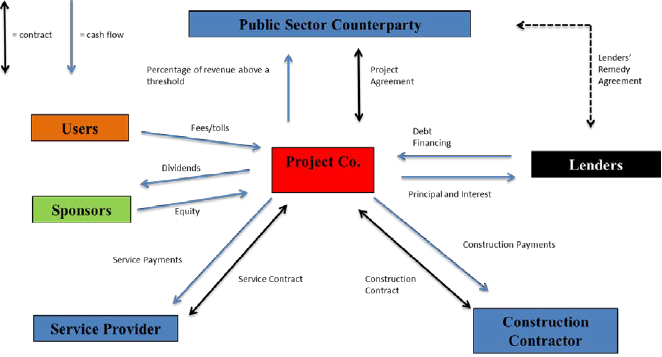

15. Among the various arrangements that can be considered PPPs, it is useful to make a fundamental distinction between user-pay concession-based PPP projects and availability-based PPPs. The most important difference between the two is the source of the private counterparty's revenue. In the concession format, revenue mainly comes from direct payments from service users, for example tolls on a toll-road. The concession-holder therefore assumes volume or traffic risk. Under an availability type of PPP, the private party's revenue consists mainly of payments made by the public authority to the private party; conceptually the services are not sold to the public but instead sold to the government. These payments are sometimes referred to as availability payments in that the government pays the private party on the basis of the service or infrastructure being available for use by the public, regardless of actual usage levels. However, payments may vary depending on compliance with contractual terms (OECD, 2010).

Figure 4. Typical PPP Transaction Structures

Availability-based PPP model

Concession-based PPP model

Source: OECD (2014)

16. This publication is intended to assist MENA-region governments in getting infrastructure built once a decision has been made to procure a project by way of PPP. For this reason it will adopt a broad definition of PPP that considers any long-term contractual relationship between a state or state owned entity (SOE) and a private-sector entity whereby the latter delivers and finances public services using a capital asset, sharing the associated risks, to be a PPP (OECD, 2012, Recommendations of the Council on Principles for Public Governance of Public-Private Partnerships). Long-term service arrangements that do not include private financing but which in other elements approximate the dynamics of a PPP in that there is a risk transfer with regard to the provision of services will also be considered.

17. In environments where public finances are under pressure, PPPs are often looked to as a panacea for public infrastructure funding. However, PPPs are not a cure for all public financial ills and just as there are good reasons to procure by way of PPPs in appropriate circumstances, there are also inappropriate circumstances in which to procure by PPP. Projects attempted in these inappropriate circumstances are less likely to be successful.