ASIA DRIVING GLOBAL INFRASTRUCTURE SPEND

Globalization and the rapid industrialization of the BRIC economies have seen total global infrastructure investment almost double over the last decade, rising from $1.7 trillion in 2006 to more than $3 trillion in 2015.

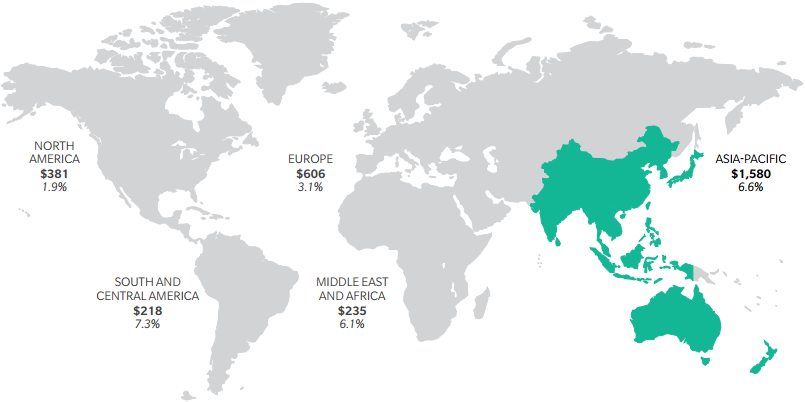

The scale of investment in infrastructure development varies significantly between regions. The Asia-Pacific region spent the most on infrastructure in 2015, accounting for over 52 percent of global infrastructure spend, and 6.6 percent of its Gross Domestic Product (GDP) (see Exhibit 1). In contrast, North America accounted for only 12 percent of global infrastructure spend, and 1.9 percent of its GDP.

While the United States is expected to increase spending on infrastructure in the coming years following President Trump's announcement of $200 billion of government funding to help revitalize US roads, bridges and airports, this will not significantly impact the split of regional investments given China's current and predicted spending levels at home and abroad. Already accounting for over half of Asia-Pacific's total spend on infrastructure, China's Belt & Road Initiative is a global trade project that will see the country refocus its infrastructure investment internationally in the coming years.

EXHIBIT 1: INFRASTRUCTURE SPENDING - TOTAL, AND AS A PERCENTAGE OF GDP

$ BILLIONS, 2015 ESTIMATES

Source: APRC analysis of data from Construction Intelligence Center

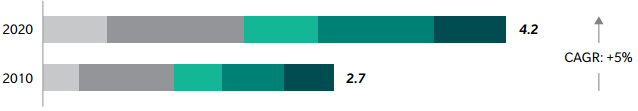

EXHIBIT 2: GLOBAL INFRASTRUCTURE SPEND - SECTOR BREAKDOWN

$ TRILLIONS, 2010-2020

| Rail |

| Road |

| |

| Electricity and Power |

| |||

*1 Includes airports, dams, ports, land control systems, and inland waterway infrastructure

*2 Includes telecommunications, sewage infrastructure, and water infrastructure

Source: APRC analysis of data from Construction Intelligence Center

The ability of China to finance such a grand plan has been questioned, as has the country's true motivations behind the scheme, but if the majority of the plan comes to fruition then the new projects will ensure that the current oversupply in many state run Chinese metal industries is reduced.

Japan and India also contribute notably to the region's infrastructure spend, though based on 2015 figures they are a distant second (14.4 percent) and third (11.5 percent) respectively. Many Southeast Asian economies such as Indonesia, Thailand, the Philippines, and Vietnam, where infrastructure spend is still relatively small, have all announced ambitious plans to enable further economic development via greater infrastructure investment.

In terms of the magnitude of finance needed, the critical financing requirements of developing Asia remain in power, followed by transport. These sectors form the economic backbone for societies.7 Rana Hasan, Director of the Development Economics and Indicators Division, Asian Development Bank |

Pairing this renewed focus on infrastructure and supporting reform vigor with the broad regionalization efforts of the ASEAN Economic Community (AEC) 2020, we expect Southeast Asian economies to emerge as an additional growth engine for infrastructure in the region.