HOW ARE PROJECTS BEING FINANCED

IN ASIA, THE PUBLIC SECTOR FINANCED OVER 90 PERCENT OF THE REGION'S INFRASTRUCTURE INVESTMENT

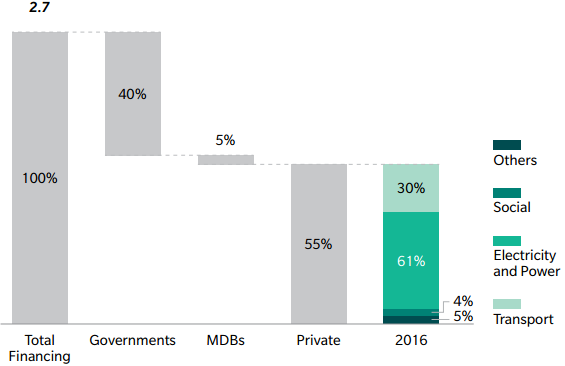

The world spends about $2.7 trillion annually on infrastructure.9 Public financing accounts for 45 percent - 40 percent from government budgets, 5 percent from multilateral development banks (MDBs) - and private sector investments make up the remaining 55 percent (see Exhibit 5).

However, this breakdown differs significantly when comparing emerging markets with developed economies. World Bank estimates 70 percent of infrastructure projects in emerging markets are financed by government budgets, 10 percent by MDBs,10 and the remaining 20 percent by private players. In Asia, Asian Development Bank (ADB) estimates public financing make up about 92 percent of the region's infrastructure investment.11 These are in stark contrasts to developed economies where the split between public and private sources is about 30:70.10

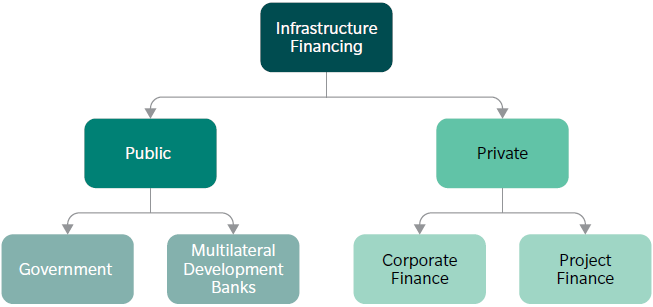

Public capital is largely derived from governments and MDBs, the latter being institutions created by groups of countries to provide financing and professional advice for the purposes of infrastructure development. Examples of MDBs include World Bank, ADB, and Asian Infrastructure Investment Bank (AIIB) which inaugurated in early 2016.

Private capital, however, is typically arranged via corporate finance or project finance. Corporate loans are still prevalent in emerging markets, where the private infrastructure company (or state-owned company) takes loans directly instead of ring-fencing this away from other assets. Listed companies tend to owners or investors in these infrastructure projects, or providers of the infrastructure services.

Project finance is becoming increasingly common in certain markets, as it is often the most efficient financing arrangement for public-private partnership (PPP) projects.

EXHIBIT 5: BREAKDOWN OF GLOBAL INFRASTRUCTURE FINANCING

$ TRILLIONS

Source: APRC analysis of data from Asian Development Bank, World Economic Forum, World Bank, and InfraDeals

EXHIBIT 6: SOURCES OF INFRASTRUCTURE FINANCE

Source: APRC analysis