UNDERSTANDING PUBLIC-PRIVATE PARTNERSHIPS (PPPs)

While there is no standard, internationally accepted definition for the wide range of types of agreements between the public and private sector entities, the term "public-private partnership" has been used to describe this class of deal structure. PPPs are typically characterized by high specificity, low re-deployable value, and high intensity of capital. They are agreements wherein the public sector (government entities - including ministries, municipalities, and state-owned enterprises) procure and construct public infrastructure by tapping relevant financial or technical expertise and operational efficiencies of the private sector (businesses and investors).12

Usually done through a legally binding contractual arrangement, the partners engaged in the PPP agree to apportion responsibilities related to the implementation, management, and operation of the infrastructure project in an optimal way that allows risks to be allocated to the parties that are best able to manage them. Exhibit 7 showcases common risk allocation splits for projects in Asia. This project implementation mechanism generates cost efficiencies and improves performance.13

In this instance, a special purpose vehicle (SPV) is set up with contractual financing agreements between the partners. On the one hand, the private player is able to take on the management and operational roles of the project while working towards the clear goal of maximizing profits using its private sector expertise. On the other hand, the government can remain focused on its primary responsibilities, such as implementing regulations and providing supervision, while still fulfilling social obligations without having to deploy all its scarce public resources.14

Exhibit 7 shows five categories of PPP models that could either exist as individual options or in combination; the latter being more common in recent years. An example of a concession PPP project is covered later in our report under "Case study: Central Java IPP".

Although there are many benefits associated with PPP infrastructure projects, it is especially crucial to correctly identify sectors best suited to the PPP framework and ensure deal structure and risks are allocated to the right parties.

EXHIBIT 7: UNDERSTANDING PPP MODELS AND RISK ALLOCATION

BASIC FEATURES OF PPP MODELS |

|

| 1 Private Ownership: The private sector is responsible for the design, construction, and operation of an infrastructure facility 2 Concession: In this form of PPP, the government defines and grants specific rights to an entity to build and operate a facility for a fixed period of time 3 Leases: The operator is responsible for operating and maintaining the infrastructure facility (that already exists) and services, but are generally not required to make any large investments 4 Turnkey: A traditional public sector procurement model for infrastructure facilities where a private contractor is generally selected through a bidding process and the contractor then assumes the risks involved in the design and construction phases 5 Supply and Management Contract: A contractual arrangement for the management of a part or whole of public enterprise by the public sector with the public sector retaining the ownership of the facility management |

RISK ALLOCATION DECISIONS WILL IMPACT BANKABILITY ASSESSMENTS

| COMMON RISK ALLOCATION BY PARTY*1 |

| |

RISK | TRADITIONAL (DESIGN-BID-BUILD) | DESIGN-BUILD

| |

POLITICAL WILL AND REGULATORY | Public | Public | Public |

PLANNING AND ENVIRONMENTAL APPROVALS | Public | Public | Public |

CHANGE IN SCOPE | Public | Public | Public |

PERMITTING | Public | Shared | Shared |

UTILITIES | Public | Shared | Shared |

LAND PURCHASE AND GROUND CONDITIONS | Public | Shared | Private |

DESIGN | Public | Private | Private |

CONSTRUCTION | Private | Private | Private |

QUALITY ASSURANCE AND CONTROL | Public | Shared | Private |

OPERATIONS AND MAINTENANCE | Public | Public | Private/Shared |

MACROECONOMIC CONDITIONS | Shared | Private | Private |

FINANCING | Public | Public | Private |

DEMAND RISK | Public | Public | Public/Shared |

FORCE MAJEURE AND SUPERVENING EVENTS | Public | Shared | Shared |

*1 These allocations are general guidelines based on APRC analysis and can vary from project to project

Source: United Nations Economic and Social Commission for Asia and the Pacific's website, Federal Highway Administration website, APRC analysis

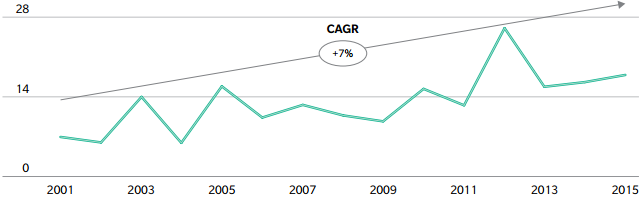

EXHIBIT 8: TOTAL PPP INVESTMENT IN ASIA-PACIFIC (EXCLUDING INDIA)

$ BILLIONS, 2001-2015

Source: APRC analysis of data from World Bank