WHAT INVESTORS LOOK FOR IN INFRASTRUCTURE

Though governments and financial institutions remain important brokers in infrastructure funding, the world needs to increasingly tap into private capital markets to address the growing infrastructure deficit. This is especially true owing to the reduced fiscal capacity most governments are faced with, due to budget constraints and reduced capital lending from financial institutions as a result of the new "Basel 3" capital regulations.

However, private financing is not straightforward and can come across as a multidimensional investment universe; different investors tend to assess the risks and returns of capital-intensive infrastructure investments differently.

Infrastructure as an asset class provides for portfolio diversification and the potential for stable cash yields. It should therefore, in theory, appear as an attractive investment alternative for institutional investors (pension funds, sovereign wealth funds, insurance companies, etc.) that generally have long-term liabilities and low risk appetites. In reality however, the uptake of the expansive asset class has historically been limited.

For example, infrastructure asset allocation in 2014 only accounted for 0.8 percent of the $50 trillion managed by institutional investors globally.9

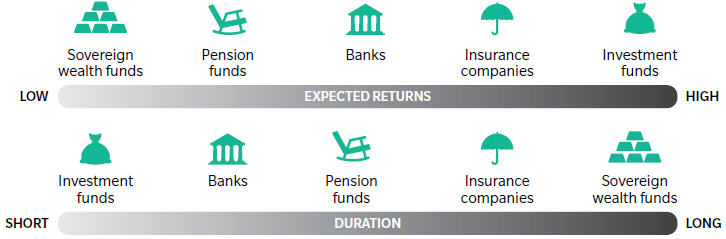

In order to increase institutional investors' commitments to the asset class, it is important to understand the different investment behaviors and preferences of different investor classes - ranging from duration, to return expectations, to type of investment grades. Exhibit 9 shows example investor preferences for expected returns and duration. These are indicative of general preferences as with the advent of some very long-term third party funds, for example, the lines often blur.

Most institutional investors continue to look for defensive diversification from their infrastructure allocations. In an Asian infrastructure project context, this necessitates effective structuring and risk transfer to high quality counterparties along with feasible options for managing currency exposures. Toby Buscombe, Partner & Global Head of Infrastructure, Mercer Private Market |

EXHIBIT 9: INDICATIVE PREFERENCES FOR INSTITUTIONAL INVESTORS

EXHIBIT 10: UNIQUENESS OF INFRASTRUCTURE INVESTMENTS TO INVESTORS

40% DIVERSIFICATION Investment returns are more stable and show a lower correlation with other asset classes than other types of investments (equities, fixed income, etc.) | 20% HIGHER RETURNS Generally, infrastructure projects are natural monopolies with high barriers to entry. Upon completion of construction and subsequent development of demand patterns, projects have low payment and cash flow risks | 12% INFLATION HEDGING Rates of return set by regulators are often linked to future inflation (at times, revenue can also be linked to inflation for greater protection) |

IMPORTANT ASPECTS OF INFRASTRUCTURE COMPANIES TO INVESTORS

FACTORS AND RANKINGS | IMPORTANCE RANKING (HIGHEST IS 5) |

1 Stable regulation and contracts | 4.2 |

2 Earnings stability | 3.9 |

3 Counter-party risk | 3.6 |

4 Greenfield versus brownfield | 3.1 |

5 Earnings growth potential | 3.0 |

6 Investment size | 2.8 |

Source: APRC analysis of data from EDHEC Infrastructure Institute Singapore

Beyond yield and tenor, the Singapore Infrastructure Investment Institute also highlighted other key considerations from an in-depth survey, conducted in 2016, of investors' perceptions and expectations from investing in infrastructure.18 The results suggest that these investors, with a broad geographic focus, are increasingly interested in infrastructure as an asset class and are more receptive towards its illiquid nature, likely a result of margin pressures in a low-interest rate environment. Viewing infrastructure through a different prism as that of the government, more than two-thirds of the respondents said they had intentions to increase their investment spend on infrastructure in the following years and four in five expect to maintain their investment over a time horizon of more than 10 years. To these investors, the project's attractiveness is largely dependent on the financial features summarized in Exhibit 10.

Unsurprisingly, the stability of regulatory and contractual frameworks emerged as the most important factor, followed closely by the stability of investors' returns on investments.

The ability to identify, quantify, and manage risks, both insurable and uninsurable, will largely influence equity investors' potential in formulating a winning bid; in addition to getting a desired risk-adjusted return on investments after satisfying the contractual requirements imposed by governments and capital providers. On the other hand, lenders need to be reassured that all project risks associated with their ventures have been identified, analyzed, and effectively controlled or transferred before agreeing to finance an infrastructure development project or operational asset.